- In the long term, Avalanche is poised to potentially trade above $100 as historical trends indicate.

- This expected rally could be fueled by the upcoming final unlocking of the AVAX token on August 20.

Avalanche (AVAX) is still recovering from a market crash that sent its price down to $17.29 — a level not seen since November 2023.

AVAX has seen a 2.05% price increase to $21.07 year-to-date, with a market cap of over $8.2 billion. Its trading volume has also surged by 30%, indicating that it is poised for a recovery.

AVAX Prepares for a Rise to $100

Kaleo Crypto Analyst highlighted the strengthening ETH/BTC ratio as a precursor for Layer 1 (L1) EVMs like Avalanche to gain traction, setting the stage for a rally.

The ETH/BTC ratio indicates how Ethereum (ETH) is performing relative to Bitcoin (BTC). An increase in the ratio suggests that Ethereum is appreciating faster than Bitcoin, or that Bitcoin is depreciating while Ethereum is holding steady or growing.

This change suggests market momentum and interest, potentially making Ethereum, and by extension Ethereum-compatible platforms like Avalanche, more attractive to investors.

In a chart, Kaleo noted that AVAX is at a historical crossroads similar to the one seen before the 2021 rally that pushed it to a peak of $147.

Source: X

In the analyst’s words,

” Preferee to start the year, bleed, send to $100 and more.”

While technical patterns signal an optimistic outlook, Kaleo also mentioned an important fundamental catalyst that could help this rally towards the expected region.

He wrote,

” TThe last major AVAX token release (9.45M AVAX / ~$200M) will take place on August 20th. After this, there will be no more new tokens to distribute to the team and strategic partners..“

This final release is considered a bullish indicator, signaling the maturity and stability of Avalanche’s distribution strategy.

This builds investor confidence and can stabilize the token price by preventing sudden increases in available supply.

While Kaleo’s view on AVAX is bullish, AMBCrypto looked at other fundamental indicators.

Fundamental Perspectives on Avalanche

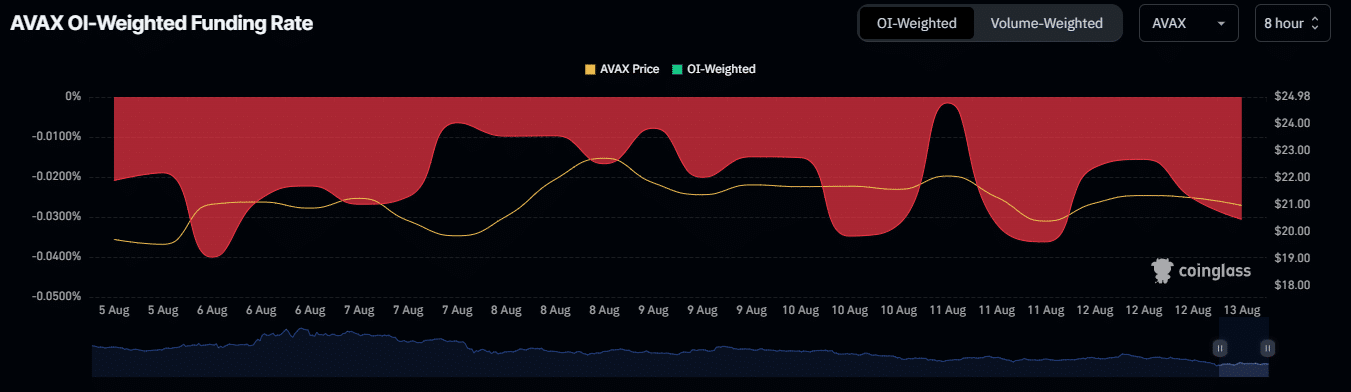

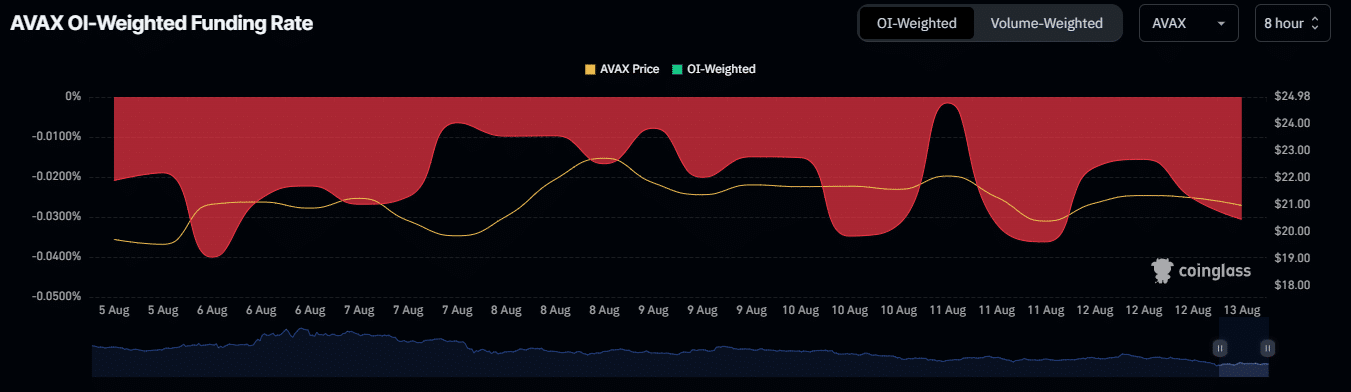

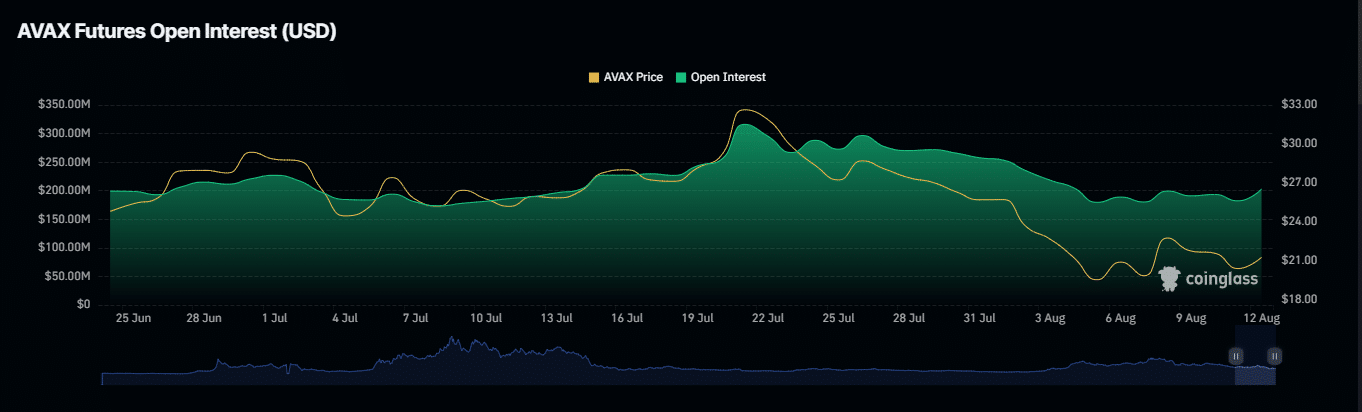

On the fundamental side of Avalanche, AMBCrypto looked at its open interest and OI-weighted funding, which showed mixed signals in the market at the time of writing.

On the one hand, the OI-weighted financing rate has been mostly negative since the beginning of August, at -0.0306% at the time of going to press.

Source: Coinglass

A predominantly negative OI funding rate indicates bearish sentiment, as it means that short position holders are paying fees to long position holders, expecting the asset price to decline.

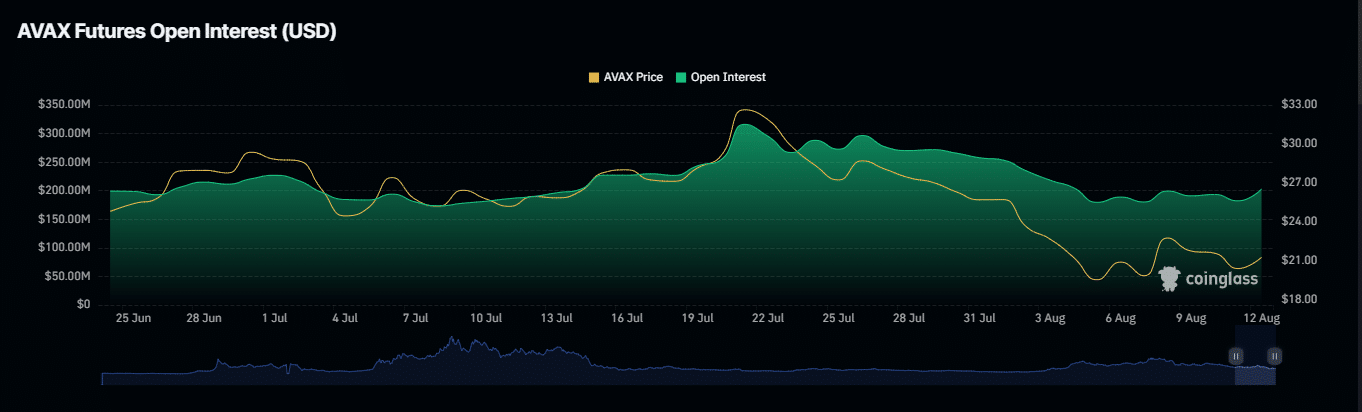

On the other hand, open interest has seen a notable increase in the past few days, since August 5th when AVAX was trading at its 2024 low.

Is your portfolio green? Discover the AVAX profit calculator

As of press time, open interest has increased by 8.14%, valued at $202.11 million.

Source: Coinglass

An increase in open interest usually means that new funds are entering the market and higher participation can lead to greater liquidity and potentially higher prices.