Join our Telegram channel to stay up to date with the latest news

Chainlink price fell 7% over the past 24 hours to trade at $12.17 as of 3:40 a.m. EST, representing a 122% increase in daily trading volume to $609 million.

This comes even as Grayscale secures approval to list the first U.S. Chainlink ETF (exchange-traded fund) on NYSE Arca this week.

🔥 UPDATE: Grayscale Chainlink ETF expected to launch this week first $LINK ETF, according to ETF analyst Nate Geraci.

Grayscale will convert its Chainlink private trust to ETF format after SEC filing approval. pic.twitter.com/GSt86B4SWO

– Cointelegraph (@Cointelegraph) December 1, 2025

US regulators have given Grayscale the green light to convert its $30 million Chainlink Trust into an ETF that will be listed on the NYSE Arca under the symbol GLNK. The structure is designed to give traditional investors exposure to LINK without directly owning the token.

🔥 According to @NateGeraci This week, the market could see Grayscale launch its own Chainlink ETF, the first Spot ETF for $LINK .

The company aims to convert its private trust into an ETF. pic.twitter.com/retps09xWr– ALLINCRYPTO (@RealAllinCrypto) December 1, 2025

The ETF may also include staking a portion of its holdings, allowing the fund to earn rewards while using a liquidity-based creation and redemption model similar to other crypto ETFs.

The approval comes after months of filings and signals a growing willingness among regulators to accept altcoin ETFs beyond Bitcoin and Ethereum.

Despite this, traders appear to be “selling the news” as LINK showed today, suggesting that expectations for the ETF were already priced in and short-term speculators are locking in profits.

If the Chainlink ETF attracts significant inflows following its launch, it could improve liquidity and deepen market depth for Chainlink price over the coming months.

Chainlink Signals On-Chain

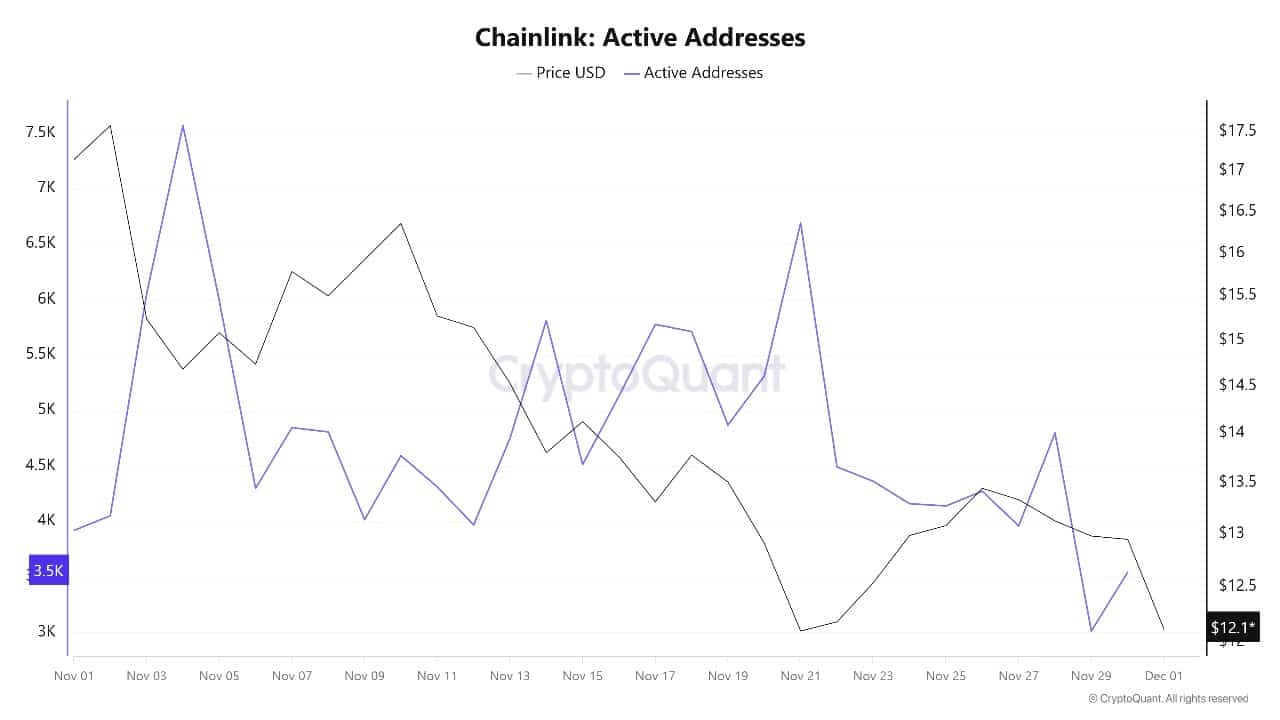

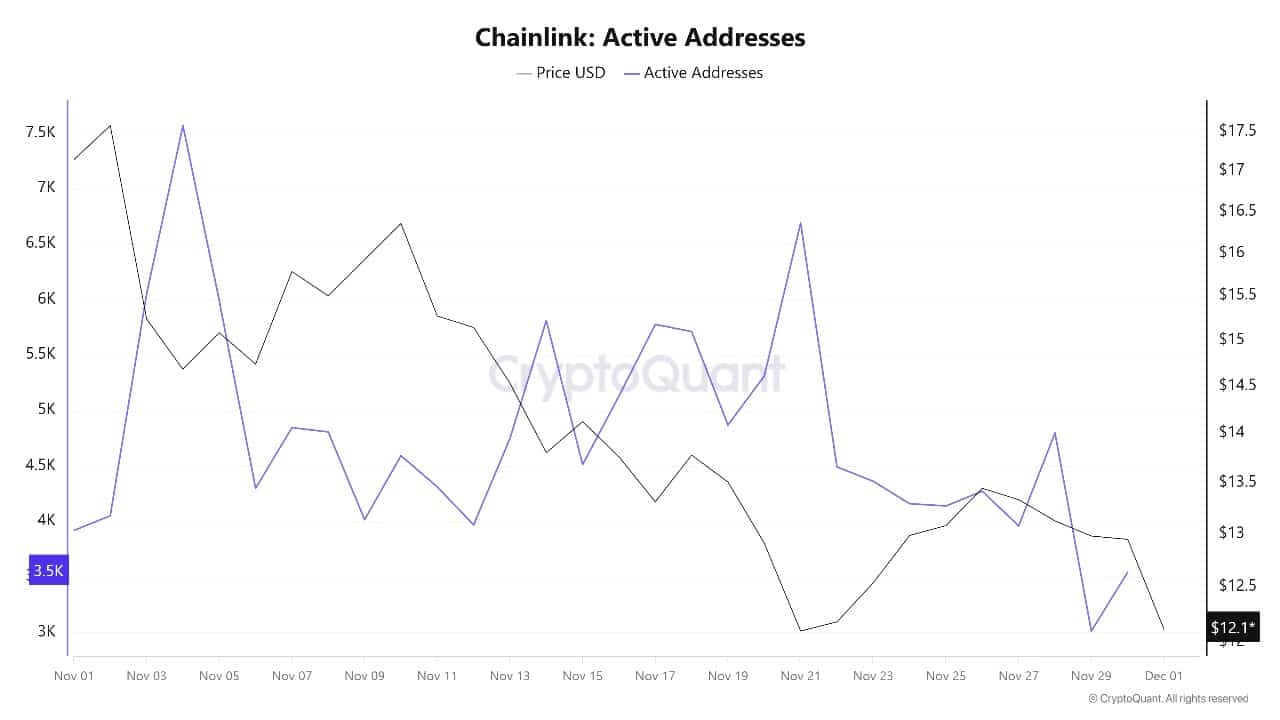

On-chain data from Q4 2025 shows that usage of the Chainlink network is trending upward, even though the price has declined in recent weeks. Analytics providers are reporting about 2,298 new addresses and about 10,000 active addresses, at recent highs. Levels not seen since early 2025 indicate that user adoption continues to grow.

Source of active Chainlink addresses: CryptoQuant

LINK’s exchange reserves have fallen to around 158 million tokens, their lowest point since mid-2022. This generally means that fewer coins are immediately available for sale on the open market. This drop in liquid supply aligns with the Chainlink reserve program, which converts protocol revenue into LINK and removes approximately 0.35% of the total supply each year, acting much like a stock buyback program that slowly increases scarcity.

Large financial players such as UBS and regional banks in Turkey are testing or integrating Chainlink standards for tokenized securities, reinforcing the idea that Chainlink’s oracle and messaging tools could be at the center of the next wave of tokenization.

Chainlink price continues downtrend in falling channel

Chainlink price has moved from a round top trend after failing to sustain above the $20 region earlier this year. The coin fell inside a descending channel, with lower highs and lower lows from the last high.

It now sits just above a horizontal support zone around $11-$12 that previously served as a solid floor in 2024.

The 50-week simple moving average is now falling near $17.5, while the 200-week simple moving average is hovering around $12.6. LINK is trading slightly below or around this long-term trendline. This shows that the bulls are fighting to defend a major support cluster.

LINKUSD analysis source: Tradingview

There have been several bounces indicating that many long-term holders view the current area as a value zone, but a sharp weekly close below would signal a deeper bearish phase.

Momentum indicators are cautious rather than outright oversold. The weekly RSI is in the 30s, indicating weak bullish strength, but also leaving room for a relief bounce if new buyers step in.

The MACD has moved below the signal line and remains in negative territory, confirming that sellers are still in control of the trend, while the ADX around 30 indicates a fairly strong downtrend that has not yet exhausted itself.

Chainlink eyes crucial support at $11-$12

In the short term, if Chainlink price loses the support between $11-12, the next downside target could be the lower horizontal zone near $8-9, where the last major accumulation zone formed before the previous rally.

However, if the $11-12 band holds, LINK could attempt to move back towards the initial resistance around the $17-18 region.

Near the decline of the 50-week SMA and the upper boundary of the recent channel. A weekly close above this level would be the first sign of the end of the downtrend. Potentially paving the way to $22.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news