- Whale sales intensified, pushing down the price of ADA and key indicators such as the stock-to-flow ratio.

- ADA’s recovery depends on maintaining critical support levels amid bearish market sentiment.

From AMBCrypto covered According to this news 24 hours ago, the whales made even more moves, selling over 70 million Cardano (ADA) in the last 48 hours. This significant sale sent shockwaves through the market, putting further pressure on ADA’s price and key performance indicators.

At press time, ADA wasis trading at $0.9352, marking a 5.79% decline over the past 24 hours. As traders face increased uncertainty, questions arise over whether Cardano can regain momentum or whether further losses are inevitable.

How the sale impacted ADA

The first notable effect of the whale activity was the sharp decline in ADA prices, which is now approaching critical support levels. This intense selling pressure reduced ADA’s market capitalization to $32.87 billion, a decline of 6.08%, showing the extent of the market reaction.

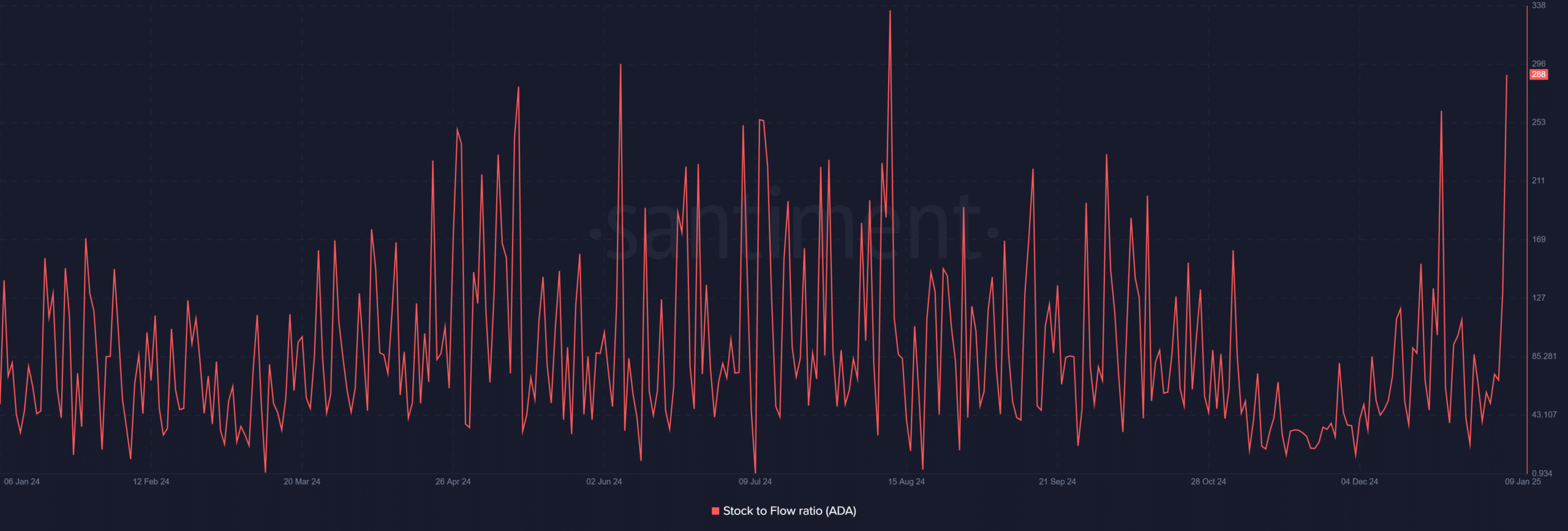

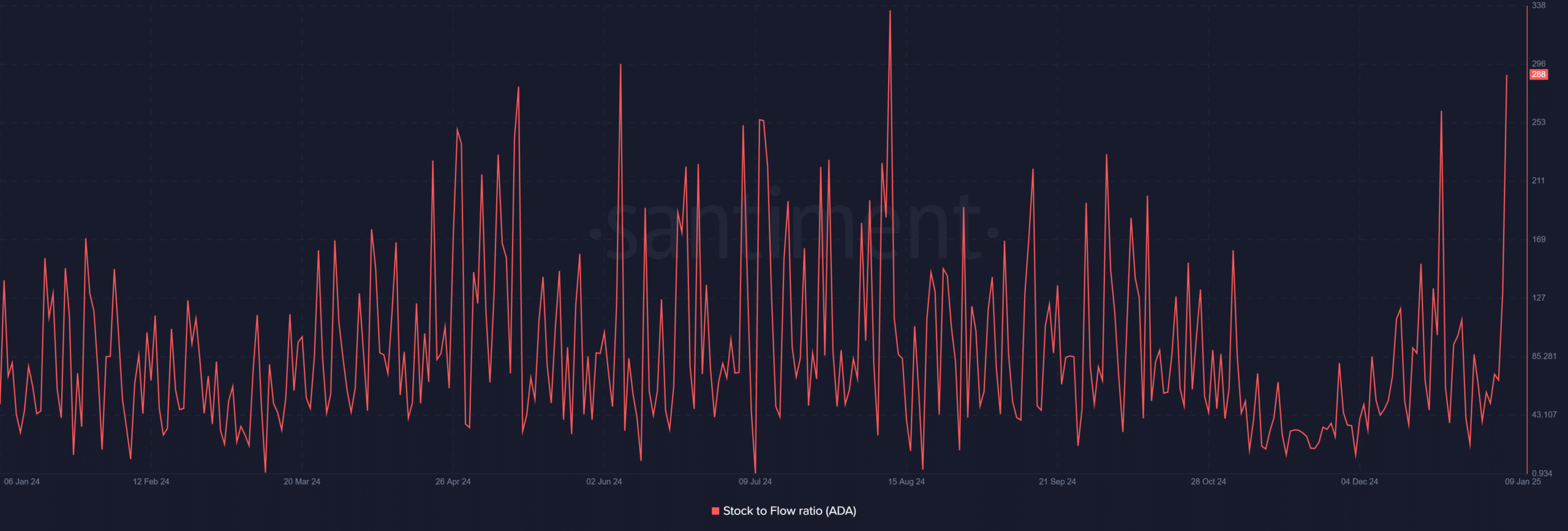

Additionally, the stock-to-flow ratio increased from 291.37 to 288.50, highlighting lower investor confidence as scarcity and demand indicators trend downward.

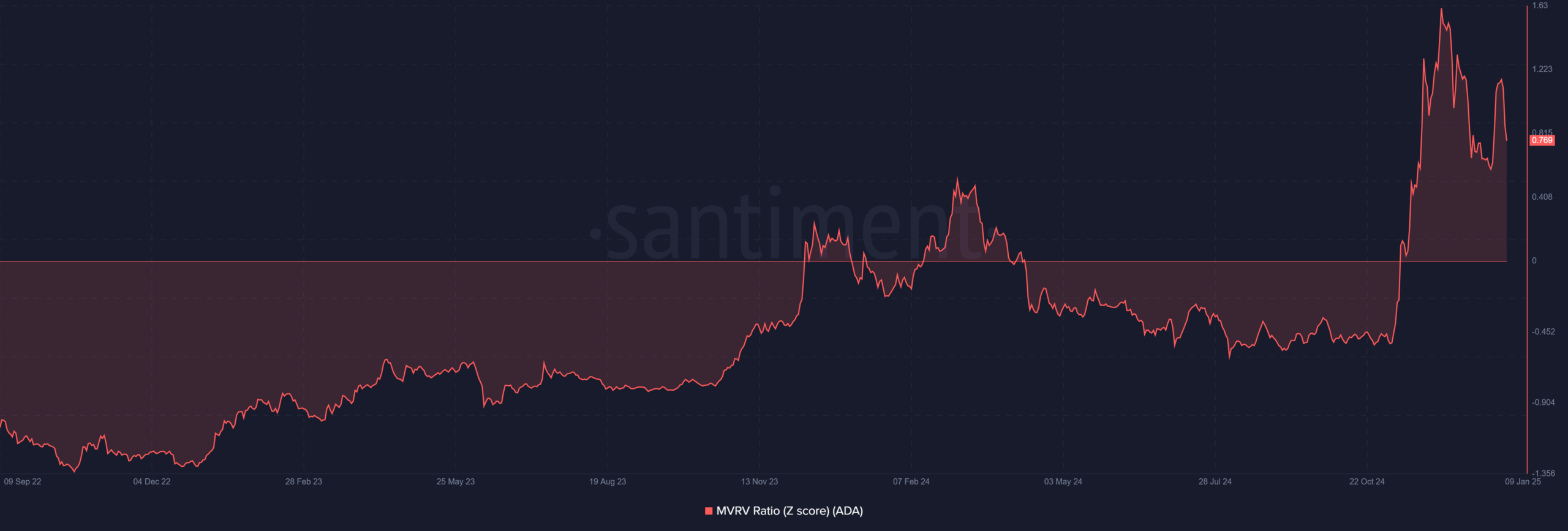

Source: Santiment

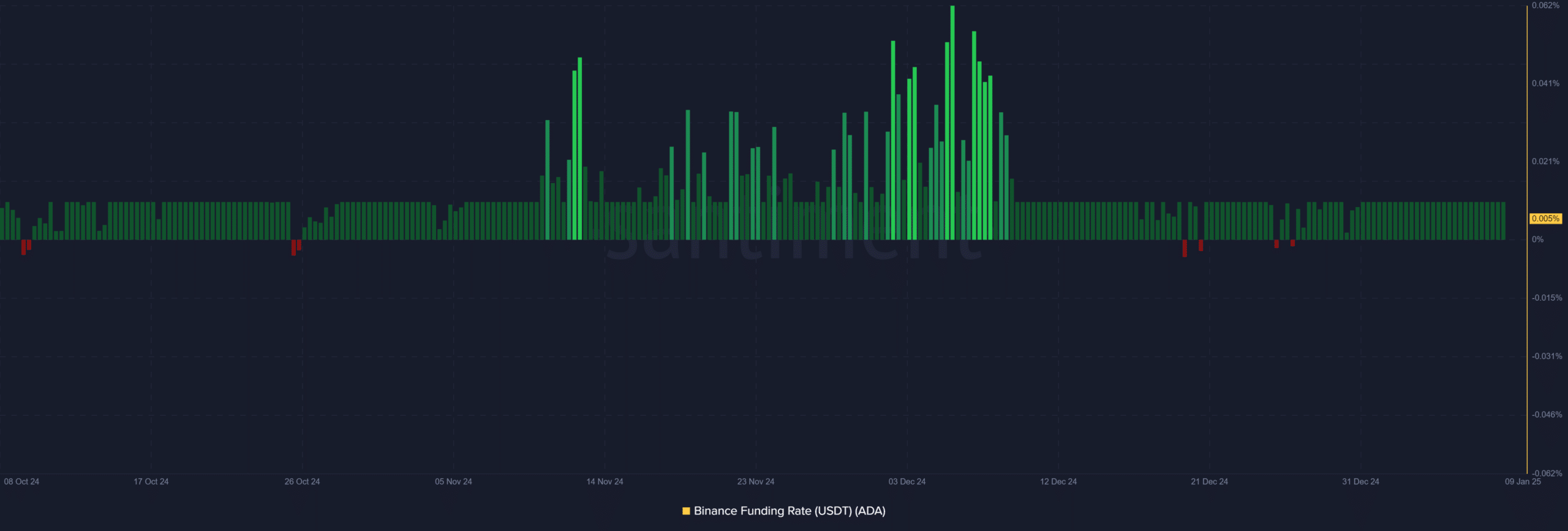

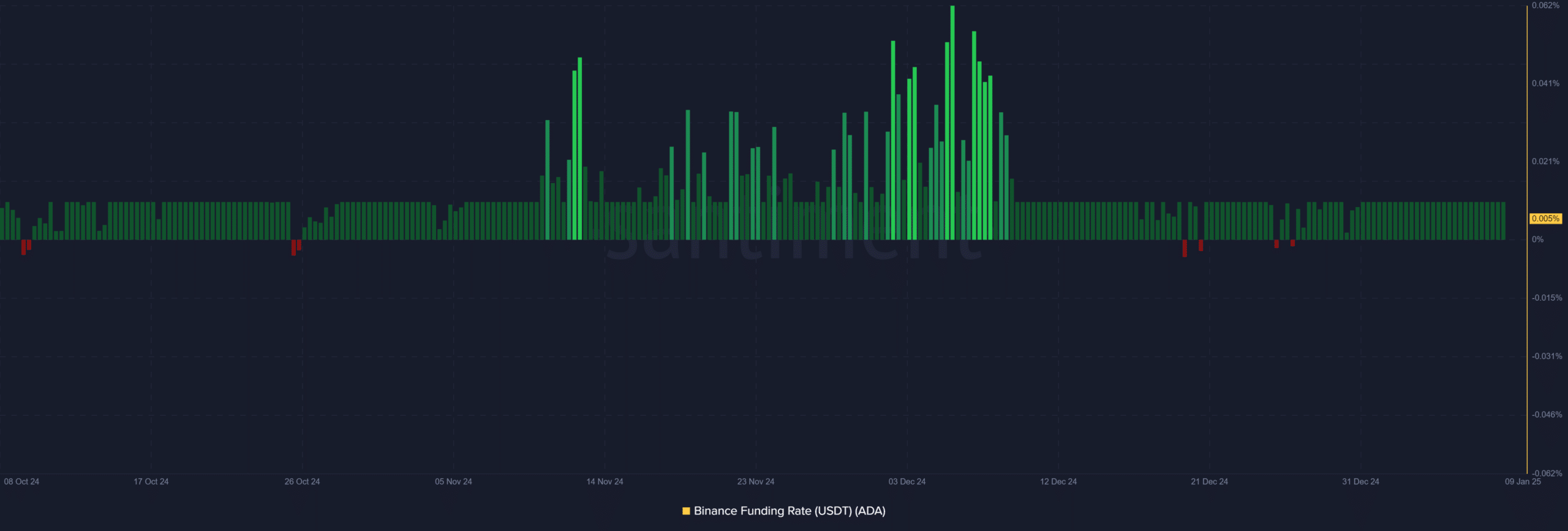

Additionally, the derivatives market showed significant bearish signals. On Binance, the funding rate increased from 0.01% to 0.0055%, reflecting a reduction in bullish sentiment among leveraged traders.

Source: Santiment

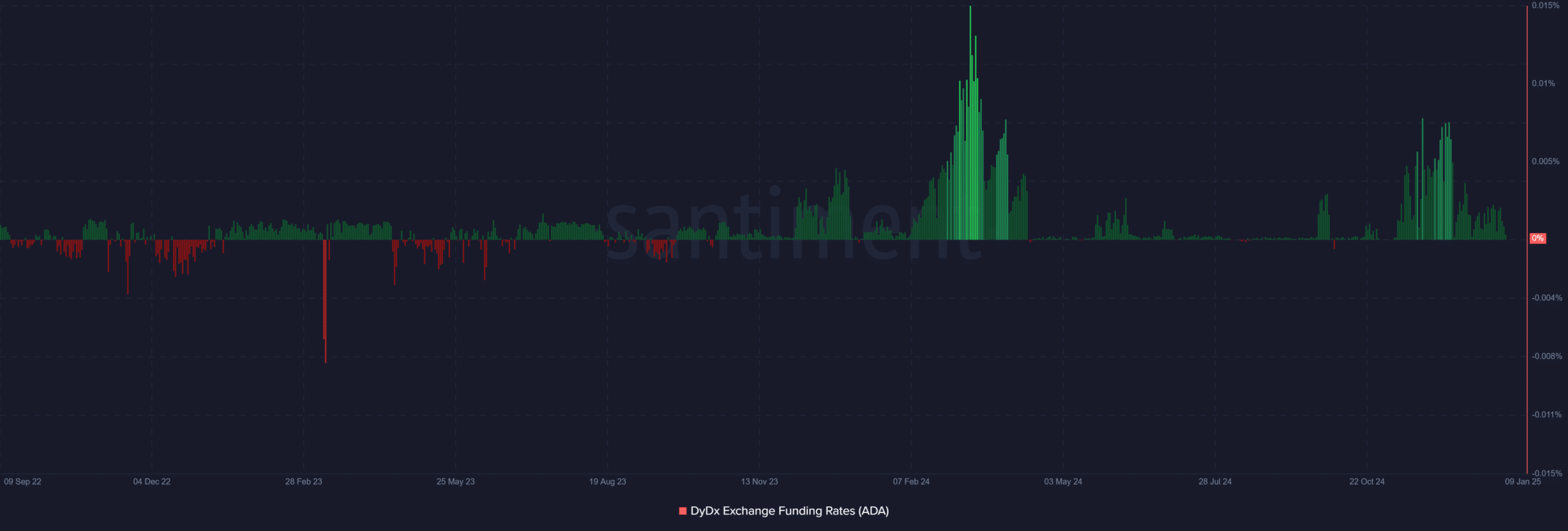

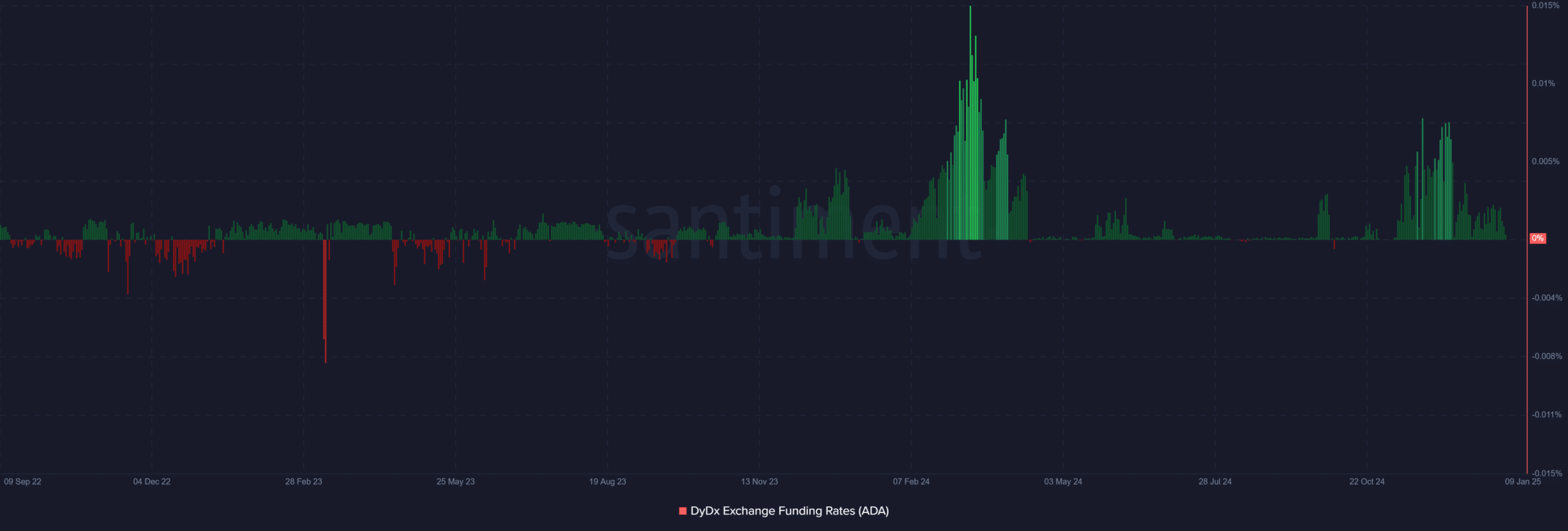

Likewise, funding rates on the DYDX exchange fell from 0.000334 to 0.000057, further highlighting the decline in market optimism. These moves suggest traders are repositioning to account for increased volatility and downside risks.

Source: Santiment

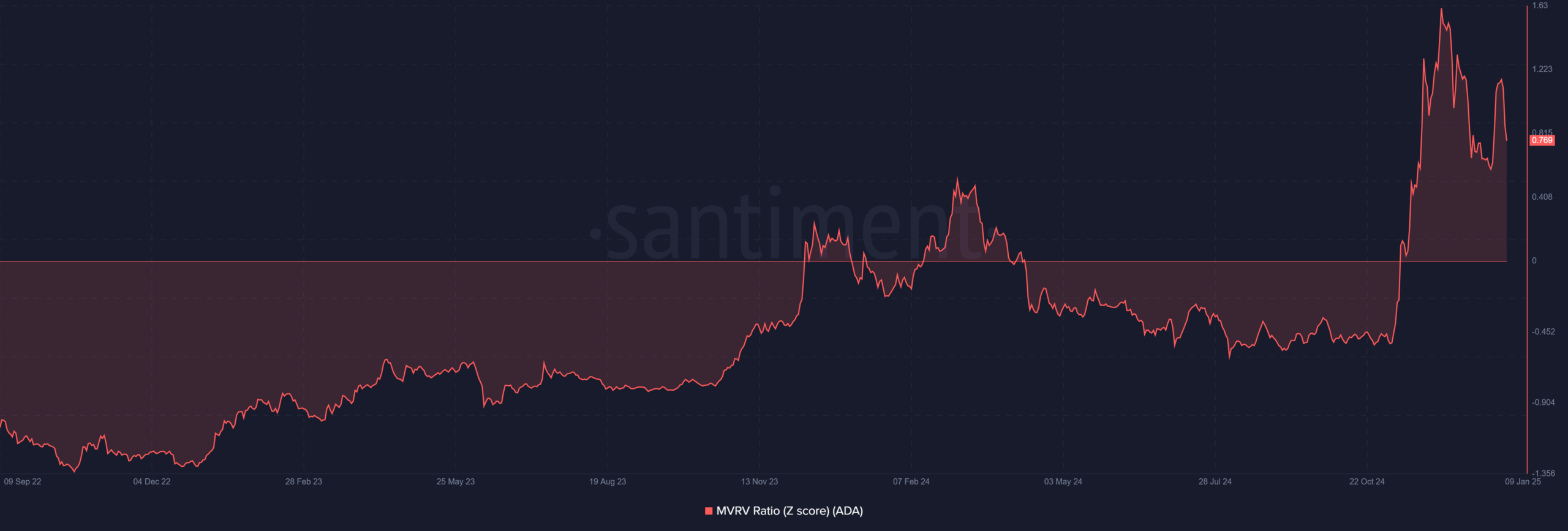

Additionally, the MVRV ratio – a metric assessing holder profitability – increased from 0.92 to 0.769. This decline indicates that ADA holders are experiencing increased losses as the price continues to fall.

Together, these metrics illustrate the impact of the whale selloff, which left traders and investors with limited confidence in ADA’s near-term performance.

Source: Santiment

Can Cardano recover?

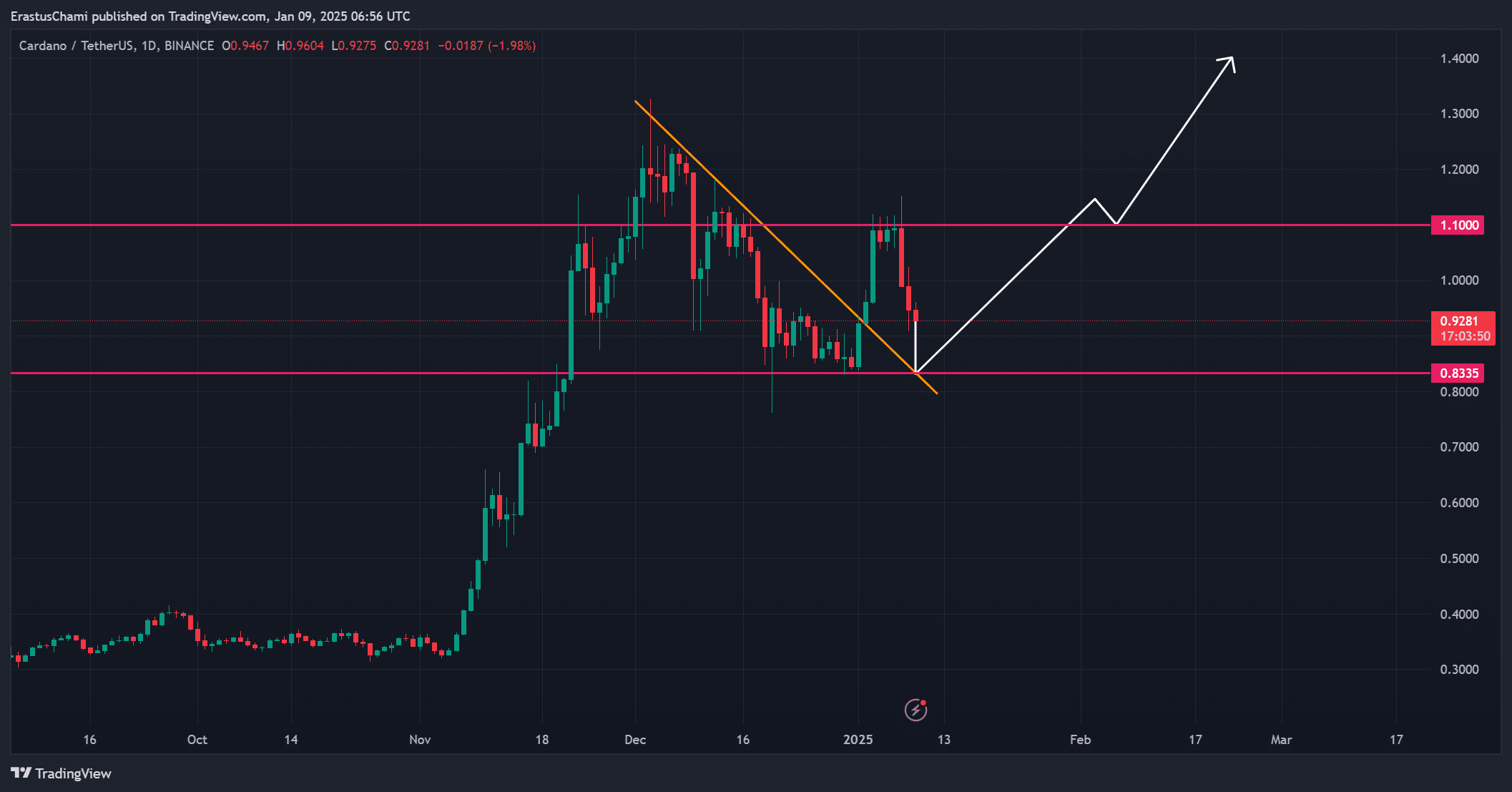

Despite the bearish outlook, ADA could find relief near the critical support level of $0.8335, which could trigger a technical rebound. However, for this to happen, buyers must step in to absorb the selling pressure and restore confidence.

If this key level fails, ADA risks continuing to fall, which could exacerbate investor losses.

Source: TradingView

Read Cardano (ADA) Price Prediction 2025-26

In conclusion, Cardano’s recovery depends heavily on whether whales stop their selling activity and buyers re-enter the market.

If ADA maintains its critical support level, a rebound is possible. However, given current indicators pointing to downward momentum, a rapid recovery appears difficult in the short term.