Ether held firm Tuesday as the market attempted to stabilize after a rough November marked by derivatives resets, collapsing gas fees and preparations for a relaunch of U.S. futures next month.

Ethereum (ETH), the second-largest crypto asset, was trading near $2,920 in the afternoon.

According to Coingecko data, the price is up around +4% over the past 24 hours as traders look for signs of stability after weeks of heavy pressure.

The latest move comes as funding rates and open interest rates calm down after a sharp decline earlier this month.

And in the background, Cboe is preparing a “perpetual” ether futures product that is expected to roll out in mid-December, giving U.S. traders another way to hedge or gain exposure.

DISCOVER: The 12+ Most Popular Crypto Presales to Buy Right Now

How strong is Ethereum’s on-chain activity after the November drop?

The market as a whole struggled for most of November. Bitcoin fell to a seven-month low last week, and ether fell at the same time.

BTC has started to rise again, while ETH’s rise today marks a small pause after several sessions of selloffs and risk aversion.

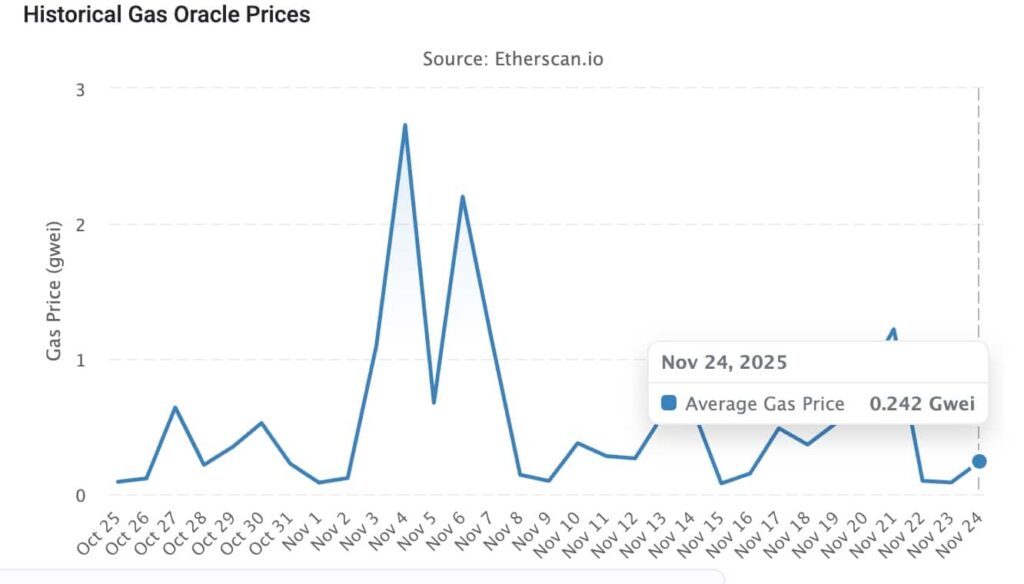

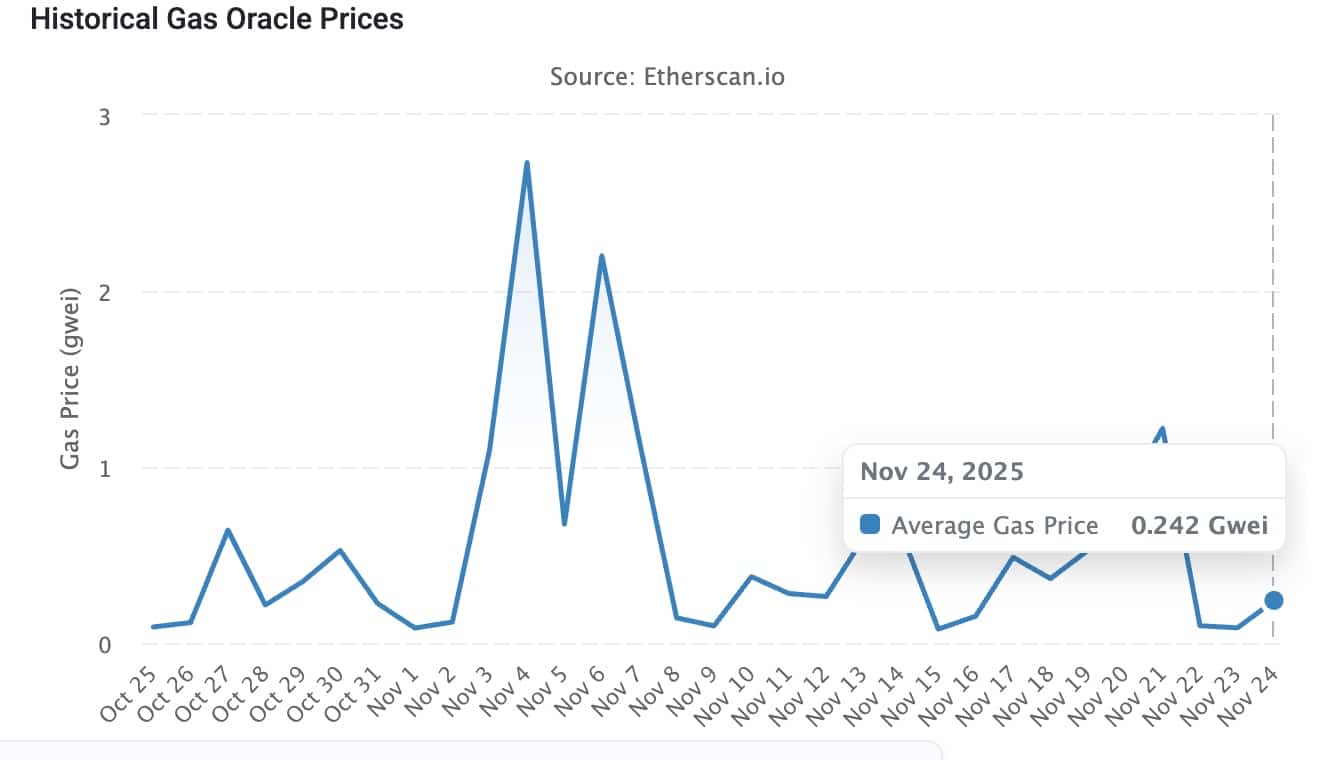

Liquidity on Ethereum has improved as the market has rebounded. Medium L1 gas briefly slipped at around 0.085 gwei Tuesday morning. This is one of the lowest levels of the year, and it has made on-chain activity cheaper for users.

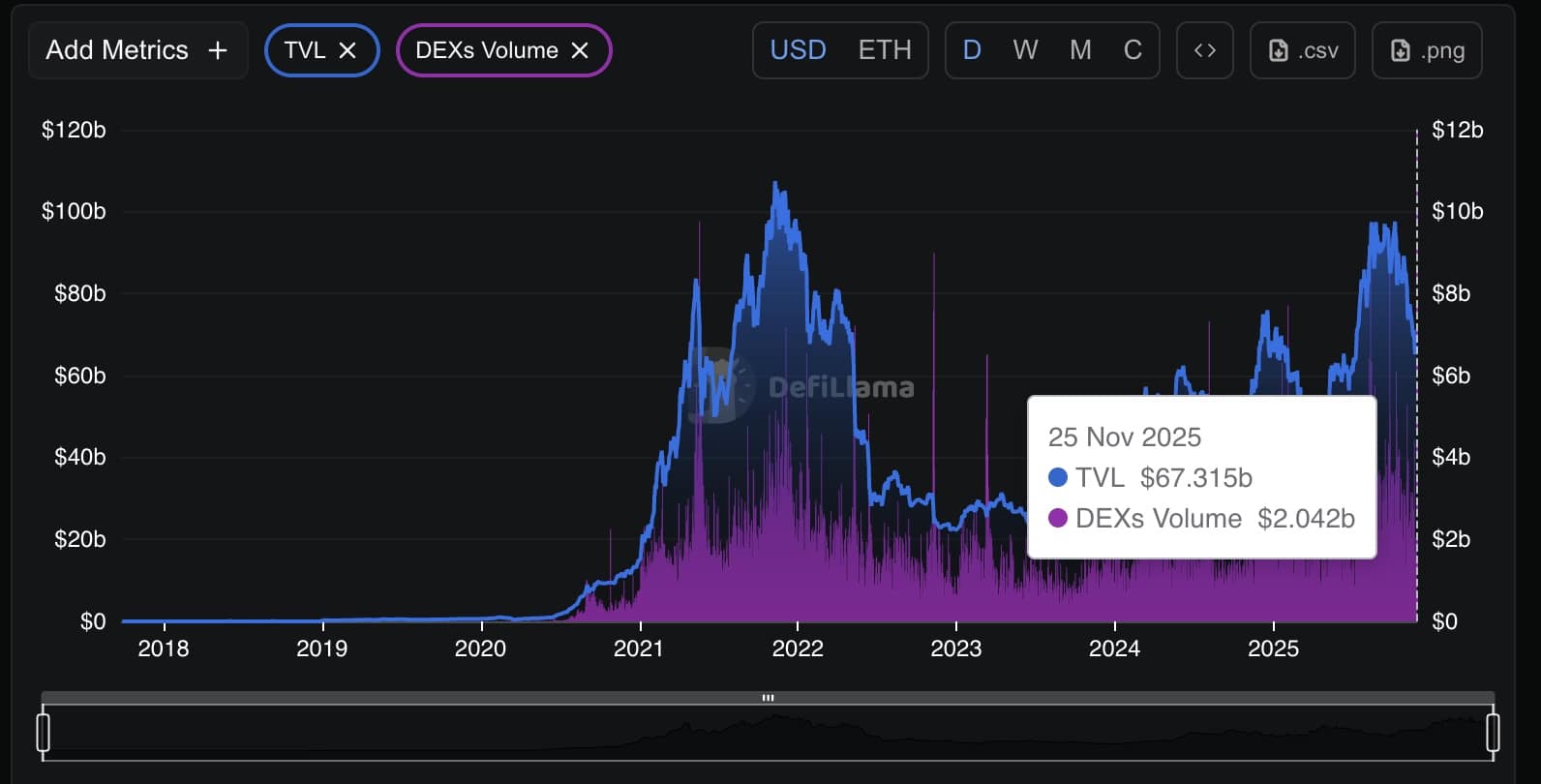

At the same time, DEX volume reached around $2.04 billion in the last 24 hours.

According to DéfiLlama datathe network has processed approximately 1.5 million transactions and approximately 464,000 active addresses. These figures show stable participation even after the recent decline.

CoinGlass data shows that ETH open interest is near $35.84 billion and futures volume over the past day is around $88 billion.

The positioning has grown again, but it has not reached high leverage territory. Spot volume is always lighter than futures.

One structural event to watch for in December is the launch of Cboe’s new “Continuous Futures” ether on December 15.

These US-regulated contracts aim to mirror perpetual futures contracts, with daily cash adjustments and a quoted duration of up to 10 years.

Rob Hocking of Cboe said Perpetual futures were “historically traded overseas” and noted that the exchange’s new structure is meant to provide “a controlled means of obtaining some leveraged exposure” under a U.S. system.

Kaiko, Cboe’s index partner, said the products meet “a real need for institutional investors” who want efficient, long-term exposure without relying on unregulated markets.

DISCOVER: 9+ Best High Risk, High Reward Cryptocurrencies to Buy in 2025

Ethereum Price Prediction: How Soon Could Ethereum Surpass Bitcoin?

Ethereum is also attracting attention in the market. Analyst Michaël van de Poppe said The ETH/BTC pair appears “eager to break out higher” in the coming days.

Its chart shows the pair holding above a key support zone between 0.02920 and 0.03200 BTC, a level that has been a stable demand zone for months.

ETH/BTC remains in a tight range and Michaël van de Poppe thinks the move is close. “Probably 1-2 more days, then $ETH will break the trend and outperform Bitcoin,” he said.

The pair has spent months correcting from its yearly high of 0.08556 BTC. Since then, it has moved sideways with narrow candles, showing how much volatility has compressed.

It is now bucking a descending trendline that has limited every rally since late summer. This pressure suggests a possible escape attempt.

The 50-day moving average on the daily chart is flattening just above current levels. ETH has also tested this zone several times, leaving higher wicks that indicate regular buying.

The RSI is moving out of oversold territory, corresponding to price stabilization.

Van de Poppe calls this support zone the “sweet spot for buying,” noting strong defense with repeated long lower wicks.

If ETH breaks the trendline, it sees targets near 0.036 to 0.038 BTC and later 0.042 BTC. If it fails, the pair could fall back towards 0.030 BTC.

For now, traders are waiting to see if ETH can finally change momentum after a long period of underperformance.

DISCOVER: 15+ Coinbase Lists to Watch in 2025

The article Can Ethereum Price Prediction Recover From November Drop: ETH USD Price Analysis for December appeared first on 99Bitcoins.