- Chainlink mirrors a historical pattern in Ethereum, suggesting a potential rally.

- Whales and institutions continue to accumulate LINK tokens.

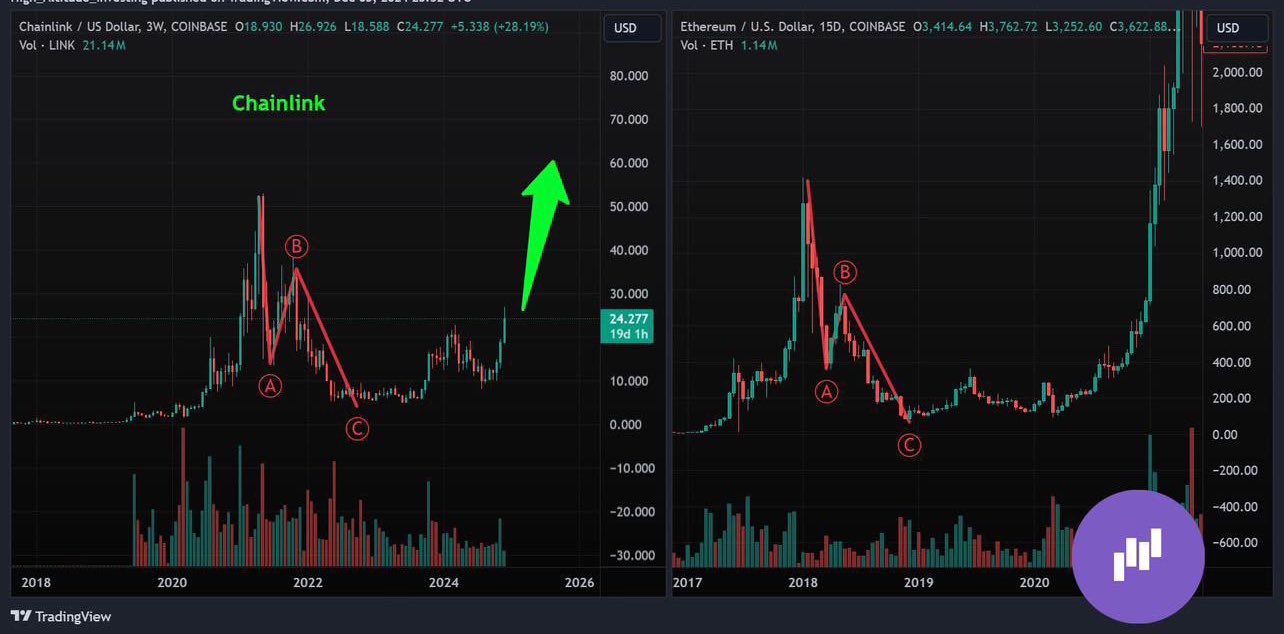

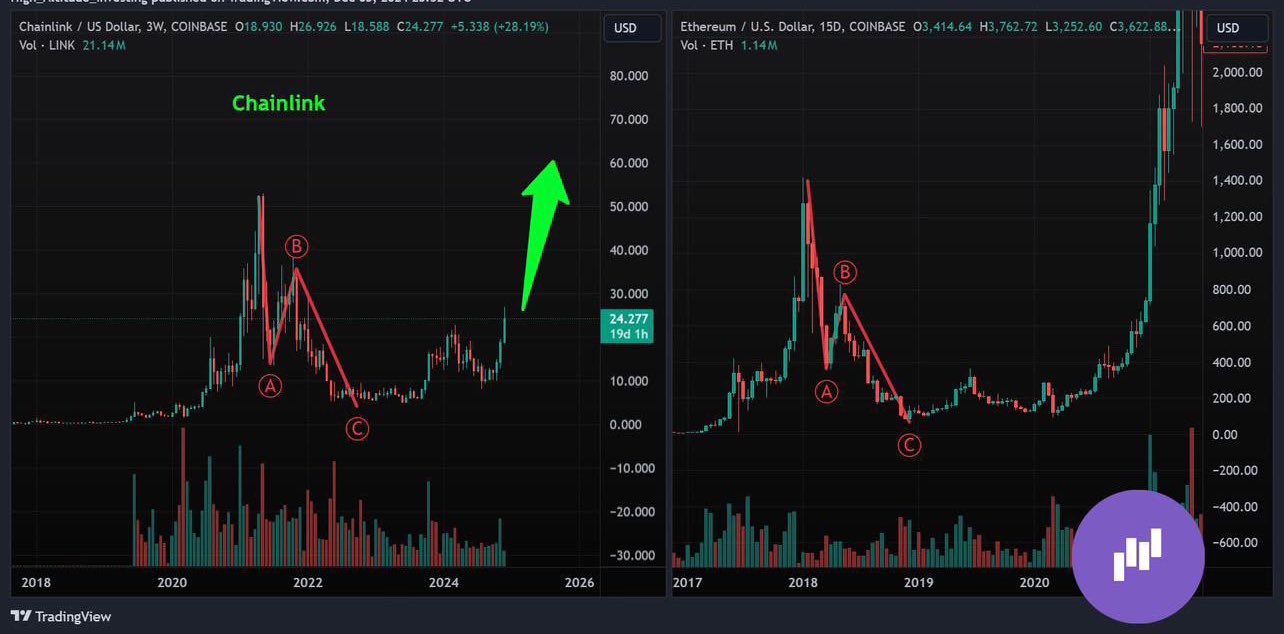

Comparing the price actions of Chainlink (LINK) and Ethereum (ETH) showed a potential similarity in the patterns of both coins.

LINK’s three highs and lows from 2018 to 2024 surged to a high of around $52, followed by a sharp decline towards B and a slower, steadier recovery phase towards C.

This move mirrors Ethereum’s price trajectory over a similar period, suggesting that LINK could mimic ETH’s past performance.

Ethereum, on the other hand, showed a more pronounced movement, reaching new highs in its latter stages, especially visible in the strong uptrend after 2020, reaching a new high at $4,800.

Source: TradingView

If Chainlink continues to follow ETH’s historical performance, it could reach the $90 mark. These could provide a bullish outlook for LINK, assuming current market conditions are sustainable.

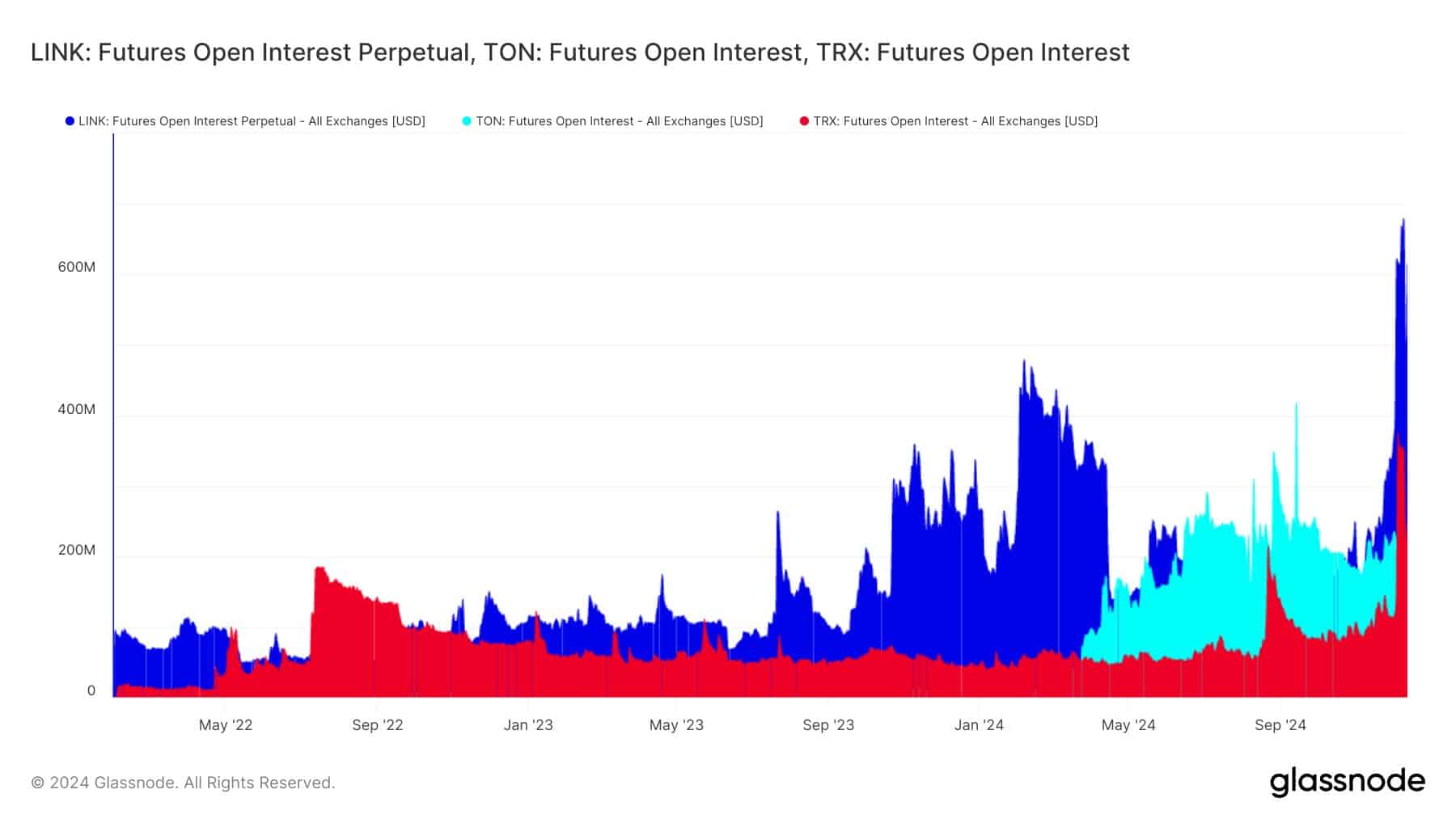

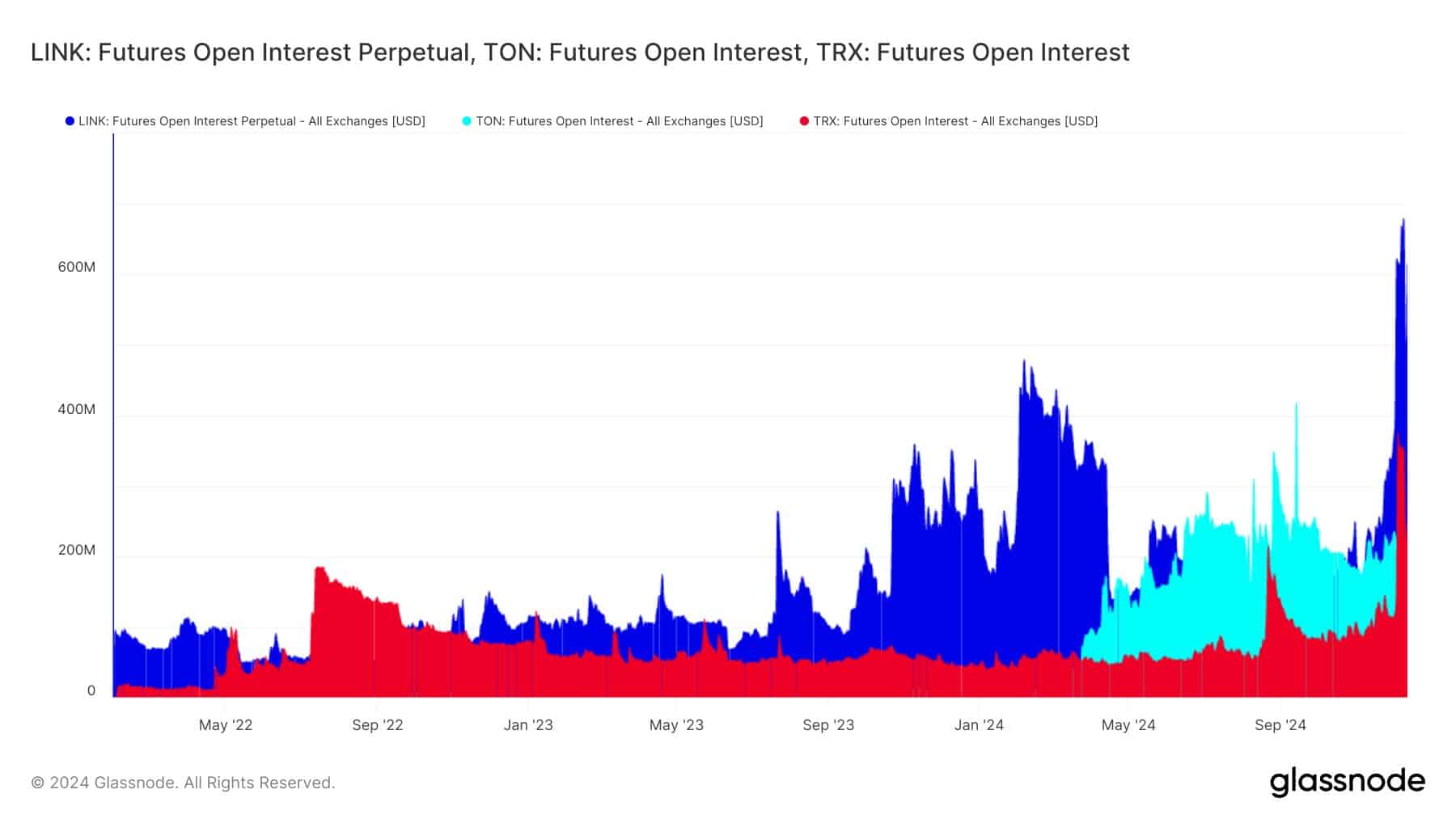

LINK Open Interest

Additionally, LINK’s Futures Open Interest (OI) reached a record $770.27 million, surpassing both Toncoin (TON) and Tron (TRX).

This increase in LINK’s OI, almost three times that of TON and twice that of TRX, indicates growing trader confidence or speculative interest in its future price movements.

Historically, this period has seen LINK reach its highest price in almost two years, highlighting renewed interest and perhaps speculative optimism about its market potential.

Source: Glassnode

The recent sharp rise in LINK’s OI indicates increased commitment, suggesting traders may be positioning themselves for further appreciation or hedging against other positions.

This trend suggests that LINK’s momentum was heavily influenced by derivatives trading, which could either stabilize or increase volatility.

Whale and institutional purchases

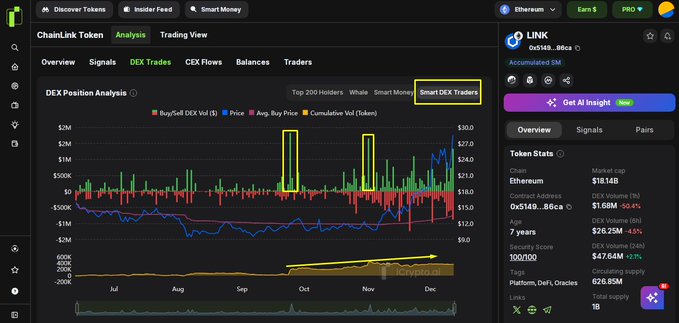

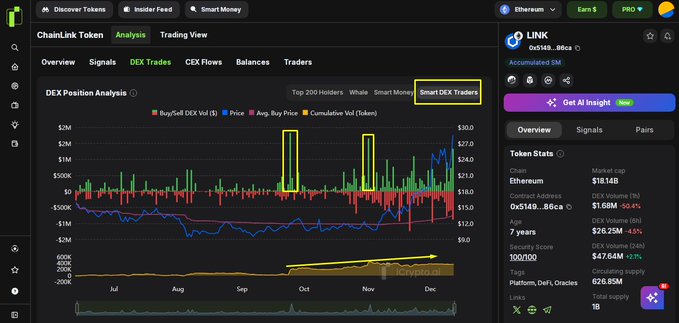

Analysis of DEX positions revealed an increase in LINK holdings by whales and Smart DEX traders, with buying activity outpacing selling.

This increase in buying activity correlates with LINK price increases, suggesting that major holders may be accumulating and expecting future price increases.

This indicates strong buying pressure, which could have contributed to the stabilization or increase in the market price of LINK. If the trend continues, it could lead to further appreciation.

Source: iCryptoAI

Additionally, Donald Trump’s World Liberty Financial increased its stakes in LINK and AAVE. The fund purchased an additional 37,052 LINK for $1 million and 685.4 AAVE for $247,000.

Is your wallet green? Check out the LINK Profit Calculator

This purchase reached a total of $2 million on 78,387 LINK at an average cost of $25.51, which appreciated by $232,000, reflecting an 11.6% gain.

Following this, Zach Rynes praised the President-elect of the United States on X (formerly Twitter):

“Donald Trump is the Michael Saylor of Chainlink $LINK »

This aggressive accumulation underscored the fund’s bullish outlook on LINK, projecting potential gains if the trend persists.