Join our Telegram Channel to stay up to date on the coverage of information on the breakup

The United States Future Trading Commission (CFTC) commission commission has paved a way for certain exchanges of offshore cryptocurrency to reintegrate the American market as part of its Foreign Board of Trade (FBOT) framework, paving the way for businesses, including Binance and Bybit to serve local investors.

The president of acting CFTC, Caroline Pham, said in a August 28 statement that this decision “provides the regulatory clarity necessary for the legally onshore trading activity” after what it called an era of “unprecedented regulations by the application”.

She added that American merchants will again have “choice and access to the deepest and most liquid global markets” in digital assets.

Pham also hosted American companies which were forced to settle abroad.

“From now on, the CFTC welcomes Americans who wish to exchange effectively and safely under CFTC regulations, and open the American markets to the rest of the world,” she said. “”This is only another example of how the CFTC will continue to deliver victories to President Trump as part of our cryptographic sprint. »»

The new CFTC route could increase the volume of trading for binance and other exchanges

In recent years, offshore exchanges have been “chased from the United States,” said Pham. This forced exchange platforms, such as Binance, to explore other ways to access the American market.

The exchange ended up maintaining American traders via a separate entity called Binance.us, a platform that is still not available in all states.

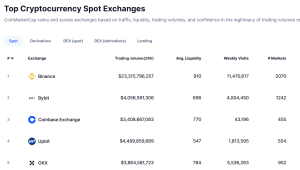

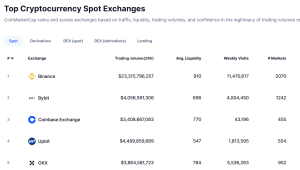

Whatever the restrictions, Binance remains the largest crypto exchange platform in the world in terms of commercial volume. Coinmarketcap data show that 24 -hour exchange volumes are currently above $ 23 billion.

Top crypto exchanges by exchanging volume (source: Coinmarketcap))

The next largest crypto exchange by negotiation volume is Bybit, another off-shore platform with more than $ 4 billion in negotiation volume 24 hours a day.

The appeal was prevented from operating in the United States in 2021 due to regulatory problems which included insufficient KYC procedures.

The new CFTC route will address the restrictions that these platforms and others have faced in recent years. This could potentially lead to an increase in volumes on popular exchanges which have its registered office outside the United States, especially since the Donald Trump administration is forged with its pro-Crypto policy.

CFTC acting on the pro-Crypto Blank House advice

During his electoral campaign last year, Trump made a series of promises to the cryptographic community, which faced a regulatory attack by Rhe Securities and Exchange Commission (SEC) and its former president, Gary Gensler.

Since he took the White House in January, Trump began to hold several of his promises. The same month as its inauguration, the American president signed a executive decree Approving “growth and use responsible for digital assets, blockchain technology and related technologies”.

The Congress has also adopted the Stablecoin Genius law, a key bill that establishes the directives for stable issuers in the United States. Many have seen the movement as a step in the right direction to give the web industry the regulatory clarity it has requested over the years.

The Trump administration has also dismantled an application for cryptography in the American Ministry of Justice, as well as the Application of the Application and appointed more user -friendly leadership in many regulatory organizations, including the SEC.

The SEC crypto working group takes the road and hosts a series of round tables across the country to offer stakeholders opportunities to offer comments and hear representatives of projects related to crypto.

Details 👉 pic.twitter.com/hbb9t9edyh

– US Securities and Exchange Commission (@secgov) August 22, 2025

In July, the president’s cryptography working group also published a report presenting a roadmap for Trump’s mission to make the “world’s cryptography capital” in the United States.

In total, 18 recommendations were made to the CFTC, two of which are directly concerned with the agency. The remaining recommendations concerning the CFTC concerned other agencies such as the SEC and the American Treasury.

This led the CFTC to launch an aggressive initiative of “Sprint Crypto” at the beginning of the month, which acts on the advice received from the White House.

The initiative has two phases and is designed to quickly deploy rules for cryptos and other digital assets. As part of the initiative, the CFTC has progressed to allow trading in cash for digital assets on registered term exchanges, and recently started “the commitment of stakeholders” on all the recommendations made in the White House report.

“The Trump administration inaugurated a new dawn for the crypto, and it is up to the market participants to seize this opportunity to be part of the golden age of innovation,” Pham said in a statement on August 21.

“Under the solid leadership and vision of President Trump, the CFTC is at full speed to allow immediate trade in digital assets at the federal level in coordination with the Crypto de la SEC project,” added Pham.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup