- After its latest breakout, AAVE has shown strong bullish momentum over the past week

- Traders should closely monitor the resistance at $142.68, as a break above this level would signal sustained upside.

Aave (AAVE) has recently seen a strong rally, breaking above key resistance levels and flipping them into support after seeing a 55% surge in just over a week.

However, with the overall market sentiment still in the “Fear” zone at press time, the question is whether the bulls can maintain this momentum.

AAVE Bulls Caused 55% Surge in Just Over a Week

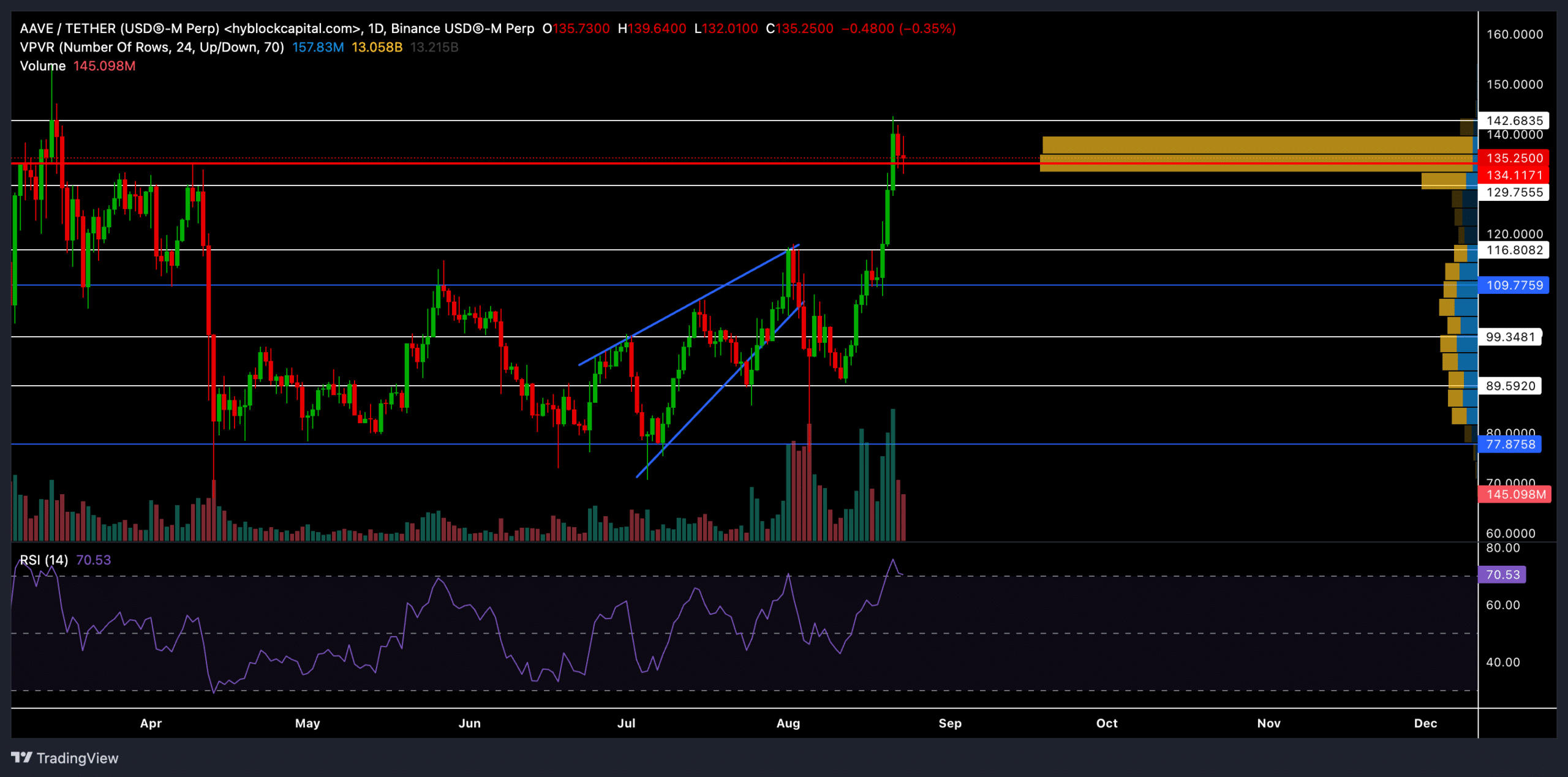

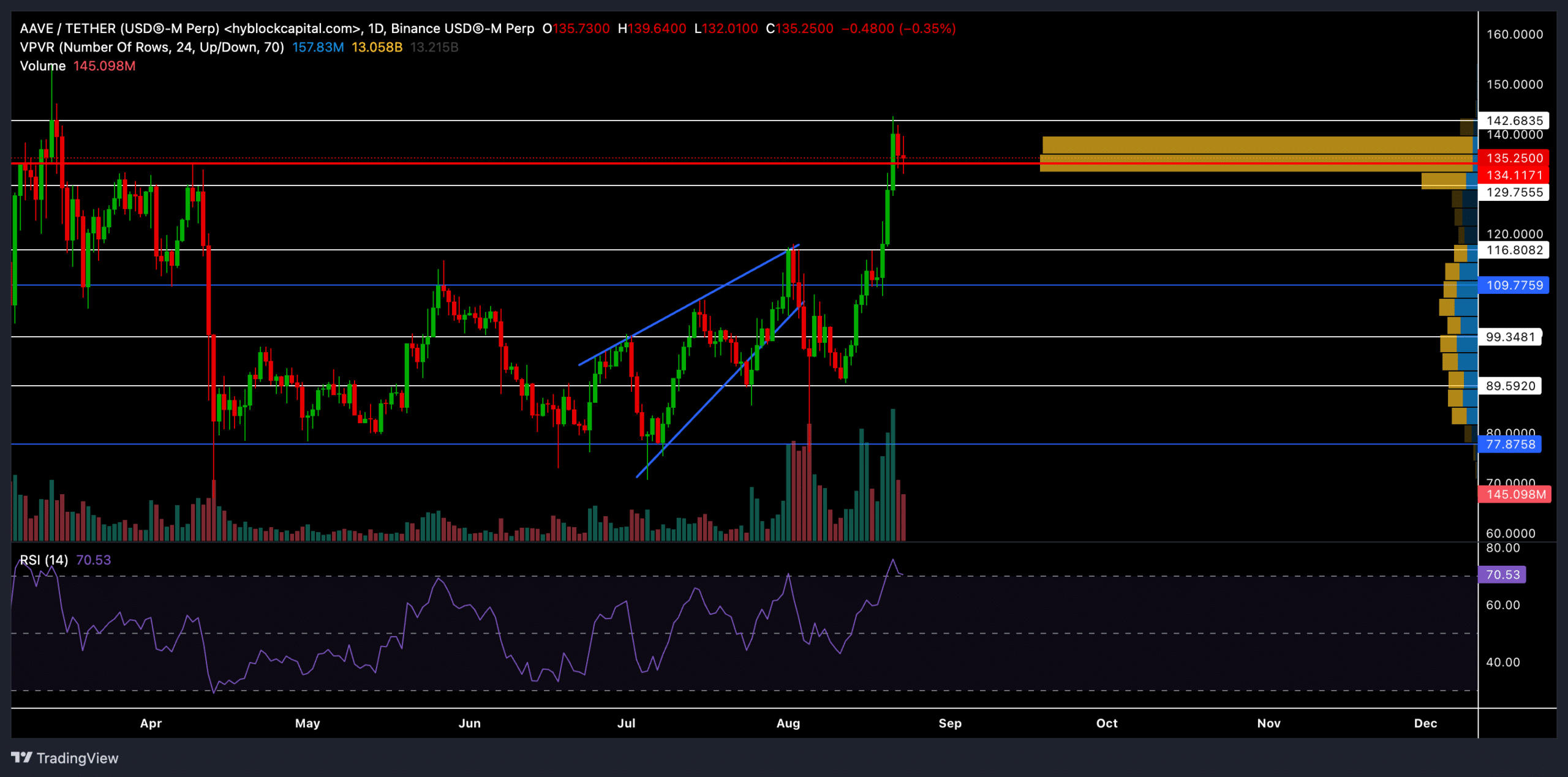

Source: TradingView, AAVE/USDT

During the first week of August, AAVE experienced a classic rising wedge breakout after failing to break above the $116 resistance level (now support).

However, the recent bounce from the $89 support level has paved the way for buyers to reverse the trend. This bounce has pushed the price significantly higher, with AAVE trading at $135.68 at press time. The price then hit resistance near the $142.68 level, which could be a crucial hurdle for the bulls to overcome. It is worth noting here that the recent surge was accompanied by heavy volume, but the price entered a relatively high volatility zone.

The Visible Volume Profile (VPVR) indicated strong resistance around the $135-$142 range, which coincided with the previous high-volume rally. Failure to break above this level could lead to a pullback towards the $116 support level.

After its latest buying rally, technical indicators have become overbought. A potential correction could therefore be plausible, especially with the Relative Strength Index (RSI) reversing from the 75 area.

Key levels to watch

The immediate resistance to watch seems to be located at $142.68. If AAVE manages to break and sustain above this level, the next target could be around $150. On the downside, if the price fails to sustain above $129, it could revisit the $116 support.

Given that the altcoin recently flipped from resistance to support at $129, we could see a potential retest of this support, followed by a consolidation phase.

Overall volume has dropped 33.05% over the past 24 hours, while open interest has fallen 6.60%. This suggests that some traders have taken profits or closed positions following the rally.

The long/short ratio over the past 24 hours, at press time, was 0.9889, indicating a nearly balanced sentiment with a slight bearish trend.

Source: Coinglass

Finally, the AAVE/USDT long/short ratio on Binance was particularly bearish at 0.2758, which could mean that some traders are expecting a pullback. Investors should also monitor overall market trends and any major news that could affect AAVE price action in the coming days.