Join our Telegram channel to stay up to date with the latest news

Cardano continues to trade with a massive decline even after rebounding from the $0.30 low. However, new on-chain data shows that whales are back to aggressively buying ADA alongside other altcoins.

Large holders have accumulated another significant volume in recent weeks, signaling renewed conviction despite broader market pressure.

This buildup, combined with tightening supply and improving technical setups, is once again fueling speculation of a stronger rally to higher levels.

With interest rising, can it maintain bullish sentiment for Cardano price?

According to data from Ali Martinez, a popular analyst on X, whales purchased 210 million Cardano tokens over the past three weeks. This level of accumulation demonstrates strong interest on the part of large holders.

210 million Cardanos $ADA purchased by whales in the last three weeks! pic.twitter.com/Mqq4xdQGSK

– Ali Charts (@alicharts) January 17, 2026

In one of the latest purchases, a whale filed $7.9 million USDC on the Hyperliquid exchange, purchasing 6.46 million ADA for a position worth approximately $2.50 million.

Whale activity is an informed money indicator, suggesting that the Cardano token price could be gearing up for a rally.

ADA Volumes Increase in Derivatives Market

Cardano is seeing an increase in volume in the derivatives market, with traders now monitoring what happens next in its price.

Data from coin mechanism shows that Cardano increased its futures volume on the Bitmex exchange by 10,654%, reaching $40.04 million.

Cardano derivatives enjoyed a surprisingly large boost.

BitMEX futures rose an extraordinary 10.654% to a whopping $40 million, in conjunction with an impending listing of $ADA eventually by @CMEGroup. The institutional appetite is obviously waking up. A… pic.twitter.com/QmNDacBvpQ

– Mentor (@CardanoMentor) January 17, 2026

This indicates an increase in activity in the derivatives market, given that Bitmex is a major derivatives exchange.

Can ADA reach $1?

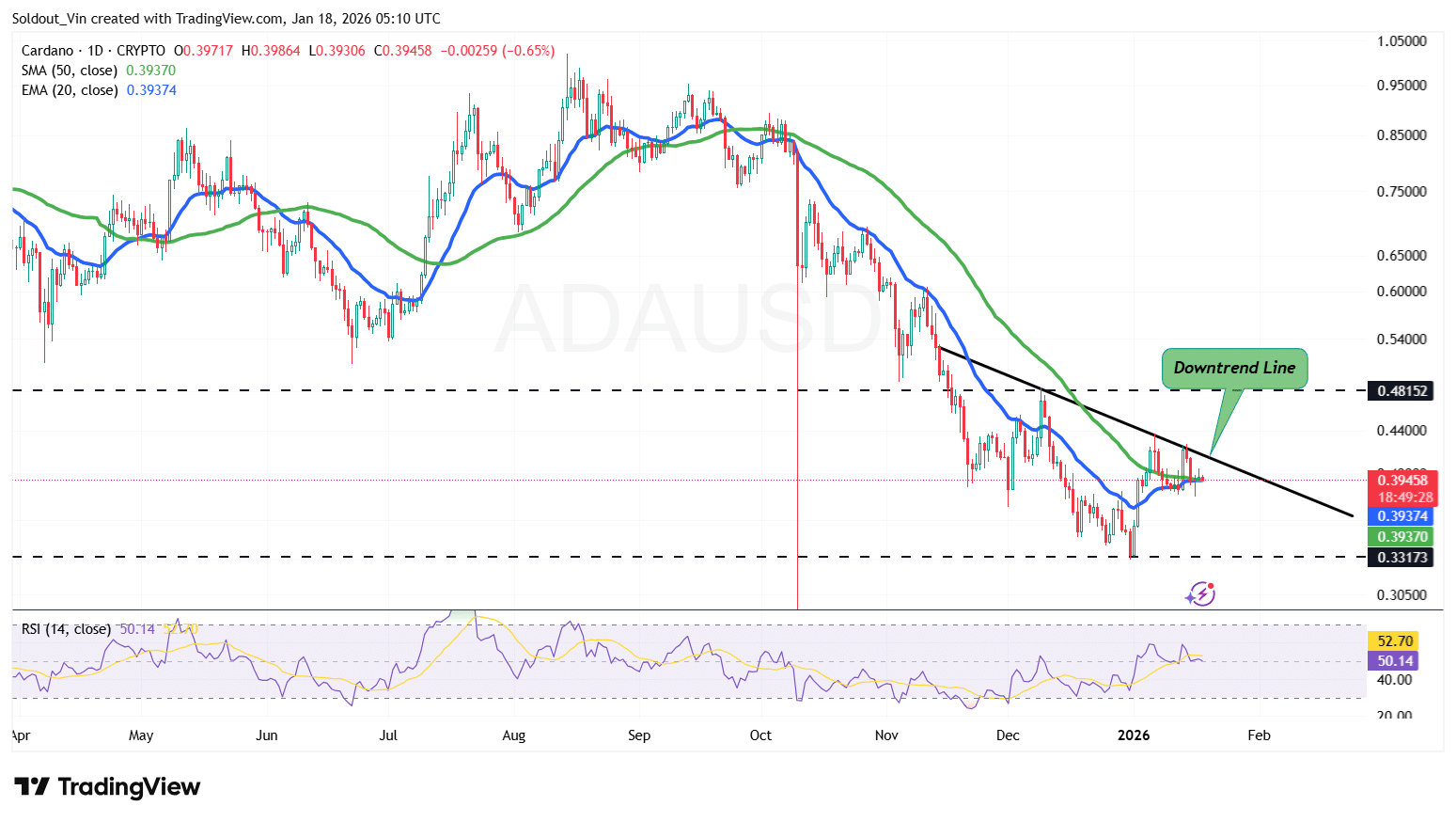

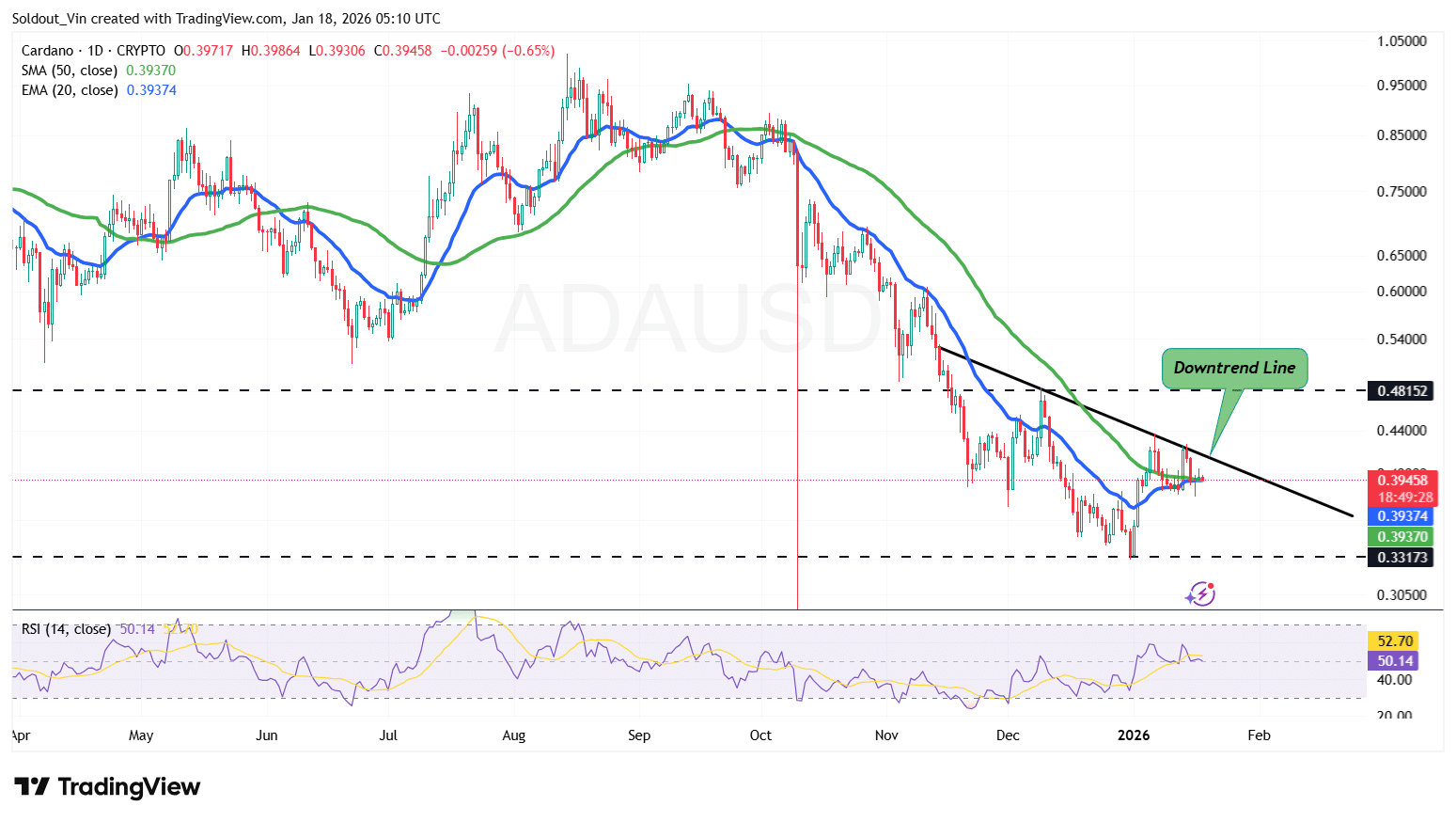

Cardano price is currently consolidating near the $0.39 to $0.40 region, holding above the short-term support zone between $0.33 and $0.35, which buyers have been defending after the recent sell-off.

This stabilization follows a sharp decline from October highs, with demand approaching $0.33, a historically significant support level. The rebound from this area suggests that selling pressure is easing, although bullish conviction remains cautious.

ADA is trading around the 20-day EMA (~$0.39) but remains below the 50-day simple moving average (SMA) near $0.48, which continues to act as key resistance. The downward slope of the 50-day SMA suggests that the broader trend remains bearish unless ADA manages to recover and hold above this level.

Cardano’s Relative Strength Index (RSI) is hovering around 52, close to the neutral zone. This reflects a modest recovery in momentum with no signs of overbought conditions, meaning the price has room to rise if buying strength increases.

From the perspective of the ADA/USD 1-day chart, Cardano could attempt to move towards the $0.45 to $0.48 resistance zone, where the downtrend line and the 50-day SMA converge. A clear break above this zone would be the first significant signal of a change in trend and could open the door to a move towards $0.60 in the medium term.

For ADA to realistically target $1, price would need a sustained trend reversal, including a breakout above its resistance around $0.54.

Conversely, failure to breach downtrend resistance could trigger another pullback, with $0.35 as initial support, followed by the $0.33 demand zone if selling pressure returns.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news