- Clean Cloud Act offers penalties for AI and Crypto data centers with high energy intensity

- Countries like Pakistan take advantage of excess electricity to stimulate bitcoin extraction and IA infrastructure

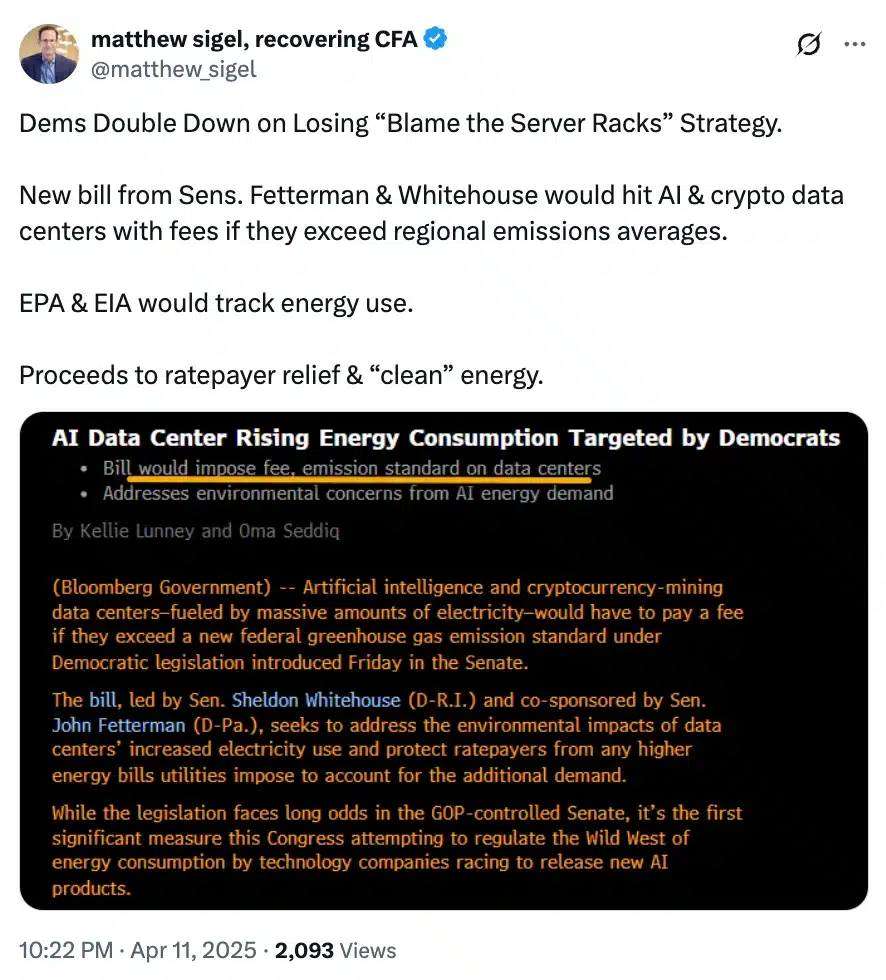

American legislators have presented a bill targeting the environmental assessment of AI and crypto operations. Entitled The Clean Cloud Act, the legislation is led by the SHELDON WHITEHOUSE and John Fetterman senators.

The bill aims to curb the energy requirements of data centers by applying stricter carbon emission standards.

What will happen if the bill is adopted?

If adopted, the bill will allow the Environmental Protection Agency (EPA) to impose penalties on the facilities that exceed federal thresholds.

By providing reasons, Senator Fetterman said,

“Fighting to keep the United States at the cutting edge of AI technology and protecting our natural resources for our children and grandchildren are not mutually exclusive objectives.”

Echoing similar feelings, noted Senator Whitehouse,

“Data centers and energy cryptominage installations overload our already tense electrical network, which increases the costs of consumers’ electricity, which makes Americans more difficult to fuel their homes and businesses, and by boosting fossil fuel emissions.”

The Crypto community criticizes the bill – this is why

However, the reactions were positive in the crypto-community. Vaneck’s research manager Matthew Sigel, for example, believes that the bill unjustly targets Bitcoin (BTC) for their energy consumption.

He said,

Source: Matthew Sigel / X

Criticizing the act more, added an X user,

“It will probably not pass, but, even if it is the case, it is difficult to imagine that the administration has ever applied it except an order at close range of the Supreme Court to do so.”

Upcoming challenges

While the Clean Cloud Act awaits the approval of the Senate, doubts persist – due to its exclusive democratic sponsorship. However, Trump’s previous thrust for American domination in AI and crypto could maintain the relevance of the bill.

Even thus, the timing here is worth examining. Especially since it seemed to line up with curiosity with Bitcoin minors like Galaxy and Terawulf swivel to HPC services led by AI.

According to the metrics of the parts, the revenues of minors saw signs of stabilization at the beginning of 2025. However, the geopolitical tensions and the trade disputes in progress are always a threat to their fragile rear view mirror.

What could be more?

In fact, in the middle of the increase in costs of equipment and imminent regulatory pressures in the United States, concerns are rising on a potential decrease in the domestic demand for bitcoin extraction platforms.

The CEO of Hashlabs Mining, Jaran Mellerud, recently stressed that this could encourage manufacturers to discharge excess stocks on foreign markets. This could potentially trigger an increase in world mining activity.

Now, with American minors confronted with mounting challenges, countries like Pakistan seize the moment.

By taking advantage of excess electricity, Pakistan is positioned to feed both Bitcoin extraction and the expansion of the AI data center, completely unlike what takes place in the United States.