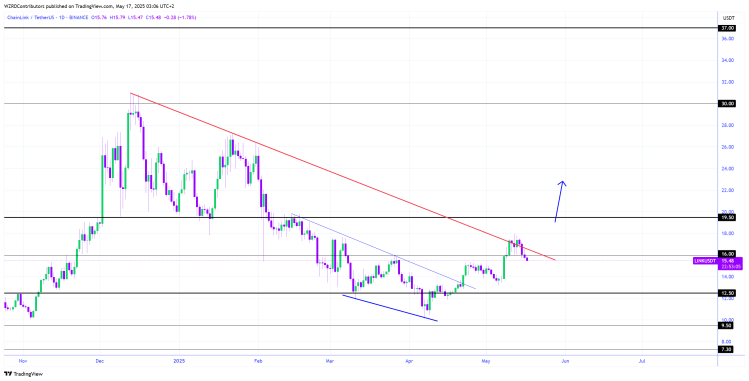

The technical analyst Cryptowzrd shared his last opinion on the prices of Chainlink (link) in a recent post on X, stressing that the asset ended the day with a neutral and undecided fence. Although the session does not have a clear directional thrust, he noted that this type of break often precedes a clearer decision.

Cryptowzrd plans to monitor the intraday table tomorrow for a potential reversal configuration above the $ 15.85 mark, which he considers the first sign of an optimistic intention. However, a decision supported above $ 16.80 would offer a more confirmed break and a long, stronger opportunity, indicating that buyers are starting to take control.

Can ChainLink free himself from current stagnation?

In his latest analysis, Cryptowzrd stressed that Link and Linkbtc closed the indecisive today’s session, the daily candles reflecting the weakness of the action of the prices. Although the absence of a clear direction is notable, the two assets will have to see an increase in the purchase pressure of these levels in order to establish a new trend.

In particular for LinkBTC, Cryptowzrd suggested that a higher potential push could materialize as the dominance of Bitcoin approaches its resistance objective. This increase in the domination of the bitcoin could provide the rear wind necessary for the link to take the momentum and the transition to a bullish tandem phase with a wider market movement.

For Link, the $ 16 level has become a major support area because a bullish reversal of this area would add an impulsive price action, potentially leading the chain towards the resistance objective of $ $ in the short term.

If ChainLink decisively breaks more than $ 19.50, Cryptowzrd anticipates a more substantial rally that could propel the active to the level of resistance of $ 30. However, these bullish results depend on coherent upward pressure and a healthy price structure to support this decision.

At this stage, the market awaits the training of the next commercial configuration, whether it is a strong reversal of support or a clean rupture above the resistance, to give momentum for the following following.

Monitor escape or consolidation

In conclusion, the analyst observed that today’s intraday painting was characterized by agitated and slow action, without any clearly established direction. Given the lack of momentum, wait is increased volatility as the market operates through these levels. However, the price must decisively pierce above the intraday resistance level of $ 16.80 to trigger a long solid entry.

That said, it is also possible that the price moves to the short -term side, consolidating in a range. If this happens, $ 15.85 will be used for the intraday key support target, where the market could find temporary stability before deciding on its next movement. With current indecision on the market, the best line of driving is to wait for a well -formed graphic model or a clear configuration which provides a high probability entry.