A cryptocurrency sell-off triggered by macroeconomic tensions wiped out $19.37 billion in leveraged trades in just 24 hours. However, now that the storm has passed and the tokens have fallen where they fell, let’s take a look at how the two largest cryptocurrencies are currently doing.

But first a precursor. On October 10, 2025, US President Trump announced his trade war against China in response to China’s restrictions on land mineral exports.

(Source: CoinGecko)

He said: “Based on the fact that China has taken this unprecedented stance, and speaking only on behalf of the United States, and not other countries that have been similarly threatened, starting November 1, 2025 (or earlier, depending on any other actions or changes taken by China), the United States of America will impose a 100% tariff on China, in addition to any tariff it currently pays. »

lol, WHAT DOES CHINA THINK Trump would do?!?!

100% rates on top of all other rates. pic.twitter.com/gcPhIbl4C5

– China Uncensored (@ChinaUncensored) October 10, 2025

Additionally, he announced export controls on critical software, which fueled speculation of a full-blown tariff war between the two countries, collapsing the crypto market.

.cwp-coin-chart path svg { strokewidth: 0.65 !important; }

1.82%

Bitcoin

BTC

Price

$114,231.28

1.82% /24h

Volume in 24 hours

$77.96 billion

Price 7d

// Make the SVG responsive jQuery(document).ready(function($) { var svg = $(‘.cwp-graph-container svg’).last(); if (svg.length) { var originalWidth = svg.attr(‘width’) || ‘160’; var originalHeight = svg.attr(‘height’) || ’40’; if (!svg.attr(‘viewBox’)) { svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight); } svg.removeAttr(‘width’).removeAttr(‘height’); svg.css({‘width’: ‘100%’, ‘height’: ‘100%’}); svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’); } });

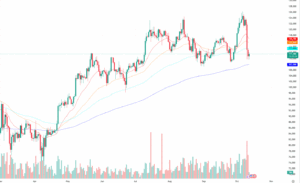

fell to $107,468 on Friday, before rebounding to close at $114,559, down almost 6% for the day. The price action saw a brief rise and touched $110,000 again, before dropping 1.82% on Saturday to end at $112.69.

For now, BTC is trading below its 50-day EMA, but has maintained its position above 200 EMA, signaling a short-term bearish trend, but the long-term bullish sentiment is intact.

Source: TradingView

If it rises above $115,000, its 50-day EMA will come into play. If it manages to hold above this level, there is a chance that BTC price could move towards the $125,761 level.

$BTC update

BTC hit new ATHs and then crashed into all liquidity boxes up to $102,000.

A quick recovery from $108,000 shows strong absorption, but $116,000 (Oracle line) needs to swing towards support for further upside.This was not a normal correction, it was a liquidity surge.… pic.twitter.com/CoTZ5Z80y5

– Pirow (@DanielPirow) October 12, 2025

On the other hand, if BTC falls below $110,000, the next major support lies at $100,000.

EXPLORE: Top 20 cryptocurrencies to buy in 2025

ETH stable at $3,825 after huge crypto sell-off

Panic liquidations saw the price of ETH briefly fall to around $3,500. Since then, however, ETH has rebounded to reclaim the support level at $3,825. It is currently trading at

.

A whale shorted $600 million worth of Bitcoin and $300 million worth of ETH, contributing to a nearly $19 billion crypto sale, one of the largest in recent history.

BREAK:

WHALE JUST OPENED A HUGE $330M MARKET $ETH SHORT

IS THE DISCHARGE COMING? pic.twitter.com/f49YjKhGmE

— AlΞx Wacy

(@wacy_time1) October 10, 2025

Analysis Donald Dean noted that $3,825 is now the key near-term support level. However, it depends, as macroeconomic developments could lead to more declines in the coming week.

$ETH $ETHUSD Ethereum – Big drop, what’s next

As mentioned, $3,825 appears to be our short-term support after the huge decline resulting from a whale short sale of BTC and massive liquidations. An impact of 19 billion dollars for crypto, unreal.

Monday could show further weakness, but long term… pic.twitter.com/f6lYzt3mC3

– Donald Dean (@donaldjdean) October 11, 2025

Despite the recent shakedown, the technical setup of ETH remains promising. Dean highlighted the formation of a bull flag on the daily chart, which signals a potential rebound if ETH holds at around $3,875.

If support holds, ETH can potentially target resistance levels between $4,500 and $5,766. On the other hand, a decline below $3,500 could lead to deeper support zones.

(Source: TradingView)

Market analyst Alex Wacy said that the recent shakeup has removed excess debt and weak hands, paving the way for a strong rally and that ETH could reach a new ATH in the coming weeks.

Funny how so many “experts” are suddenly calling for a BEAR MARKET.

Lever cleared. Compensated liquidity. Weak hands capitulated.

This is exactly when MASSIVE RALLIES were born.

All signs for me point to a new $ETH ATH in the coming weeks. pic.twitter.com/E5xOoqTh21

— AlΞx Wacy

(@wacy_time1) October 11, 2025

According to Wacy, ETH could reach between $4,300 and $5,175 in October and around $12,000 long-term by the end of 2025.

EXPLORE: Best New Cryptocurrencies to Invest in in 2025

WLFI, Aster and Sonic Labs launch major token buybacks after crypto crash

After the world witnessed one of the worst cryptocurrency crashes in recent times, three altcoin projects stepped in and launched massive token buybacks, intended to reduce selling pressure and restore user confidence.

World Liberty Financial (WLFI) announced a $10 million buyback using the $1 stablecoin. According to blockchain data, the buyback was carried out gradually using a TWAP model, which allows purchases to be spread out over time and avoid sudden price movements.

While others panic, we pile on.

Today we purchased $10 million worth of $WLFI – and it won’t be the last time.

We know how the game is played.– WLFI (@worldlibertyfi) October 11, 2025

Redeemed tokens will be removed from circulation to support the price over time.

Aster withdrew 100 million of its ASTR tokens from its treasury to repurchase them on the market, just after the platform deployed its Airdrop Checker Stage 2.

Sonic Labs committed $6 million to purchase its native $S tokens, which were added to the treasury.

While most networks struggled to stay online, Sonic worked flawlessly. Zero pending transactions, near-instant finality, and sub-cent fees on every DEX and app.

And while others withdrew, we moved forward by adding $6 million in open market purchases, increasing… pic.twitter.com/BjlyIkzm7D

– Sonic (@SonicLabs) October 11, 2025

He highlighted that the network has remained stable despite the crash, with the CEO stating that native assets can offer better long-term returns than relying on stablecoins.

EXPLORE: Next 1000X Crypto – Here are 10+ crypto tokens that can hit 1000x this year

Veteran trader Peter Brandt is bullish on Bitcoin, XRP, Ethereum and XLM

Legendary trader Peter Brandt believes BTC, ETH, XRP and Stellar (XLM) could be preparing to rise.

In his article on X, he said that BTC’s chart resembles past patterns that led to big rallies.

A few last posts for the weekend, then I leave you young people with your dreams$XRP – just a minor reaction in a larger theme$BTC – bull still alive and in good health$XLM – a bull waking up from a nap$ETH – ready to rock and roll

If I change my mind, I won’t let you know pic.twitter.com/rL1nVETYSn– Peter Brandt (@PeterLBrandt) October 11, 2025

He also said that ETH is holding up well despite recent market drops.

For XRP and XLM, Brandt pointed to signs of accumulation, meaning traders could quietly buy the dip and these coins could follow a similar trajectory higher.

In short, his message is: despite the short-term volatility, the long-term setup for these assets looks promising.

EXPLORE: 9+ Best Memecoin to Buy in 2025

BitForex CEO linked to $735 million BTC short

A recent on-chain investigation by crypto researcher “Eye” linked a mysterious whale on Hyperliquide that controls over 100,000 BTC to Garett Jin.

Jun is the former CEO of BitForex, an exchange that was shut down following fraud allegations.

1/ An investigation into the alleged identity of the mysterious Hyperliquid/Hyperunit whale, which holds more than 100,000 BTC. Recently, he sold over $4.23 billion worth of BTC to acquire ETH and is the same person behind the $735 million BTC short order placed on the same platform. pic.twitter.com/WeNvmiYP8v

– Eye (@eyeonchains) October 11, 2025

In his article on X, Eye highlighted the whale’s main wallet, named ereignis.eth. This wallet is connected to another ENS address, garrettjin.eth, which leads directly to Jin’s verified X account, @GarrettBullish, suggesting a strong connection between the two.

Eye explained: “The name ENS ereignis.eth (“event” in German) confirms its connection to this wallet, identifying it as the actor behind the large-scale operations on Hyperliquid/Hyperunit.

The wallet’s transaction history also matches Jin’s trading transactions, including transfers to staking contracts and a wallet funded by exchanges he was previously associated with, like Huobi (HTX).

Additionally, the wallet received and sent funds linked to addresses linked to BitForex and Binance deposits, which were used to execute massive transactions, one of which involved $735 million worth of BTC.

But not everyone is convinced. Crypto analyst Quinten François argued that the evidence is a little too practical in his opinion.

This doesn’t suit me.

Why would you have a .eth name leading to your X ID in a wallet that connects directly to market manipulation wallets and wallets for other crimes?

I don’t think anyone is stupid enough.

—Quinten | 048.eth (@QuintenFrancois) October 12, 2025

EXPLORE: 20+ Next Cryptos That Will Explode in 2025

The post Can BTC and ETH Rebound After $19 Billion Liquidation Storm? appeared first on 99Bitcoins.

BREAK:

BREAK: (@wacy_time1)

(@wacy_time1)