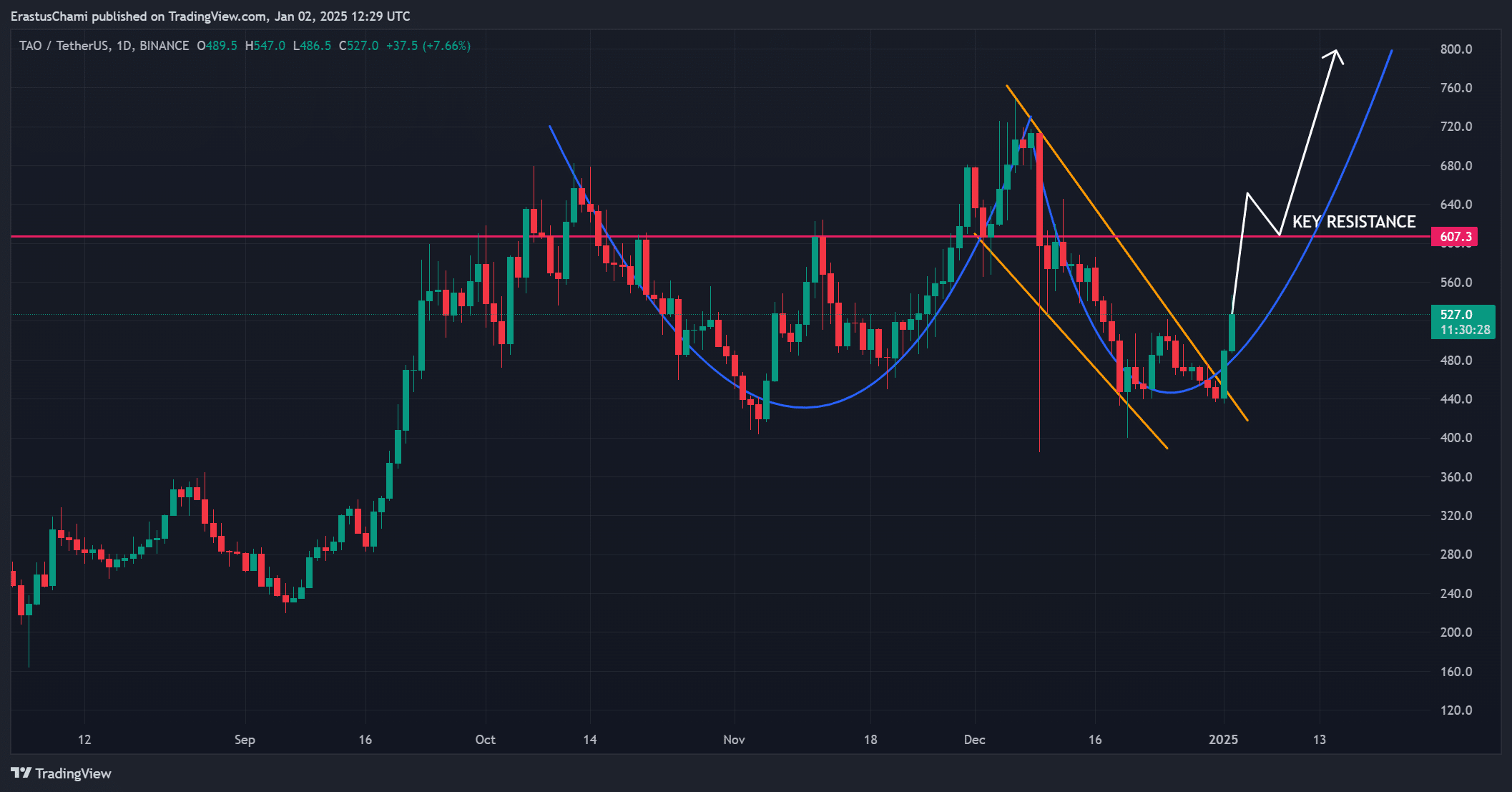

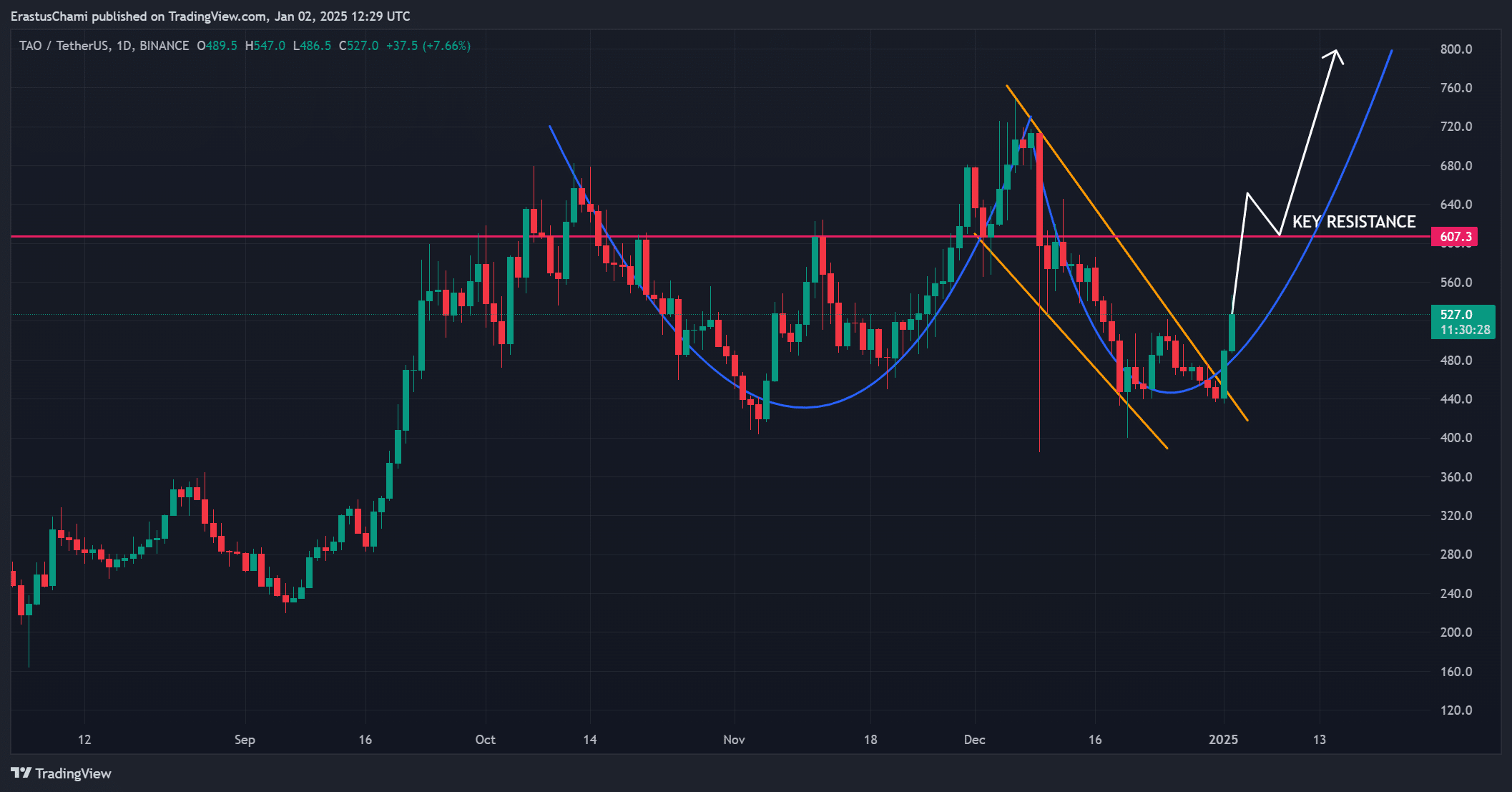

- TAO broke out of a descending channel, forming a bullish cup and handle pattern.

- Market sentiment aligned with the bullish momentum, as technical indicators and metrics supported further gains.

Bittensor (TAO) broke out of an extended descending channel, getting traders excited about a potential cup and handle formation.

Trading at $525.9 at press time, the cryptocurrency surged more than 20% in 24 hours, accompanied by an extraordinary 183.78% surge in trading volume.

TAO Price Action: Momentum Building in a Bullish Shift

TAO price action has turned decidedly bullish, with the breakout of the descending channel signaling the start of a strong uptrend.

The cryptocurrency is approaching the critical resistance level of $607, which could serve as a pivotal point for its trajectory.

A sustained break above this level would confirm the bullish reversal and open the door for further upside, with $800 emerging as a potential target based on historical price structures and technical patterns.

However, failure to break above $607 could lead to near-term consolidation, providing traders with the opportunity to reassess market conditions.

This momentum, fueled by increased trading volume and market enthusiasm, suggests that the bulls are now firmly in control.

Source: TradingView

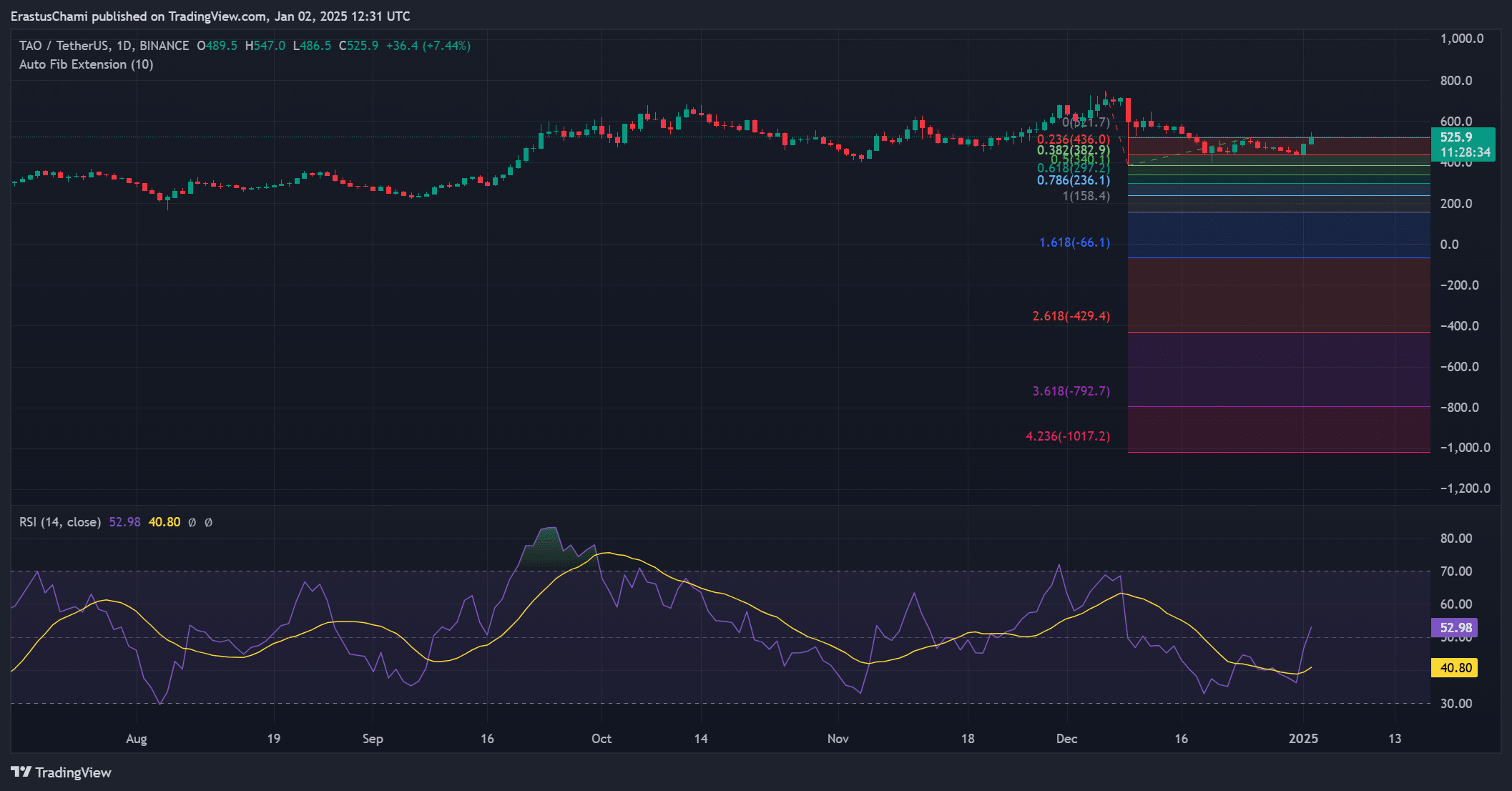

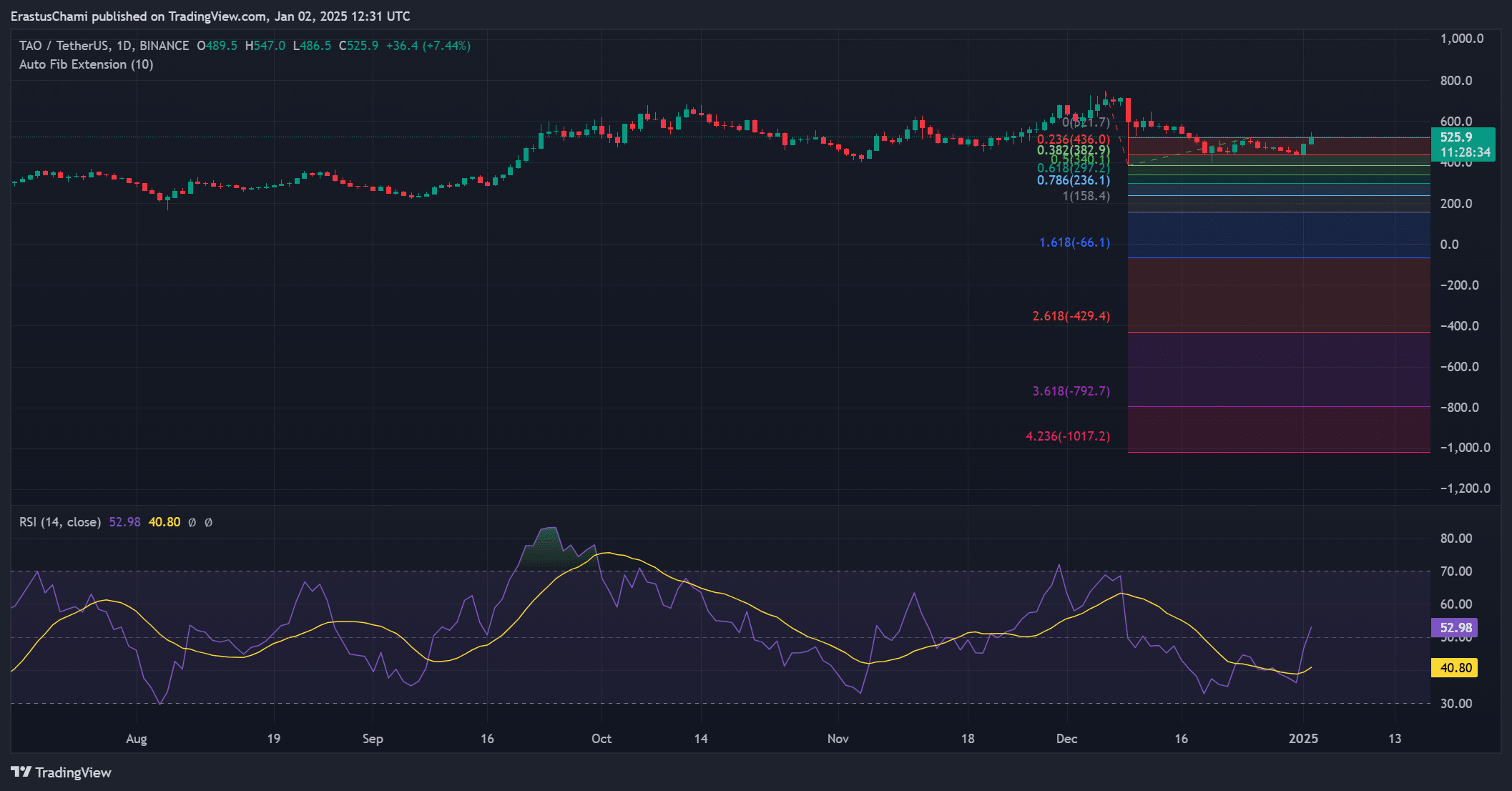

Analysis of Fibonacci levels reveals that TAO has reclaimed the critical retracement level of 0.618 at $492, suggesting the continuation of its uptrend.

The next significant level lies near the $1.618 extension to $660, which could become the bulls’ next target.

Meanwhile, the RSI stood at 52.98 at press time, indicating a neutral zone with room for further growth.

Therefore, technical indicators support the possibility of prolonged bullish momentum, but overbought conditions could slow the advance in the near term.

Source: TradingView

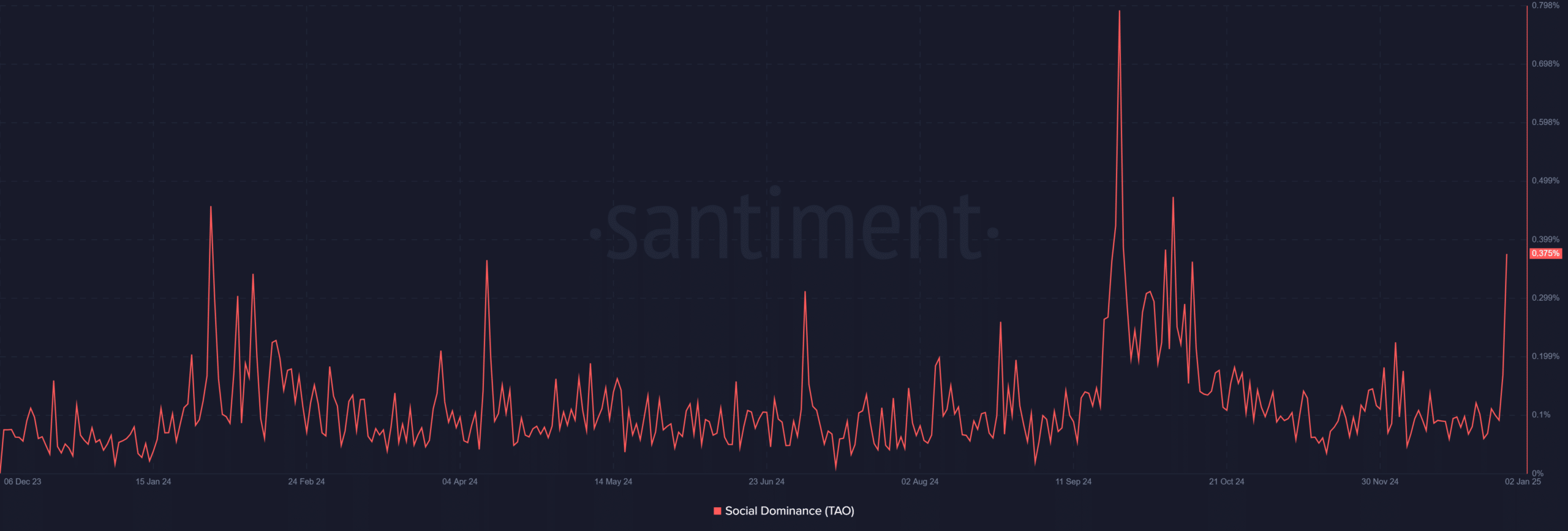

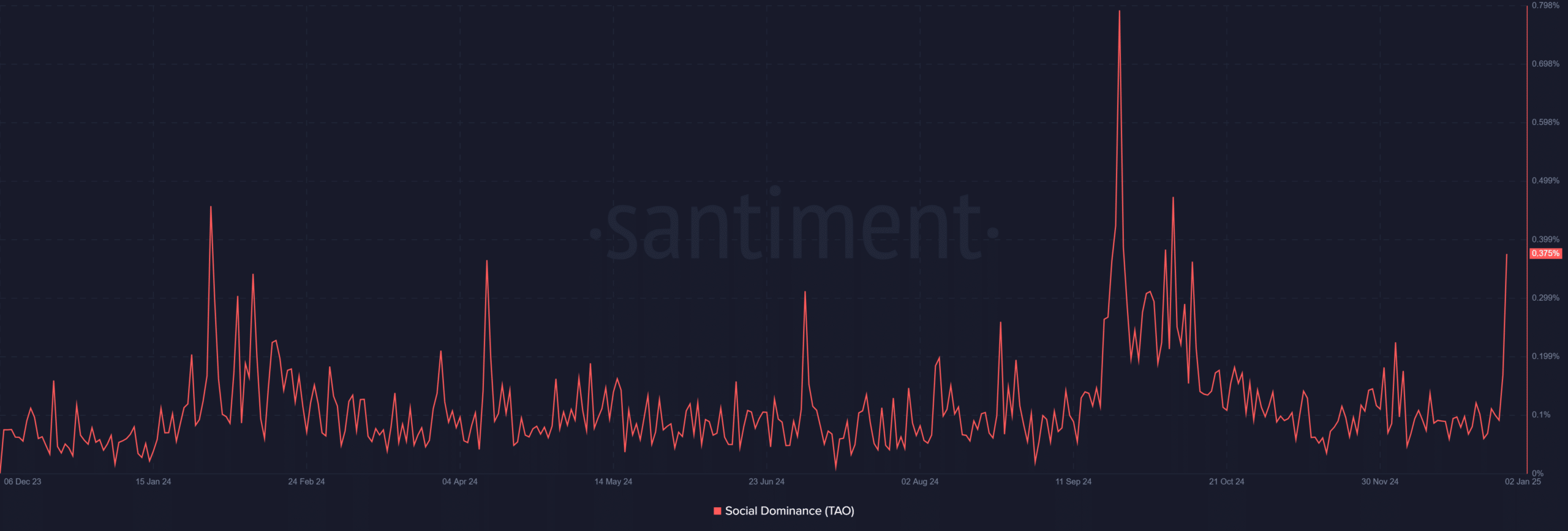

TAO’s social dominance rises sharply as interest grows

TAO’s social dominance saw a sharp increase from 0.168% to 0.375%, reflecting increased discussion and awareness on the platforms.

This rise in social interest is often correlated with increased business activity and investor optimism.

Additionally, the growing buzz around TAO could provide additional support for its price action. However, traders should remain cautious as increased attention can sometimes lead to increased volatility.

Source: Santiment

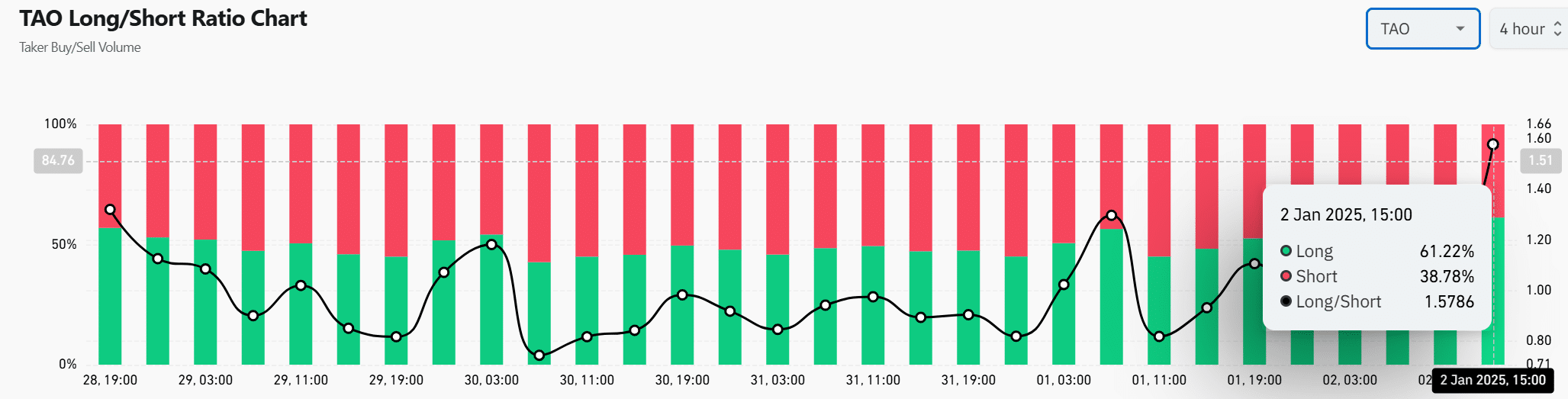

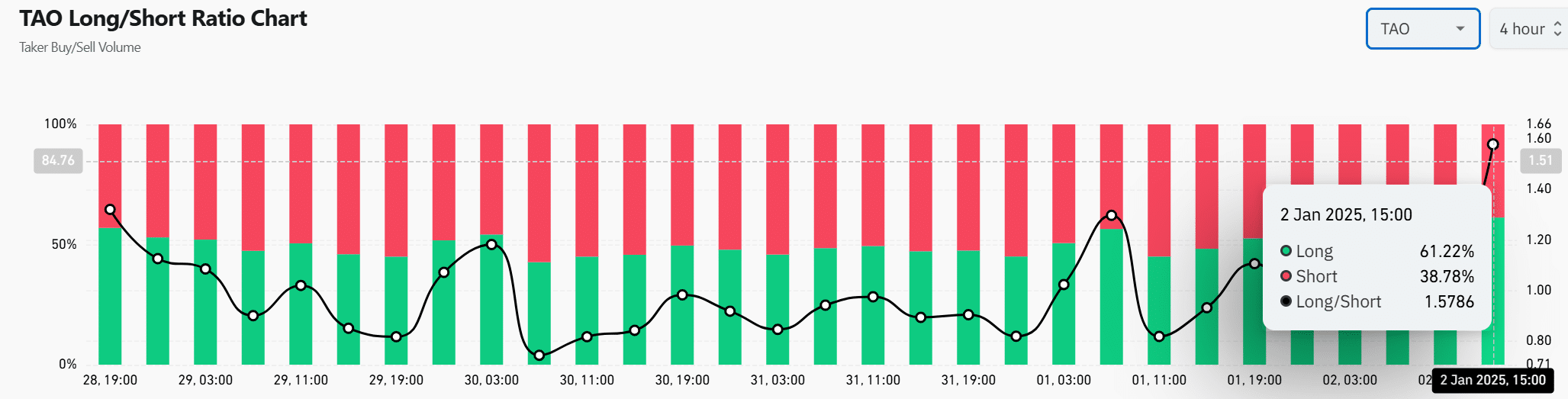

Bullish sentiment highlighted

The Long/Short ratio revealed a bullish trend, with 61.22% of traders holding long positions. This optimism aligns with the breakout, although such imbalances could lead to corrections if selling pressure appears.

Additionally, open interest increased by 28.44% to $218.74 million, highlighting strong market participation. These measures reflect the growing confidence of traders, thus confirming the current rise in prices.

Source: Coinglass

Read Bittensor (TAO) Price Prediction 2024-2025

Conclusion: the TAO rally should continue

With strong technical indicators, growing social dominance, and bullish sentiment, the TAO breakout appears poised to continue its upward move.

Current momentum suggests the potential for a sustained bullish rally as market confidence increases. However, traders should remain prepared for possible short-term fluctuations.