This article is also available in Spanish.

Chainlink (LINK) has seen an impressive rise over the past few days, surpassing the critical resistance level of $13 and posting a remarkable 35% gain. This recent breakout has sparked optimism among analysts and investors, as LINK has faced strong resistance around the $13 mark since late July, struggling to maintain bullish momentum. Today, however, market sentiment appears to be changing, with many expecting Chainlink to rise further.

Related reading

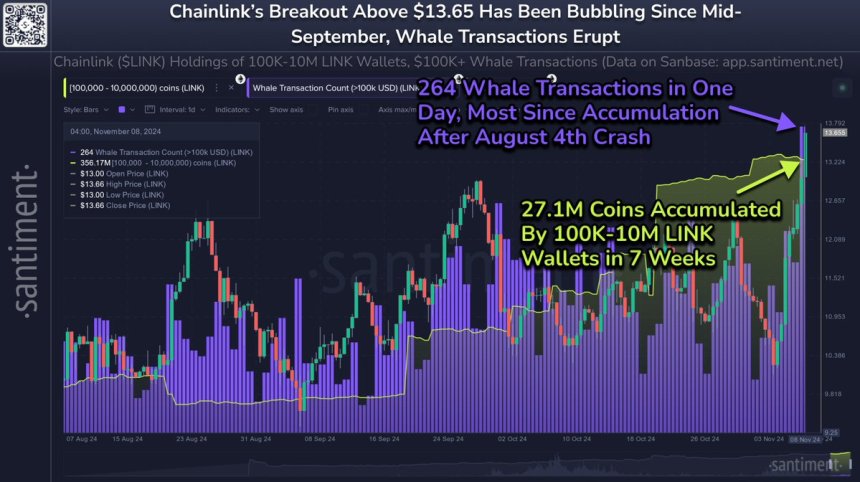

Supporting this bullish outlook, key data from on-chain analytics firm Santiment reveals that LINK whale activity has reached a 3-month high, with large holders accumulating LINK in significant quantities. This increased whale activity is often an indicator of confidence among major investors, suggesting that Chainlink’s latest surge could be just the start of a more sustained rally.

As LINK breaks free from its months-long resistance and regains momentum, the next few days will be crucial in determining whether this rally has the strength to reach higher price levels or whether it will encounter new resistance. For now, however, Chainlink’s impressive performance has analysts speculating about its potential to maintain bullish momentum in the coming weeks.

Chainlink whales wake up

Chainlink is showing signs of renewed strength, with price surpassing key resistance levels that have held the coin back for months. For the first time since July, LINK rose above $13.65, marking a significant change in price action. This breakout occurred at a time when critical data points signal a bullish outlook for the asset.

According to Santiment, Chainlink has decoupled itself from the broader altcoin market, exhibiting unique price performance in a recovering market. One of the most compelling indicators is the peak in whale activity, which has reached its highest level in three months. Stakeholders holding between 100,000 and 10 million LINK accumulated a whopping $369.8 million worth of tokens in just 7 weeks, representing an 8.2% increase in their holdings.

This increase in whale activity often demonstrates confidence in a token’s future price potential, with large investors positioning themselves for the next stage of growth.

Related reading

The accumulation of Chainlink whales, combined with its key price-breaking resistance levels, suggests that LINK is poised for continued growth in the coming weeks. As the overall market begins to recover and rise again, Chainlink’s decoupling from the pack could indicate that it is positioning itself to lead the charge in the altcoin space. Investors are watching closely as the recent price surge and whale behavior suggest that LINK could see sustained bullish momentum.

LINK Testing a new offer

Chainlink is currently trading at $13.5 after managing to break above the 200-day moving average (MA) at $12.9, a key level that signals a strong and bullish long-term outlook. This breakout put the bulls in control, reinforcing the positive sentiment around LINK price action. For the uptrend to continue, it is crucial for LINK to hold the 200-day MA as support, as this level often marks a turning point between bearish and bullish phases.

With LINK showing strength above $13, a healthy retracement to around $12.5 could provide the fuel for further upside if this level remains as support. A pullback of this nature would allow the bulls to consolidate their gains and establish a stronger foundation for the next move.

Related reading

Traders are eyeing $14.5 as the next major supply zone, where LINK could face resistance as it approaches this level. If LINK manages to rise above $14.5, it would signal robust demand and potentially open the door to even higher levels in the coming weeks as whale activity and overall market sentiment support further gains.

Featured image of Dall-E, chart by TradingView