Ethereum undergoes a correction after weeks of strong dynamics, but institutional adoption quietly reshapes the long -term dynamics of the market. According to an cryptocurrency, the popular “cryptographic cash strategy”, which has long been associated with Bitcoin, has now entered the Ethereum ecosystem. More than 16 companies have already adopted this approach, collectively holding 2,455,943 ETH worth almost $ 11.0 billion. This significant allowance has effectively locked a large part of the ETH, reducing the offer available on the free market.

Related reading

The treasure movement reflects the Bitcoin game book, where companies have strategically accumulated BTC as a reserve asset. However, Ethereum has important differences. Unlike the offer hard of 21 million bitcoin, ETH has no fixed maximum. Instead, its supply dynamic is shaped by network activity and the burning mechanism introduced with EIP-1559. Although these mechanisms can create deflationary periods, the total supply of Ethereum has further increased by around 1 million ETH (~ 0.9%) in the past year.

This duality presents both the opportunity and the risk. On the one hand, institutional assets reduce the supply of liquid and reinforce the role of Ethereum as a strategic intake. On the other hand, the variable emission means that during periods of low network activity, the growth of supply could accelerate, diluting the effects of rarity. As Ethereum is testing key demand levels, the treasure strategy can be essential to shape its next major trend.

Ethereum: risks of concentration and leverage of the treasure

According to cryptotic analysis, the recent tendency to adopt the Treasury of Ethereum has both opportunities and risks. On the one hand, institutional treasury bills have locked billions of Eth, which reduces the available offer on the market.

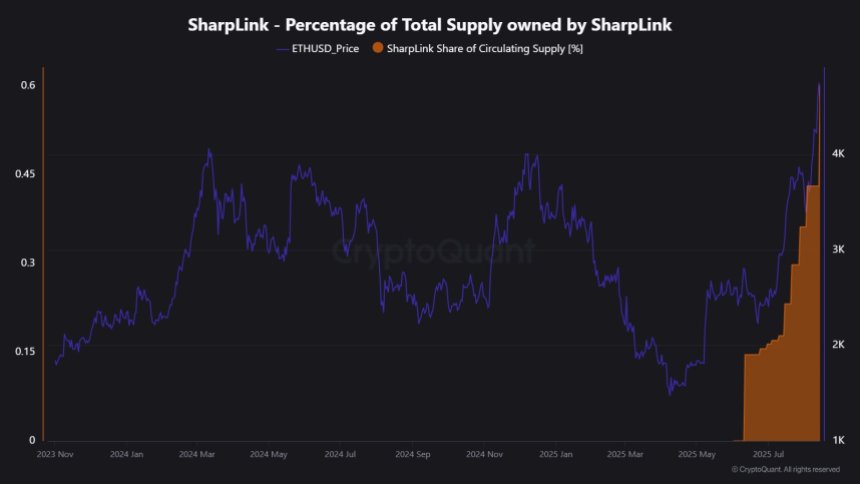

However, the structure of these operations also has risks of concentration. For example, Bitmin Immersion Technologies, which openly declared its objective of controlling 5% of all ETH, currently holds only 0.7%. The biggest holder, Sharplink Gaming, only manages 0.6%. This means that the adoption of the treasure is still concentrated among a few players. If one or two major holders were to unload their reserves, the market could face high price shocks.

Beyond the punctual accumulation, the lever effect is another growing factor. Cryptotic stresses that the interests open to the ETH long has climbed to around $ 38 billion. This level of leverage means that large price oscillations can trigger cascade liquidations. In cryptographic markets, the lever effect is synonymous with volatility.

The fragility of this configuration was obvious on August 14, when an erasure of only $ 2 billion in open interests led to $ 290 million in forced liquidations and a 7% drop in the price of the ETH. This event highlights how much things can be a spiral when liquidity is thin and the lever effect is high. Sale in cash alone does not stimulate volatility – the positions launched magnify each movement. In this context, the adoption of the Treasury of Ethereum can obtain long -term demand, but concentrated assets and the growing lever effect remain key vulnerabilities.

Related reading

ETH tests critical liquidity levels

The action of the prices of Ethereum on the 3-day graph shows that after having raised a local summit close to $ 4,790, ETH has entered a correction phase but remains well above the medium of key movement. Currently exchanging about $ 4,227, the price has retired from its peak but still holds the wider bullish structure.

The 50-day SMA ($ 2,687), the SMA 100 days ($ 2,838) and the 200-day SMA ($ 2,912) are all increasing, reflecting a strong underlying momentum. Above all, ETH is negotiated considerably above these long-term averages, confirming that the upward trend remains intact despite the decline. The strong rebound of less than $ 3,000 earlier in summer marked a decisive reversal after months of consolidation, establishing the basics of the last escape.

Related reading

If the Bulls manage to hold the support zone from $ 4,200 to $ 4,100, the ETH could release the resistance nearly $ 4,790 and potentially switch to prices. Conversely, non-compliance with this level could see a retest of the range of $ 3,800 to $ 3,600. The coming sessions will be essential to confirm if Ethereum resumes its upward trend or between a deeper correction.

Dall-e star image, tradingview graphic

(tagstotranslate) Eth

Source link