Crypto investment firm Canary Capital has submitted an application for a second XRP exchange-traded fund (ETF) in the United States. This filing is consistent with Bitwise’s recent submission of a comparable application for a spot XRP ETF.

In light of the legal and regulatory uncertainty surrounding XRP, Canary’s decision to launch this ETF demonstrates a bold approach to the asset’s long-term potential.

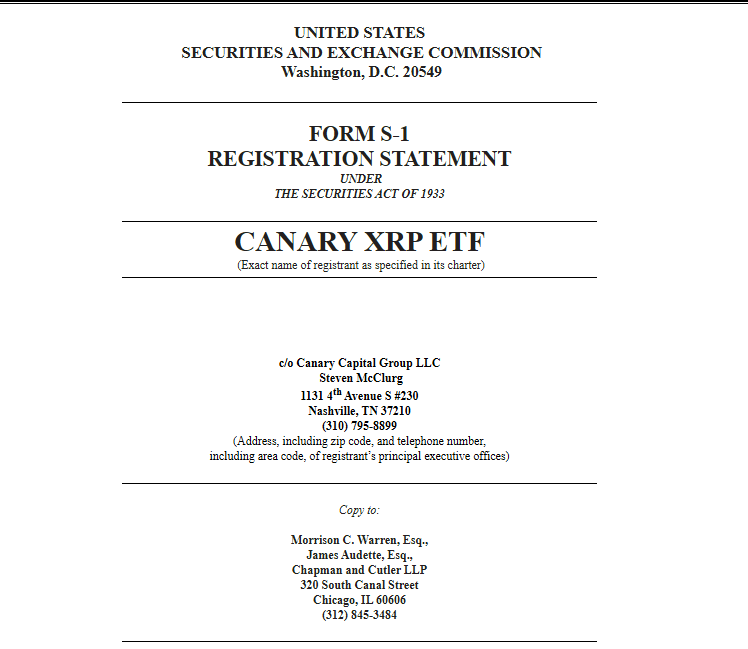

Canary Capital submitted the S-1 filing on Tuesday, which is a requirement for issuers to file an application for a public offering of new securities.

The Canary ETF is particularly ambitious as the legal and regulatory fate of XRP remains shrouded in doubt, indicating a strong belief in the digital asset’s future role in the financial sector.

Source: SEC

Canary launches: the 2nd ETF

The new Canary ETF comes as the future of XRP in the United States remains uncertain, due to ongoing legal proceedings between Ripple Labs and the SEC. The case is the subject of heated discussion over whether XRP should be classified as a security token.

Breaking: Canary Capital files second XRP ETF in the United States

– John Morgan (@johnmorganFL) October 8, 2024

The legal outcome is seen as having a significant implication on Ripple and the broader crypto market as a measure of how other digital asset issuers will be treated. However, the request filed by Canary is not motivated by desperation. This is more than wishful thinking to preserve the so-called fading purple dream.

Furthermore, the increased possibility of obtaining support from the SEC represents a sign of a change in regulatory attitude towards crypto projects at all levels.

XRP market cap currently at $30 billion. Chart: TradingView.com

Growing Adoption of XRP

The ETF filing also highlights a broader trend of institutional interest in XRP. As enthusiasm for XRP continues unabated within the crypto community, many institutional investors are looking for a reliable and regulated way to gain exposure without needing to purchase, store and secure it.

Canary Capital’s XRP ETF seeks to track the CME CF Ripple Index, providing investors with a consistent price benchmark. This helps avoid the complications of purchasing, storing, and safeguarding the asset while indirectly gaining exposure to the XRP market.

XRP up in the last 24 hours. Source: CoinMarketCap

Clear avenue for the XRP market

Canary Capital’s decision is bold. Regardless of the uncharted regulatory territory, XRP’s role in institutionalized finance is far from unknown. If the ETF is approved, it would provide large investors with a clear path to enter the XRP market. This could also signal XRP entering a new stage of maturity, based primarily on Ripple’s settlement and the SEC’s attitude towards cryptos.

At the time of writing, XRP was trading at $0.53, up 0.5% over a 24-hour period, and trading flat for the past week, according to data from CoinMarketCap.

Featured image from The Tech Report, chart from TradingView

Source: SEC

Source: SEC XRP up in the last 24 hours. Source: CoinMarketCap

XRP up in the last 24 hours. Source: CoinMarketCap