- AAVE’s breakout above the $153.98 resistance level sparks strong buying interest and new cycle highs.

- Technical indicators suggest that AAVE’s uptrend may continue, with $200 and $261 in sight.

Aave (AAVE) recently made a notable move by surpassing the key resistance level of $153.98. This breakout propelled the token to new cycle highs, sparking buyer interest.

With the price at $168.64 At press time, AAVE continued to show strong upward momentum, supported by increasing trading volume and bullish technical indicators.

Following the recent breakout, AAVE was targeting the $200 level, which constituted critical psychological and technical resistance.

Daan Crypto Trades, a crypto analyst, suggested that if AAVE successfully breaches this level, the next potential target could be around $261.18, which aligns with previous highs seen in early 2022.

Source:

This outlook reflects the current bullish market sentiment driven by strong buying pressure.

The limited historical price action in the current trading zone suggests the possibility of rapid price movements as AAVE explores new levels.

With the token trading well above key moving averages, the current uptrend remains strong, indicating that further gains could be possible if current market conditions persist.

Continued bullish momentum

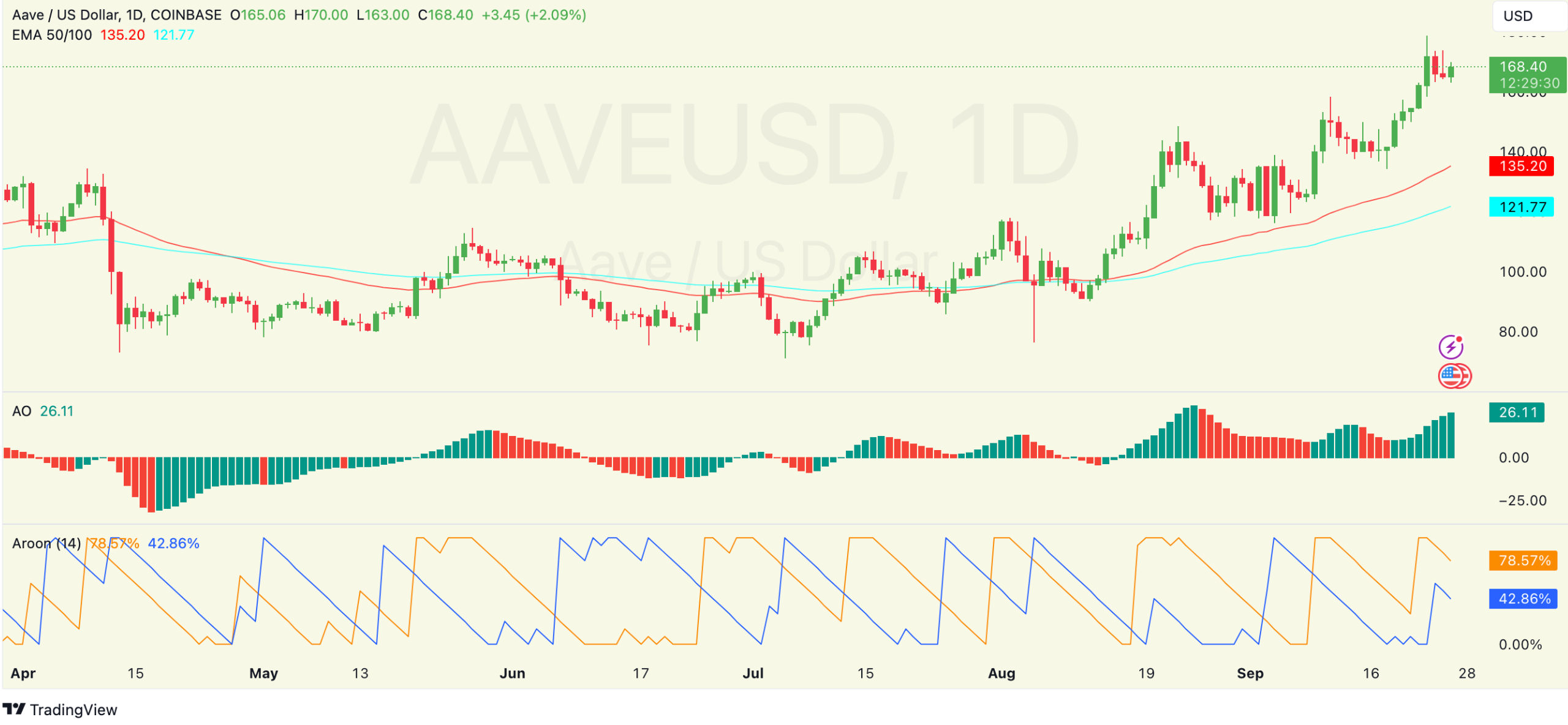

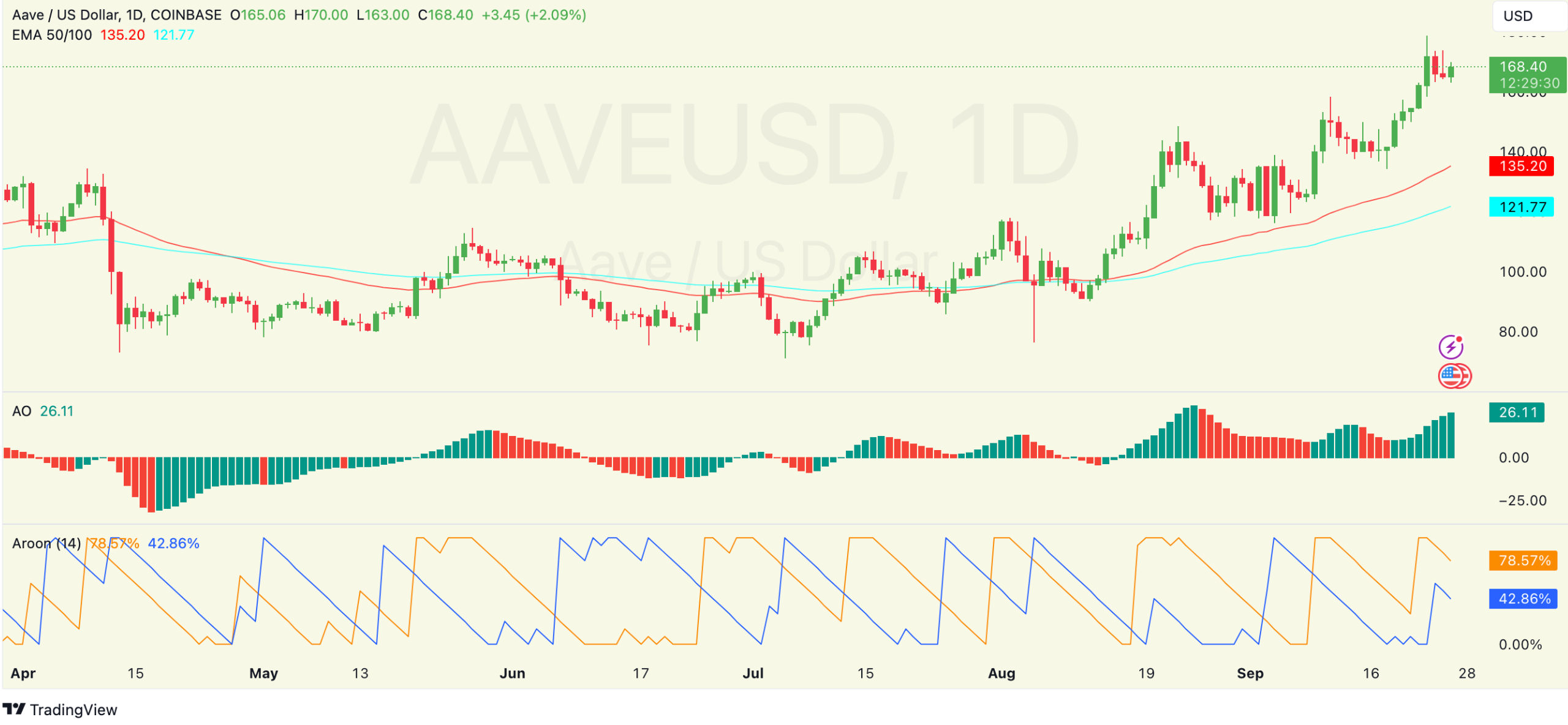

AAVE’s bullish momentum is highlighted by its positioning above the 50-day exponential moving average (EMA) at $135.20 and the 100-day EMA at $121.77.

These technical levels served as strong support during AAVE’s recent rally, reinforcing its upward trajectory.

The token’s price has remained consistently above these moving averages, highlighting the strength of the current trend.

Source: TradingView

The Awesome Oscillator (AO) was at 26.11 at press time, with expanding green bars suggesting increasing bullish strength.

This indicator, which measures market momentum, continued to signal positive sentiment, supporting the current upward price movement.

The expansion of the green bars on the histogram further indicates strong buying interest, aligned with AAVE’s recent gains.

Will the operation of AAVE continue?

Looking ahead, the Aroon indicator, used to gauge market trends, showed a clear dominance of bullish signals.

The Aroon Up (blue) was at 42.86%, while the Aroon Down (orange) was at 78.57%, indicating that recent highs have been reached and bullish signals are currently eclipsing bearish signals.

This setup reflects a strong bullish presence in the market, with sellers showing signs of weakening control.

These technical signals, combined with increased trading volume and positive market sentiment, suggest that AAVE’s recent breakout could be the start of a sustained uptrend.

AAVE’s trading volume over the past 24 hours stands at $295,637,016, reflecting a 0.85% price increase over the past day and a 16.74% gain over the last week.

Read Aave (AAVE) Price Prediction 2024-2025

The token’s circulating supply of 15 million AAVE gives it a market capitalization of $2,527,476,128, further highlighting its growing presence in the DeFi space.

As AAVE continues its upward movement, market participants are closely watching whether the $200 price target will be reached and whether the bullish momentum can be maintained.