- Recent data shows a significant increase in active addresses and transaction volumes, indicating increased activity on the network.

- On the technical side, APT presents breakout potential as derivatives and spot traders place bullish bets on the token.

Despite some signs of recovery, Aptos (APT) experienced short-term difficulties. At press time, the token was down 6.27% over the past 24 hours, reflecting the broader market slowdown.

Over longer time frames, APT’s performance has remained under pressure, with a 27.20% decline over the past month and a 7.23% decline over the past week.

However, some market signals suggest that APT could regain upward momentum, supported by positive market correlations and increasing network activity.

APT records an increase in key indicators

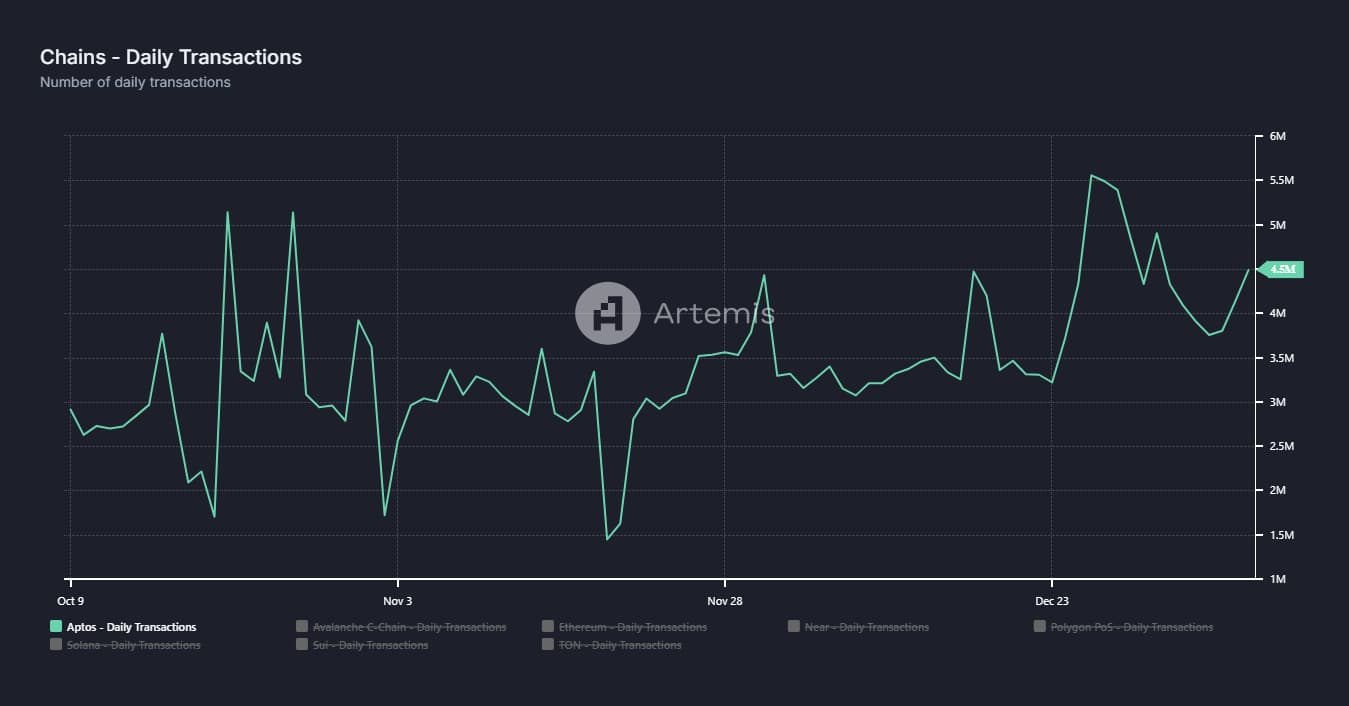

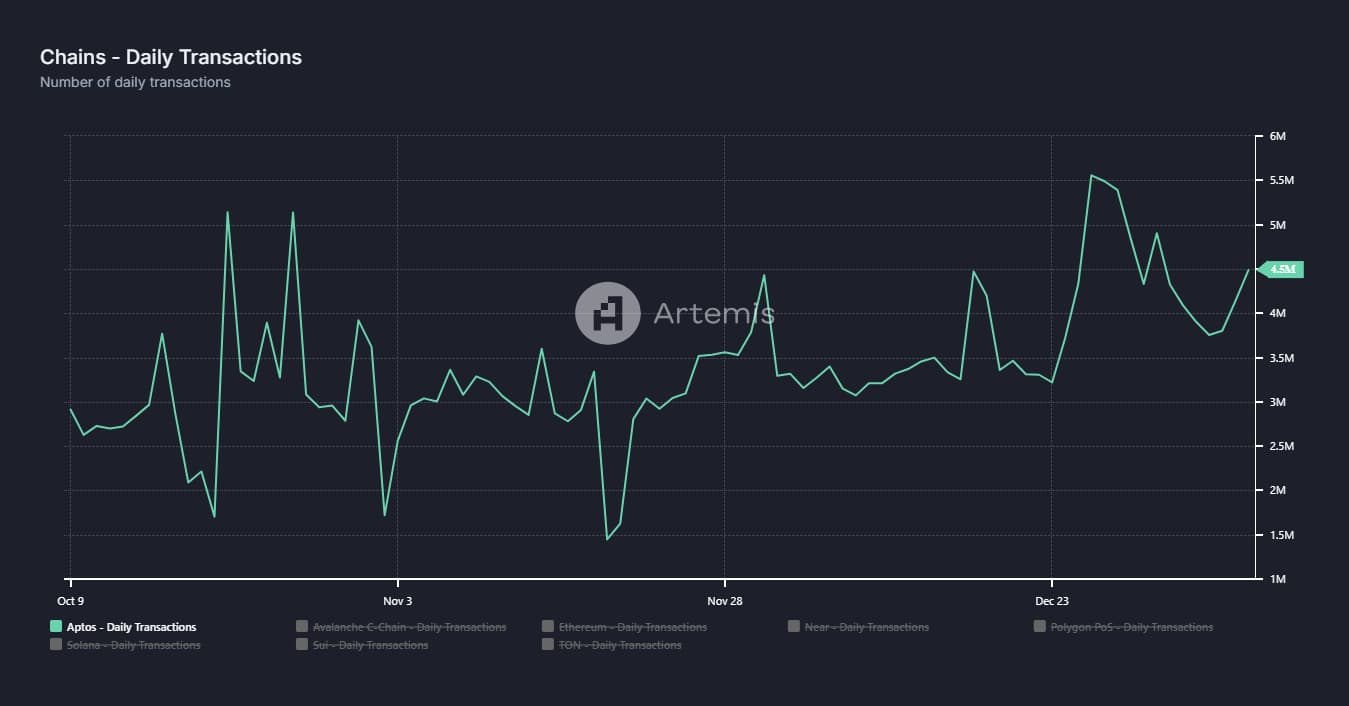

Recent data from Artemis reveals an increase in critical indicators for APT, which could influence its price trajectory in the coming days.

The report states that the number of daily active addresses on the Aptos blockchain climbed to 1.2 million, reflecting increased network activity.

Additionally, daily trading volume increased sharply, with 4.5 million transactions recorded in 24 hours. These transactions encompass both buying and selling activities, indicating increased market engagement.

Source: Artemis

While these metrics alone do not definitively indicate APT’s price direction, a deeper analysis of derivatives and spot trading trends suggests the possibility of a price recovery.

Spot and derivatives traders place buy offers

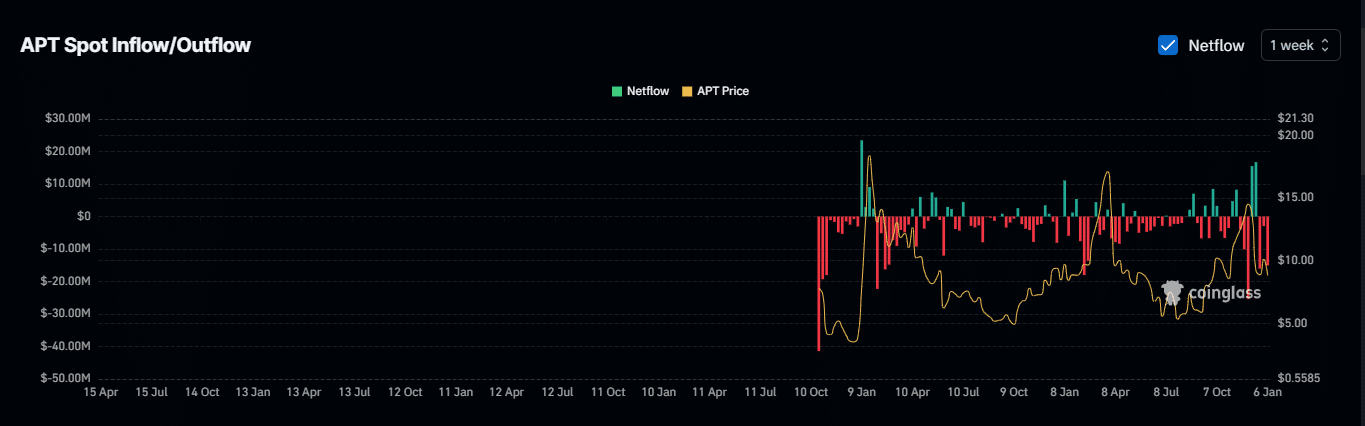

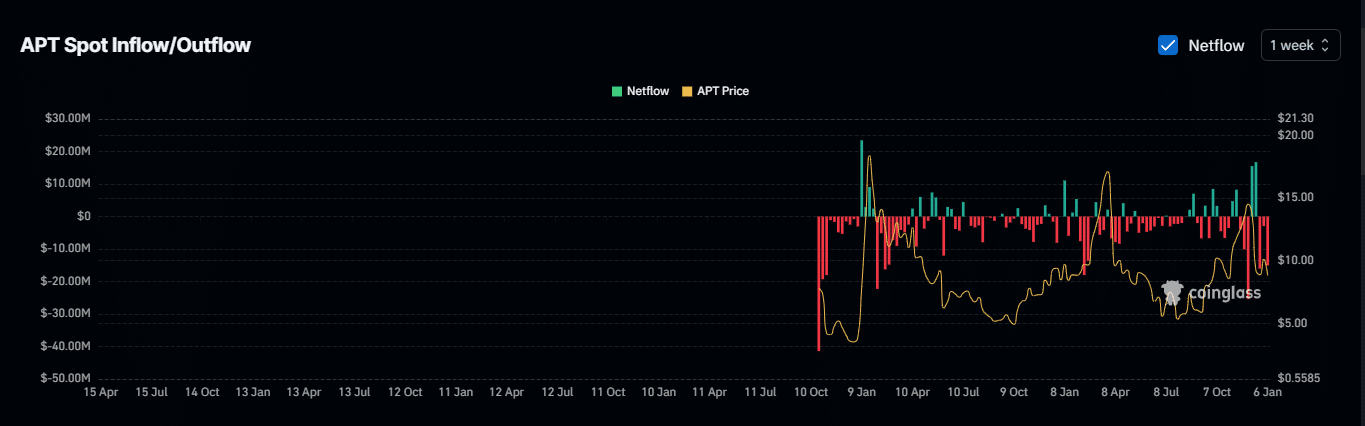

Traders in the spot and derivatives markets are displaying increased buying activity, showing a change in sentiment towards APT.

At the time of writing, APT’s outflows from exchanges have increased significantly. Over the past seven days, the total net exchange flow for APT reached $15.05 million, a sharp increase from the $2.59 million recorded the previous week.

Source: Coinglass

Net exchange flow measures the movement of assets into and out of exchanges. A negative net flow, as observed here, indicates significant capital outflows, suggesting that traders are moving their holdings into private wallets for long-term storage – a move often associated with bullish price action.

Traders in derivatives markets also contribute to the buying momentum. The funding rate, a key metric reflecting trader sentiment, has been rising steadily over the past eight hours.

According to Coinglass, the current APT funding rate stands at 0.0081%, indicating that long positions dominate the market. This positive funding rate shows that long traders are paying a premium, reflecting their bullish outlook on the asset’s upside potential.

Potential rally at $15

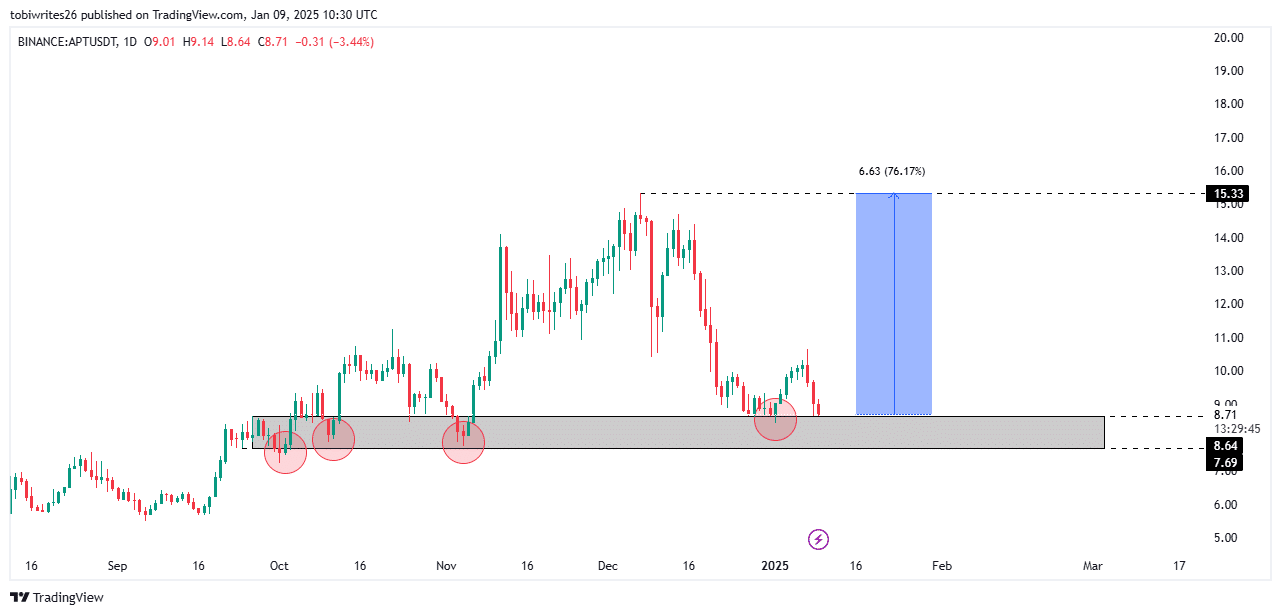

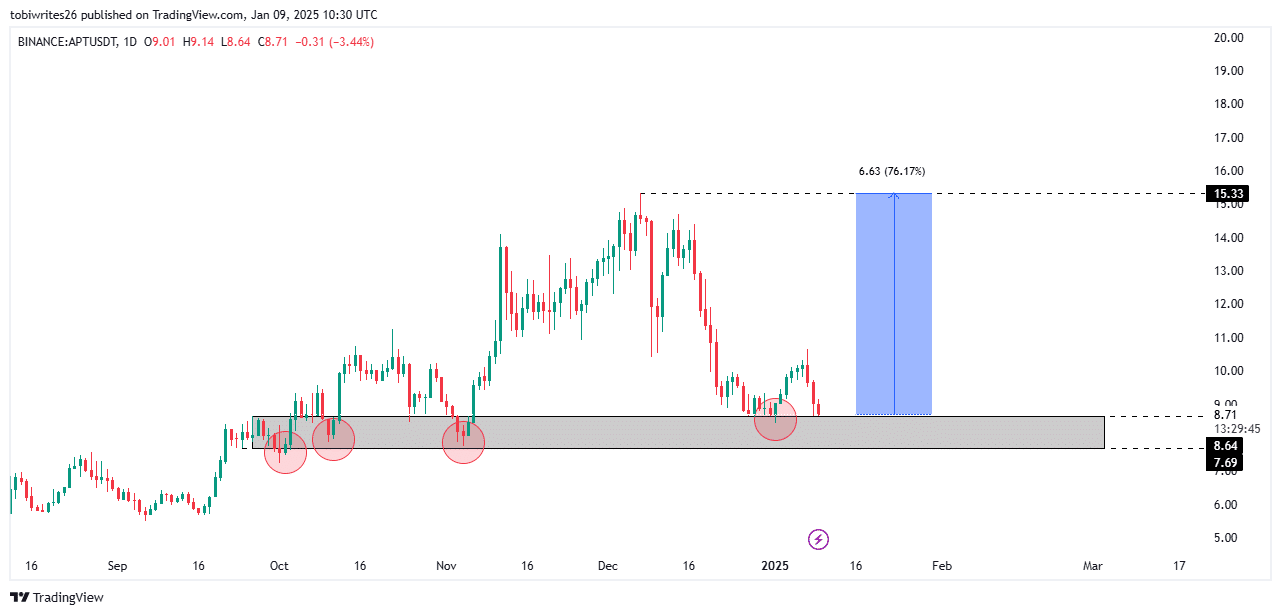

On the charts, spot and derivatives traders’ movements align with a critical demand zone between $7.69 and $8.64.

This area has historically acted as a catalyst for bullish rallies on four occasions, suggesting the possibility of a similar reaction this time around.

Source: TradingView

Read Aptos (APT) Price Prediction 2024-2025

If the demand zone triggers a new rally, APT could surge 76.17%, potentially reaching $15.33. However, if APT does not react immediately at this level, it could consolidate in the demand zone for a longer period before a possible breakout higher.

If current bullish metrics persist, APT is well-positioned for significant market upside.