Key notes

- The channel’s price reached $ 25 on September 13, scoring weekly gains by 15%.

- Live Oracle Integration of Polymarket live on Polygon Mainnet.

- The open interest has slipped despite a jump of 7% of the negotiation volumes.

The channel price hit the $ 25 mark on Saturday, September 13, which extends over weekly gains at 15%. The push occurs while Polymarket has officially adopted the flow of Chainlink for the rules of bets linked to prices. The two entities confirmed the operational partnership in a press release on Friday, indicating that integration is live on the Mainnet Polygon.

According to the declaration, the upgrade allows the creation of secure prediction markets and in real time on hundreds of crypto trading pairs. It also introduces the potential of the chain to settle the markets involving subjective questions, reducing dependence on social voting mechanisms and the relaxation of resolution risks.

“Polymarket’s decision to integrate the proven infrastructure of Oracle de Chainlink is a pivot step which considerably improves the way in which the prediction markets are created and regulated. When the market results are resolved by high-quality data and an anti-random calculation from Oracle networks, prediction markets evolve in real and real-time signals that the world can trust. ” Sergey Nazarov, co-founder of Chainlink.

By adopting ChainLink data flows, integration allows low latency and verifiable price reports and automated chain regulations. This offers polymarket almost instantaneous resolution capacities, especially in cases involving deterministic results, such as Bitcoin or Ethereum price forecasts.

Friday, the action of the link price reflected the initial enthusiasm around these news, before the overheating signals of the momentum.

Co -Coin derivative data reinforce this story because the open interests of the chain maintained $ 1.7 billion, down 0.02%, even though the negotiation volumes climbed 7.3%. This suggests that the majority of intraday speculative activity came from merchants reducing binding term positions, as the feeling of the market approaches euphoric peaks.

Liaison price forecasts: Can bulls maintain momentum over $ 25?

From a technical point of view, the Daily Chainlink price table shows a rally of 15.9% in six sessions, bouncing the level of support of $ 22, with intrajournal peaks around $ 25 on Saturday.

The 5-day and 8 days SMAS crossed over 13 days, forming a golden cross signal at $ 24. RSI is 65 years old, below the exaggerated territory, indicating a place for more upwards.

ChainLink (link) Technical price forecasts | TradingView, linkusdt 24h Chart, September 13, 2025

If the price of the link ends decisively greater than $ 25, the next key target is close to $ 28, where the escape of 42% of reactions to the data partnership with the US government stopped in August.

Declining, not holding over $ 24 could invite a support for the support area of $ 23.30. A ventilation below which would cancel the active catalyst Golden Cross Upsy, potentially sending a link to the next level of psychological support at $ 20.

The presale sub-CLD is growing while sparks in the Solana business adoption market

While Chainlik benefits from recent institution’s partnerships, projects at an early stage such as SUBBD ($ subbd), with innovative utility characteristics also gain ground.

Subbd mixes the commitment of creators-faans with the use of the real world, allowing fans to interact with the creators while pressing a content personalization led by the AI.

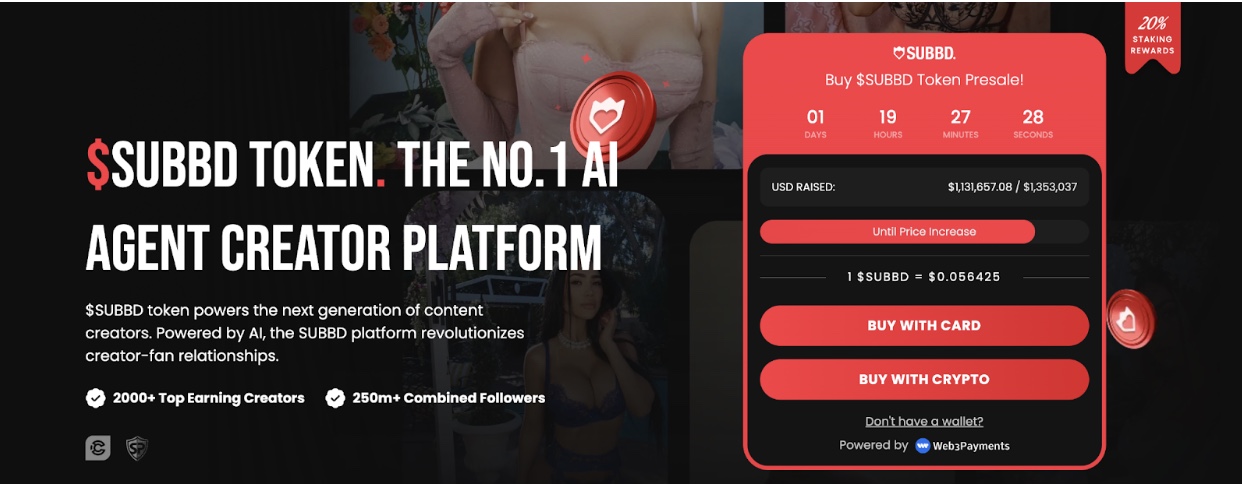

Subbd presale

Currently at a price of $ 0.05,625, the presale has raised $ 1.13 million from its target of $ 1.4 million, leaving available reduced price levels available.

Potential participants can always secure SUBD tokens directly via the official website before the next price ceiling is unlocked.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn