On-chain data shows that Chainlink has recently continued to see negative net exchange flows, a sign that could be bullish for LINK’s value.

Chainlink Exchange net flows have been negative for almost a month

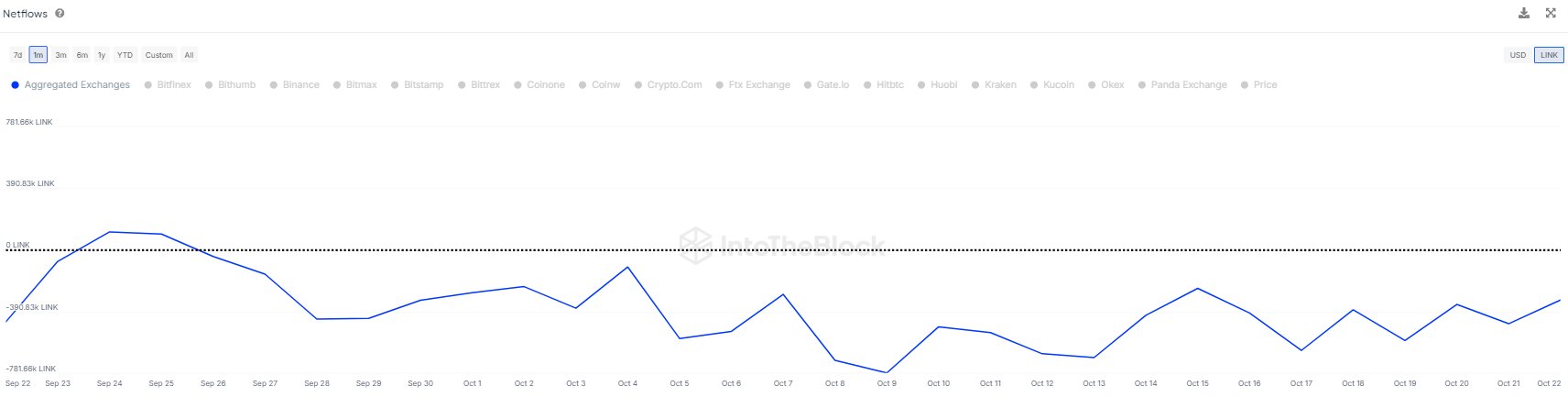

In a new article on X, market information platform IntoTheBlock discussed the latest trend in Chainlink’s exchange net flow. “Net exchange flow” here refers to a metric that tracks the net amount of LINK flowing into or out of wallets associated with centralized exchanges.

When the value of this metric is positive, it means that these platforms receive a net number of tokens. Since one of the main reasons investors send their coins to exchanges is for selling purposes, this type of trend can have bearish implications on the price of the asset.

On the other hand, the negative indicator suggests that holders are withdrawing a net amount of cryptocurrency from exchanges. Holders usually put their coins in personal custody whenever they plan to hold them for the long term, so this type of trend can be bullish for LINK.

Now here is a chart that shows the Chainlink exchange net flow trend over the past month:

The value of the metric appears to have been negative for a while now | Source: IntoTheBlock on X

As seen in the chart above, the Chainlink exchange’s net flow has fallen below zero in recent weeks, implying that investors have been consistently withdrawing from these platforms.

“This trend often signals accumulation as holders move their assets into cold storage or private wallets, reducing immediate selling pressure,” notes IntoTheBlock. It now remains to be seen whether or not these net outflows would ultimately benefit LINK.

Negative net exchange flow isn’t the only potential bullish sign the cryptocurrency has seen recently, as on-chain analytics firm Santiment highlighted in an X article.

The signal in question concerns the Weighted Sentiment metric, which tells us about the sentiment related to a given asset currently present on the main social media platforms.

This metric uses the analytics company’s machine learning model to separate negative and positive posts and calculate the net picture. It then compares this value to the total number of posts on social media that day (called social volume).

Below is a table that shows changes in this metric over different time periods for various assets in the cryptocurrency sector.

The changes in the sentiment on social media for different assets in the sector | Source: Santiment on X

From the chart, it is clear that the last daily change in Chainlink’s weighted sentiment was a sharp -372% turnaround, implying that investors are feeling FUD after the recent bearish price action.

Historically, cryptocurrencies have tended to move against public expectations, so whenever traders become too bearish, a bullish reversal may become likely. So, it is possible that the latest strong negative sentiment could help LINK price.

LINK Price

At the time of writing, Chainlink is floating around $11.4, up 4% over the past week.

Looks like the price of the coin has plunged over the past couple of days | Source: LINKUSDT on TradingView

Featured image of Dall-E, Santiment.net, chart from TradingView.com