Forget the usual beating. The conversation around Chainlink (link) striking $ 150 is no longer just a pile wish. This daring prediction comes from a mixture of difficult data – big money players buy a link, the project becomes the backbone of real assets of tokenization (RWA), and its own economic design is designed to reward growth.

A look under the hood shows a buzzing network with new users and truck investors quietly adding to their positions. While the lines are blurred between Wall Street and Crypto, Chainlink positions itself as the bridge, forcing a major redesigned of its value.

Rush in gold of real assets – Chainlink is essential plumbing!

Everyone is suitable that the next gold rush in crypto brings real things – such as real estate, stocks and obligations – on blockchain. Boston Consulting Group sees this market in balloon at 16 billions of dollars by 2030, while the World Economic Forum thinks nearly 870 billions of dollars in assets could one day obtain the treatment of token.

ChainLink builds the essential infrastructure for this change. For a tokenized asset to work, it needs reliable and real data, such as its current price or its current legal status. This is exactly what ChainLink’s oracles provide. This has led to revolutionary work with the biggest names in finance.

- FAST – They have proven that the largest banks in the world, including more than 11,500, can use the systems they already have to interact with various blockchains via CCIP technology of Chainlink. It is not a small test; He cracks the code for mass adoption.

- DTCC – The organization that will settle almost all American scholarship transactions, the DTCC, has used ChainLink technology to draw data from the common fund on a blockchain, the big American banks joining the pilot.

- Intercontinental exchange (ice) – Even the parent company of the New York Stock Exchange, ICE, operates the chain link to feed the currency and the prices of precious metals to decentralized applications.

A particularly optimistic model calculates that if Chainlink seizes a decent piece of a tokenized market of 19 billions of dollars, its annual income could rise in tens of billions. This would make its price of press time minimal.

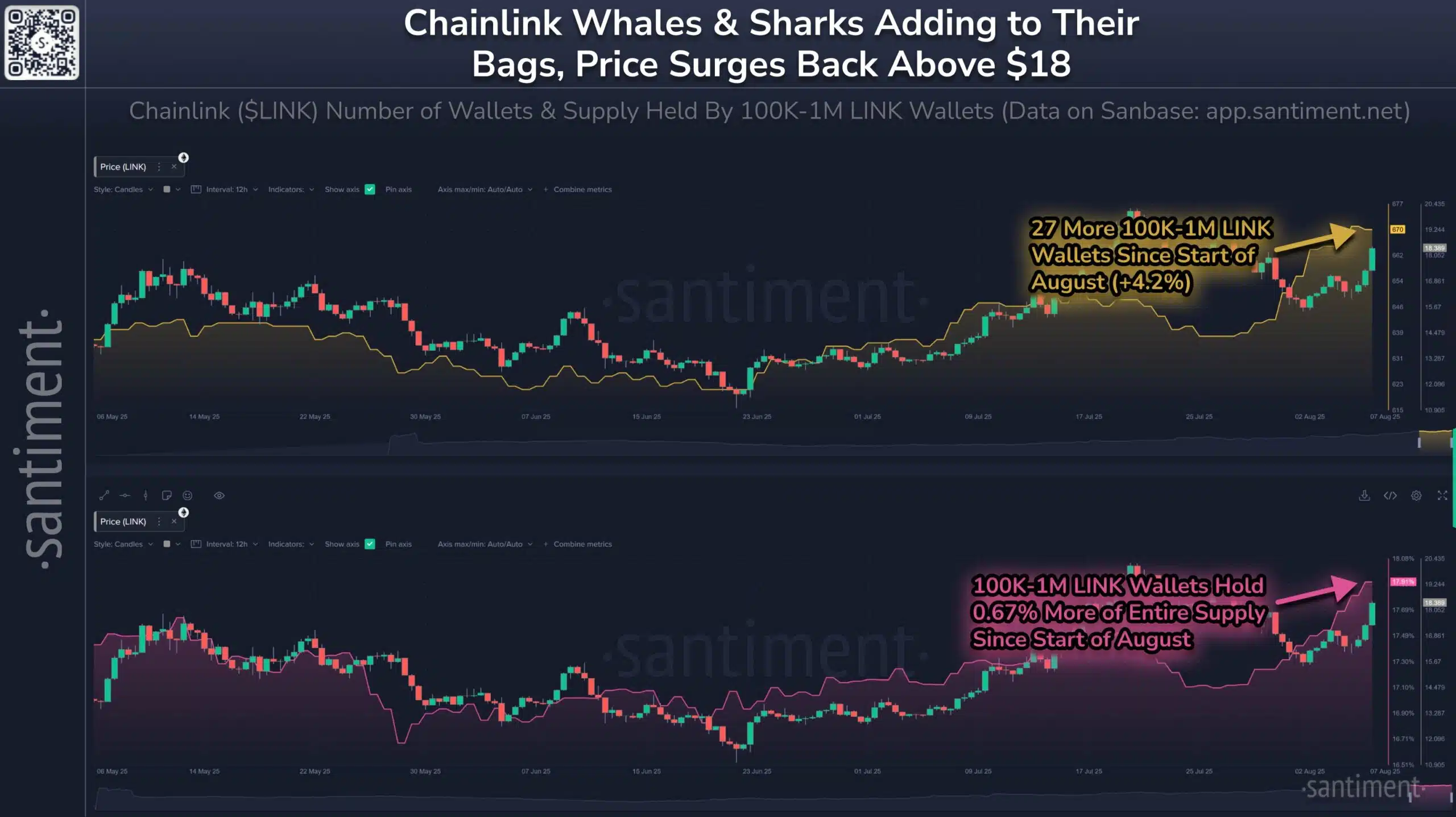

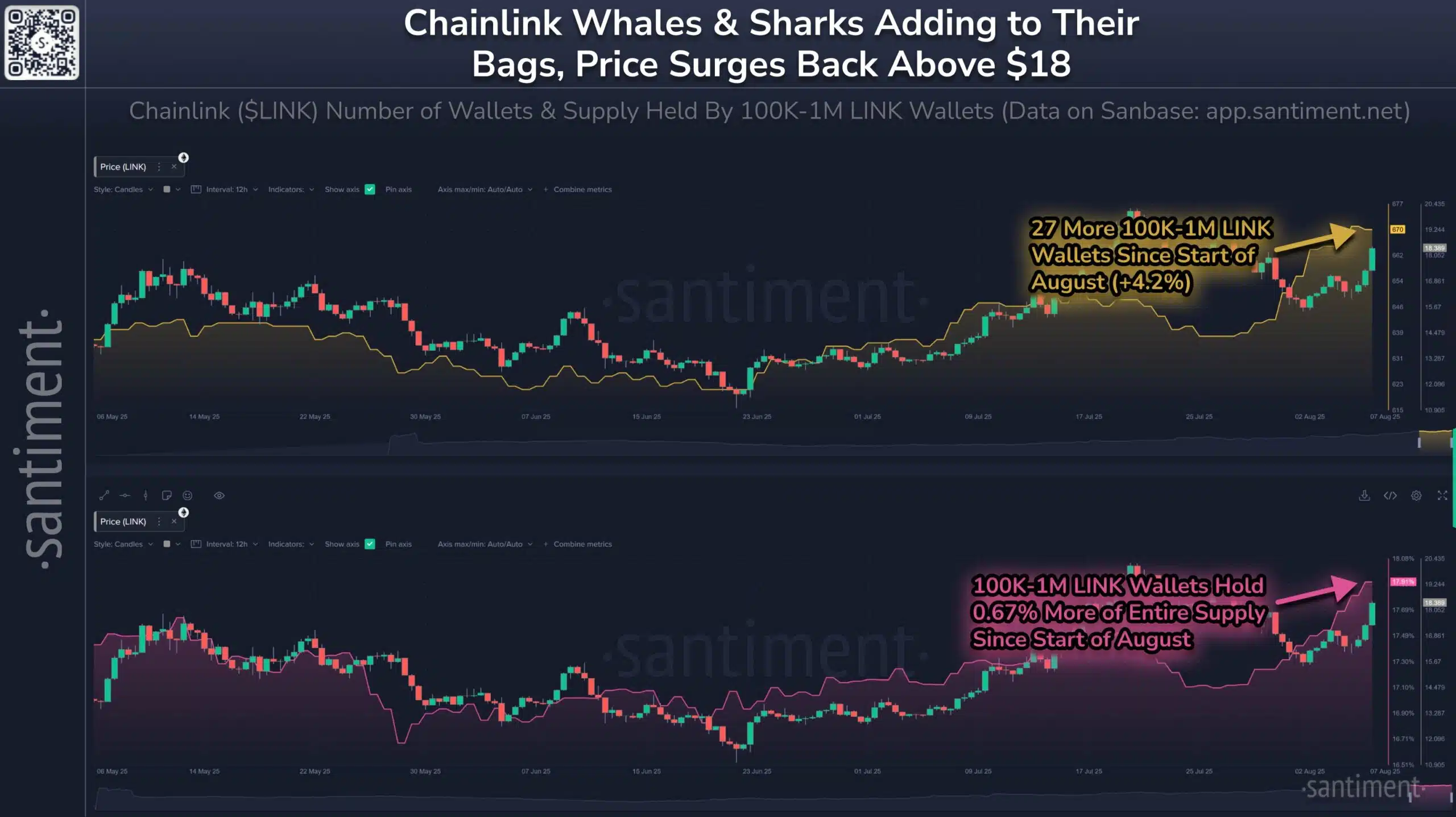

Blockchain data flash the green while the whales fill their bags

Blockchain’s data herself tells a story of confidence. Chainlink saw his busiest day of the year in mid-August, with nearly 10,000 different wallets that move and almost as many new created the next day. It’s not just bots; It is a overvoltage in the real interest of users.

What really turns the head is the activity of the whales. Deep pocket investors have increased more than 1.1 million links, or about $ 27 million in recent weeks.

Source: Santiment

At the same time, Link disappears from exchanges, reaching the lowest levels observed all year round. It is a classic sign that buyers hide their chips for the long term, tightening the available offer and preparing the land for a price leap if the demand continues.

Is Link ready for a break?

Link’s price table begins to seem just as promising. The graphic observers point to a huge four -year ceiling that the price finally tries to unravel. If Link can unravel this barrier, history shows that a major and supported rally often follows, some traders looking at $ 30 as the first stop.

Source: link / USD, tradingView

In addition to that, the followers of Elliott Wave Theory believe that Link has finished a long and painful correction and just begins a new powerful climb. If they are right, the increase by here could be massive.

Economic engine – Eliers and integrated purchase button

Beyond the graphics and partnerships, ChainLink’s own economic engine is designed to create a feedback loop where success fuels more success. This system is based on two key pillars –

- Chailink Staking V0.2 – The new jealous system acts as a sponge for the token supply. It allows people to lock their link to help secure the network – 45 million tokens are already in the swimming pool and earn a solid yield of 4.3% to 4.5% to do so. This encourages the outfit, without selling.

- Liaison reserve – The network also has an intelligent mechanism that takes the costs it earns from partners and automatically uses this money to buy a link on the market. This creates a constant and integrated demand that develops alongside the use of the network.

The figures already show the immense network scale, with more than $ 93 billion guaranteed by its oracles and more than 25 billions of transactions activated to date.

What are the upcoming roadblocks?

Of course, this is not a forehand on the moon. The Oracle game is no longer a race of a horse. Competitors like Pyth Network, with its rapid “sweater” model, prepare a niche, especially in high frequency trading.

Chainlink still wears the crown with 46% of the market, but it cannot afford to complain. And, like any crypto project, the shadow of potential bugs of intelligent contracts and unpredictable regulators is still looming.

Here is the verdict …

So, can Chainlink really reach $ 150? The argument for him is powerful, coming from all angles – his crucial role in the Boom of Rwa, the seal of approval of Wall Street giants and the history of data on the chain.

The road will undoubtedly be difficult and the competition warms up. However, for those who have a link, all signs point to a launch block under construction for what could be a spectacular increase.