- Canary files Solana ETF.

- SOL price reflects BTC’s decline below $70,000.

Canary Capital submitted an S-1 deposit with the United States Securities and Exchange Commission (SEC) for a place Solana (SOL) exchange-traded fund (ETF).

According to the form, the net asset value (NAV) of the ETF would be calculated based on the Chicago Mercantile Exchange (CME) CF Solana-Dollar benchmark rate.

This latest move follows the asset manager’s recent decision applications for place Ripple (XRP) And Litecoin (LTC) ETFs.

Although Canary does not yet have a live ETF, its three recent filings highlight an ambitious move in the crypto investing space.

Canarian support for Solana

Following the news, James Seyffart, ETF analyst at Bloomberg, highlighted Canary’s ambitions for a SOL ETF in a job on X (formerly Twitter).

Reflecting on Solana’s strong position within the blockchain ecosystem, Canary said:

“Despite the hyper-competitive L1 and EVM landscape, Solana has become a proven leader for decentralized applications.”

The statement also emphasizes Solana’s strong DeFi ecosystem, citing sustained metrics such as daily transactions, active addresses, and new addresses, all within a low-fee structure.

Furthermore, the company expressed optimism that the ongoing project growth The stablecoin deployment would further strengthen Solana’s lead over its competitors.

Solana ETF Deposits

Canary’s filing marks the latest attempt to introduce a Solana ETF in the United States, although it is not the first.

Earlier this year, asset management firms VanEck and 21Shares filed for a SOL spot ETF, submitting their S-1 applications in June.

It should be noted that outside the United States, Brazil was the first country to approve SOL ETFs in August.

SOL Market Performance

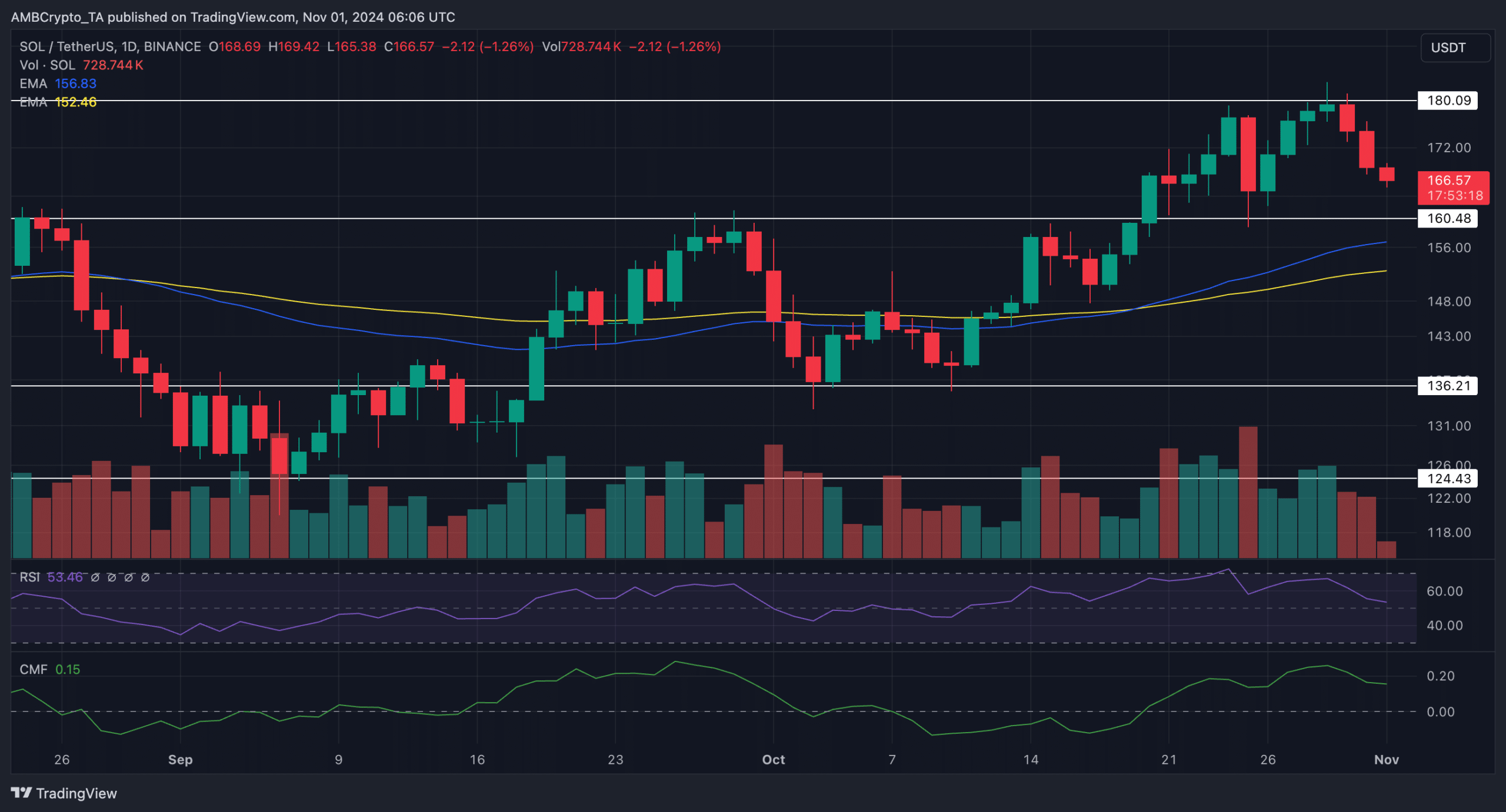

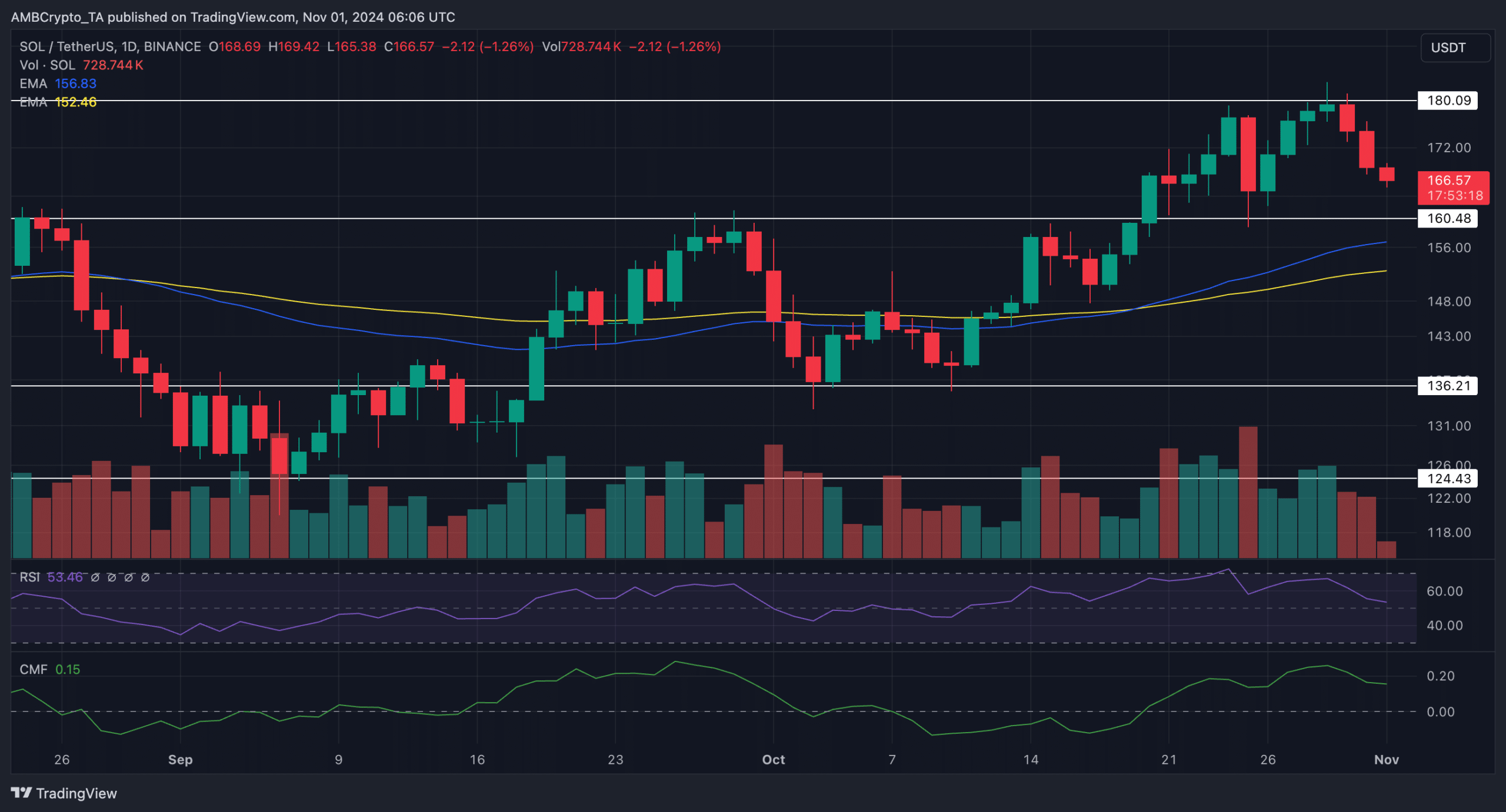

Despite the filing, things were not looking so good in terms of prices. After being rejected at the critical $180 mark, SOL’s chart was painted red.

At the time of writing, the altcoin was trading at $166, down 4.90% over the past day.

Notably, the decline in SOL price aligned with sector-wide losses, as Bitcoin (BTC) fell below the $70,000 mark.

Source: TradingView

Technical indicators reflected this trend, with the RSI and CMF showing weakening bullish strength. At press time, they stood at 53.46 and 0.15, respectively.

This downtrend has put SOL at risk of testing the $160 support level. If violated, the decline could worsen.

Additionally, if the 100-day EMA (yellow) is lost to sellers, the trend would tilt decisively in favor of the downside.

The Potential Advantage of SOL ETFs

Meanwhile, not everything is bad for SOL in the crypto sphere.

October 14, AMBCrypto reported that Grayscale requested to convert its Digital Large Cap Fund (GDLC) into a multi-crypto ETF, which included Solana among other assets.

On October 29, the SEC officially recognized Grayscale’s candidacy. This marks an important step towards the launch of the first multi-asset crypto ETF in the United States.

A decision on the application is expected within 45 to 90 days.

As the ETF race continues, Canary Capital’s recent filing highlights the growing demand for Solana-based investment vehicles.

However, will this momentum translate into regulatory approval? That remains to be seen.