Last year, the best eight best -efficient beginners FNB were all linked to cryptography. It’s about 740 new ETFs in 2024. This is a massive new. He establishes the crypto as a class of legitimate assets. Wall Street also wakes up to this news, and these guys can have their reservations!

Bitwise underlined another interesting result. Namely, “56% of financial advisers are now inclined to allocate crypto funds”. And this is only the beginning. Recently, we saw new deposits for Cardano ($ ADA) and Solana ($ Sol) ETF. So which will be the first ETF Crypto Spot to be approved?

What is an Crypto Spot ETF?

An Crypto Spot ETF is an investment vehicle. Thus, an ETF Crypto Spot, like Bitcoin or Et Etfthe Spot Etf, exposes you to these assets. The ETF spot follows the price movements of the underlying assets.

NEW: @Ericbalchunas And I took a look at the Crypto ETF deposits. We put relatively high chances of approval at all levels. Mainly focused on Litecoin, Solana, XRP and Dogecoin for the moment.

Here is the table with the chances and some other details: pic.twitter.com/xaxanxlb0m

– James Seyffart (@jseyff) February 10, 2025

However, your exposure to Bitcoin, or any other asset, is indirect. This is because you do not hold the actual underlying asset. The broker you use has the real asset. So if you buy an ETF Bitcoin Spot, you only have one action you buy on the stock market. But the broker must support each share with a real bitcoin.

This means you don’t have to have a cryptographic wallet. You also don’t need to use an crypto exchange to buy a cryptographic asset. The brokers hold this in their respective guaranteed cryptographic wallets. So you don’t need to deal with the sometimes complex complex cryptography ecosystem. Especially for new people in Crypto, this can be a good option. Convenience is a great reason for their success so far.

This model is based on the world of traditional finance and its investment structures. It is also regulated because the dry must approve an ETF. This calls for retail and institutions. However, there are also drawbacks. For example,

- You are always exposed to the volatility of assets.

- The goalkeeper is still at risk of cyber flight.

- In the event that the asset distributes awards, they go to the broker, not to the shareholders of the FNB.

Are the Crypto-Spot ETFs successful?

Currently, there are only two ETF Crypto Spot. These are Bitcoin and Ethereum. It turns out that the launch of the Bitcoin Spot ETF is the most successful launch of all time. On January 10, 2024, the SEC approved the ETF Bitcoin Spot. So, a little over a year ago.

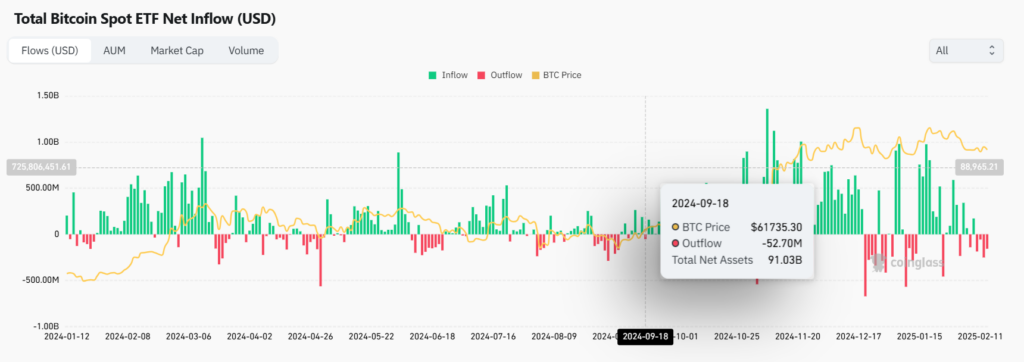

However, a year later, he had $ 107 billion in AUM (active under MGMT). No other new ETF has obtained this type of volume. In the United States, there are 11 suppliers for Bitcoin Spot ETF. Blackrock is the clear leader. Its Ibit Fund alone has $ 57 billion in Bitcoin. So, yes, the Bitcoin Spot ETF is very successful. You can also see on this table; Entrances output the outputs most of the time.

Source: Coringlass

On the other hand, the ETHEREUM SPOT ETFs do not succeed. There are nine suppliers in the United States. They were approved on July 23, 2024. However, they did not see the same request as the Bitcoin ETF. However, the fact that there is an ETF ETF Spot ETF is positive.

In 2025, some experts expected an influx of $ 150 billion in the Bitcoin ETF alone. This also benefits ETH and the entire market. There should also be many new ETFs. So let’s take a look at the two most likely contenders.

“I’m waiting for $ 150 billion in net entries #Bitcoin ETF at the end of 2025. “

– RIC Edelmanpic.twitter.com/yyfwcjd0tu

– Vivek

(@ Vivek4real_) April 6, 2024

ETF Solana ($ soil)

Yesterday, the SEC confirmed four deposits for ETF Solana Spot. They came from,

- Canary

- Valve

- Invest in the sense of a bit

- 21hares

RUP:

RUP:  SEC officially recognized the following place @Solana ETF files today:

SEC officially recognized the following place @Solana ETF files today:• ETF Canary Solana

•@vaneck_us ETF Solana

•@Bitwisinvest ETF Solana

•@ 21shares ETF Solana pic.twitter.com/v1by9spnpb– Solanafloor (@Solanafloor) February 11, 2025

We must also consider the current change of key staff in the dry. Paul Atkins will be the new president of the dry. He is pro crypto. Thus, four deposits are great news. By the way, if you are looking for a place to buy $ soil, look no further. Bydfi is the ideal place for you.

The Twins Winklevoss filed the very first ETF Crypto, for Bitcoin, in 2013. We now have four new SOLANA ETF 19B-4 deposits. This is the very first step in the application process. The dry now has a 45 -day window to approve the deposit. However, in total, the dry can grant extensions up to 240 days.

9 / But the Winklevoss wanted to take #Bitcoin general

When $ BTC It was $ 100 they deposited to create the 1st ETF

The media laughed at the idea

pic.twitter.com/kb9rgnqofn

– The Bitcoin historian (@pete_rizzo_) November 23, 2024

With the changes in the dry top brass, I would expect fairly fast approval. Polymarket, the prediction site, has an approval from Solana ETF in 2025 to 84% to date. I would say that the chances look good. What do you think? Let me know in the comments or join our social on Discord or X.

Source: Polymarket

Cardano ($ ada) ETF spot

Grayscale filed an ETF Cardano Spot. Or, to be precise, Nyse Arca has filed with the name of Grayscale. NOW, Graycale already has various cryptographic trusts. Among others, Solana, but also for Suis, Aave, XRP and much more. 27 in total. As for $ ADA, you can also buy it from bydfi.

Nyse Arca Files for the first ETF Cardano in the name of Grayscale

Nyse Arca has filed a 19B-4 form in the name of Grayscale to create an ETF Cardano (ADA), with the Coinbase Guard as a goalkeeper and Bny Mellon as a director.

This marks the very first ETF proposal based on … pic.twitter.com/ispupddrnq

– The wolf of all the streets (@scottmelker) February 11, 2025

Grayscale already offers Bitcoin and ETF ETF products. So it seems that they have fully confidence in cardano. As a result, $ ADA jumped 11% after this news. However, Polymarket sees only 58% for an ETF Cardano Spot this year.

Which crypto spot ETF will be the first?

It looks like an easy victory for Solana, right? However, do not underestimate the resilience of Charles Hoskinson, co-founder of Cardano. On the other hand, if we look at Polymarket, they see Litecoin with 84% chance for an ETF spot in 2025.

The main thing is that, most likely, there will be a lot of new ETF Crypto Spot this year. However, at the moment, I see Solana taking the seat before and obtaining the first approval this year. In all honesty, however, I do not expect these new ETFs to do as Bitcoin ETF. Nevertheless, it is a massive victory for the crypto. Let me know your reflections on this subject in the comments.

Non-liability clause

The information discussed by Altcoin Buzz is not financial advice. This is only for educational, entertainment and information purposes. All information or strategies are relevant thoughts and opinions for accepted levels of tolerance to the risk of the writer / examiners, and their risk tolerance may be different from yours.

We are not responsible for the losses that you can undergo due to any investment directly or indirectly linked to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so make reasonable diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Cardano or Solana, which will first obtain an ETF Crypto Spot? appeared first on Altcoin Buzz.

(@ Vivek4real_)

(@ Vivek4real_)  RUP:

RUP:  SEC officially recognized the following place

SEC officially recognized the following place