- Cardano needs an increase of 1,960% to reach the $ 10 mark, reflecting its past exponential rallies. Can history repeat itself?

- The active addresses have dropped considerably-will the activity of the ADA network recover in time to fuel an escape from major prices?

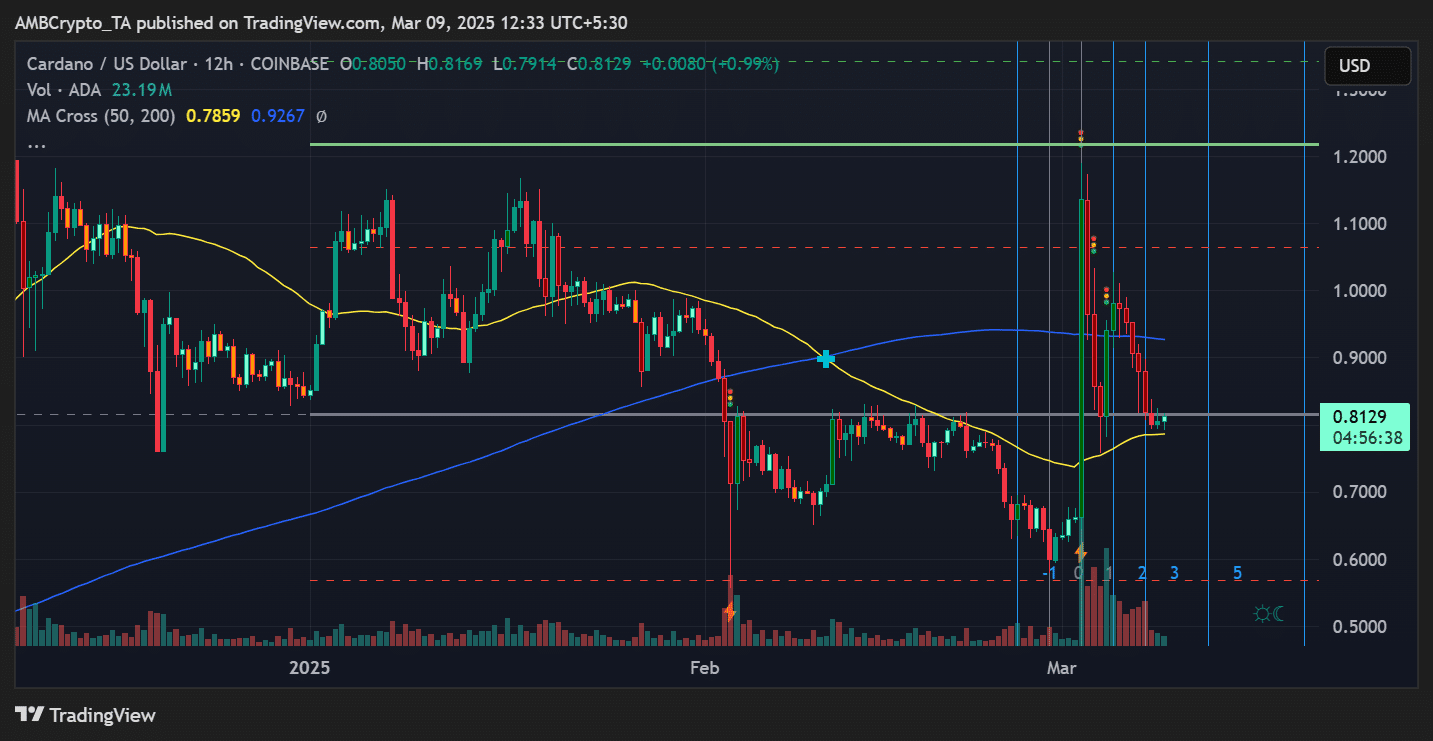

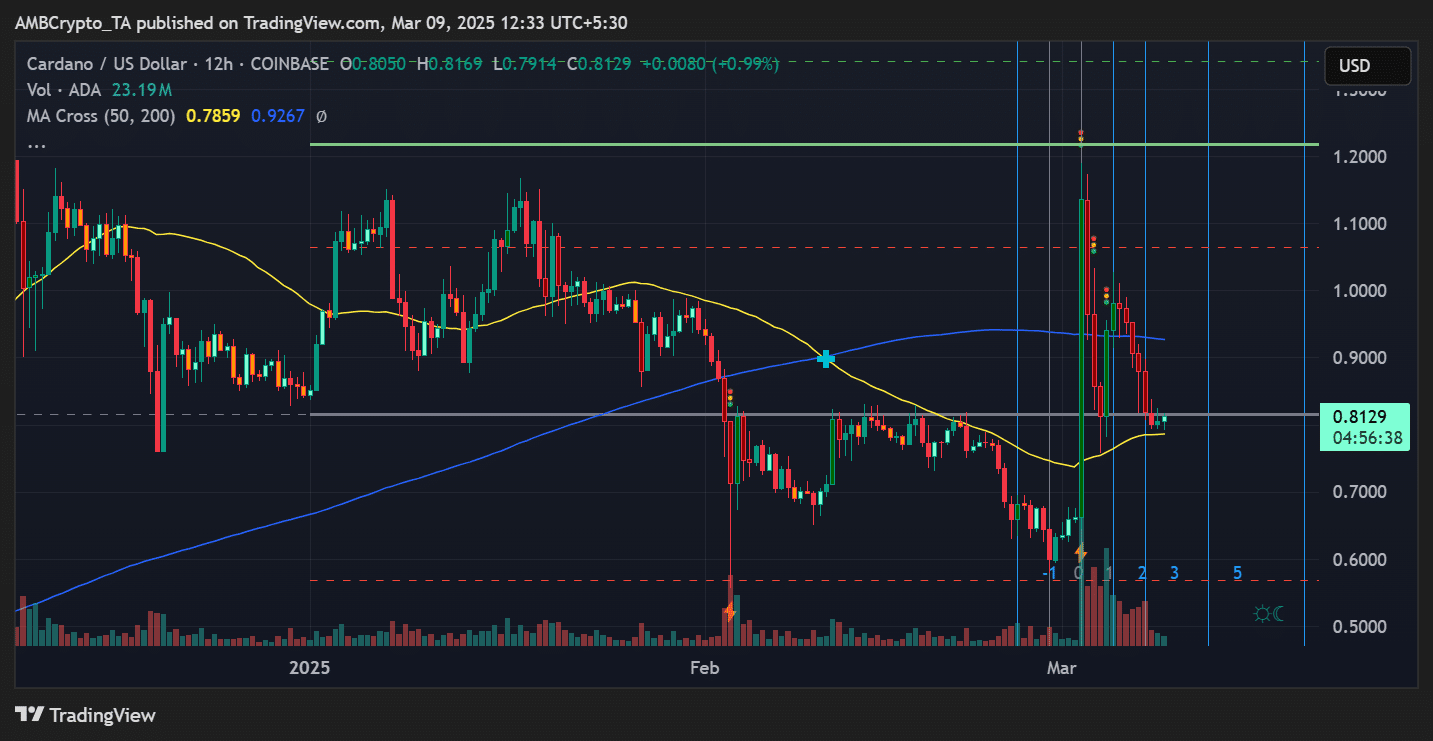

Cardano (ADA) has shown signs of potential break, analysts watching a wave to the $ 10 award bar. The assets maintained the support greater than $ 0.80 and tests critical resistance at $ 1.20.

If he successfully cleanses this barrier, a substantial rally could follow. However, achieving this ambitious objective would require a significant increase in prices.

To assess the feasibility of such a decision, data on the chain and historical trends must be taken into account.

Key price levels for Ada potential rally

The current structure of the action of cardano prices suggests a historic fractal training, reflecting past bullish cycles.

The weekly graph indicates that ADA has already experienced exponential overvoltages once it has exceeded major resistance areas.

If this model is repeated, the next stage of the rally could push Cardano to the price range scheduled at $ 10.

In the short term, ADA faces critical resistance at $ 1.20, a level that acted both as a support and resistance in past cycles. Beyond that, $ 1.50, $ 2.20 and $ 3.00 remain the key psychological levels.

Crossing them could pave the way for new gains.

Source: tradingView

However, ADA must maintain its position greater than $ 0.80, which currently serves as a crucial support zone. A failure to maintain this level could invalidate upward perspectives, leading to a deeper retirement.

Channel metrics: do data support a rally?

By examining daily active addresses, a significant drop was noted in user activity.

The latest chain data shows a sharp drop in the number of active addresses interacting with the network, which suggests a reduction in network engagement.

Historically, an increase in active addresses preceded the main price rallies, which means that ADA may need an increase in network participation to support its movement up.

Source: Santiment

In addition, the volume of exchanges and liquidity are important factors to monitor. The most recent volume data suggest that the purchase of pressure remains stable, but has not yet shown the explosive growth observed in previous escapes.

If the volume increases next to an escape from prices, this would lead to high confidence in the market.

Historical comparison: How much would an ADA have to win?

A look at ADA’s past past pasts provides a reference point for its upward potential. During cycle 2021, ADA saw an increase of 2,600% in a similar time.

If a similar scheme was to be emerged, ADA would require overvoltage of approximately 1,960% to reach the lens of $ 10.

Although such a decision is not unprecedented, it would require a combination of thrills in the market, increased adoption and global dynamics of the cryptography market.

Will ADA burst or do he face rejection?

The next few weeks will be essential to determine if Cardano can maintain its upward trajectory. If ADA erases the resistance by $ 1.20, a movement around $ 2.20 and beyond becomes more and more plausible.

However, not breaking this level could cause additional consolidation, delaying the expected rally.

Investors must monitor activity on the chain, commercial volume and macroeconomic factors influencing the larger market.

Although ADA’s past performance suggests the potential of a major rally, its ability to reach $ 10 depends on the sustained momentum and increased investor participation.

At its current price, Ada remains at a crucial point. Whether new heights or faces resistance, traders will closely monitor the next major movement.