China has reportedly reduced its U.S. Treasury holdings for a ninth straight month, pushing exposure to the lowest level since 2008. Bitcoin held steady near recent highs as gold climbed toward $4,200, showing how markets respond when confidence in U.S. debt wanes. This decision is part of a broader trend: central banks are slowly moving away from the dollar.

For ordinary investors, this is not abstract geopolitics. When large countries sell US debt, it changes the way money flows between stocks, bonds, gold and Bitcoin. This ripple can reach your wallet faster than you think.

This analysis is important because Bitcoin often thrives on macroeconomic uncertainties. When trust in traditional systems wavers, people look for alternatives.

DISCOVER: The Best Ethereum Meme Coins to Buy in 2026

What is really happening with Chinese and American debt?

U.S. Treasury bonds are government IOUs. Countries buy them because they are liquid and historically stable. China once held more than $1.3 trillion, but that figure has declined over the past 15 years.

Today, China has been selling Treasury bonds for nine consecutive months. This places China at its lowest level of exposure since the global financial crisis. So what? When a major buyer pulls out, it means a loss of confidence in U.S. debt as a safe global asset in the event of default. This opens the door to alternatives.

Why Bitcoin Keeps Showing Up in This Conversation

BREAKING: The US dollar now accounts for around 40% of global foreign exchange reserves, the lowest in at least 20 years.

This percentage has decreased by -18 percentage points over the last 10 years.

Over the same period, the percentage of gold increased by +12 points, to 28%, the highest since… pic.twitter.com/M0BqI09iQ4

– Kobeissi Letter (@KobeissiLetter) January 9, 2026

Global dollar reserves are now around 57-58%, their lowest level since the 1990s. At the same time, central bank gold reserves have doubled since 2014. Bitcoin enters the debate as a digital alternative to gold. Think of it as a global savings account that no country controls. This story takes on even greater importance when confidence in public debt fades.

This does not mean that Bitcoin will replace the dollar tomorrow. This means that Bitcoin is benefiting from the same fear that is pushing gold higher.

DISCOVER: Top 20 cryptocurrencies to buy in 2026

Who wins and who feels the pressure?

(Source: GOLD Price / TradingView)

Gold has already reacted, reaching $4,200 per ounce at the end of 2025 thanks to central bank diversification. Bitcoin tends to lag, then catch up, as retail investors deal with the same story.

On the other hand, the United States faces increased pressure to attract buyers for its debt. Even Japan has suggested that its $1.1 trillion treasury could become a trade negotiation tool.

For starters, this explains why Bitcoin sometimes rises when traditional markets feel uncomfortable. It trades on trust, not cash flow.

The Risk Control Most Headlines Ignore

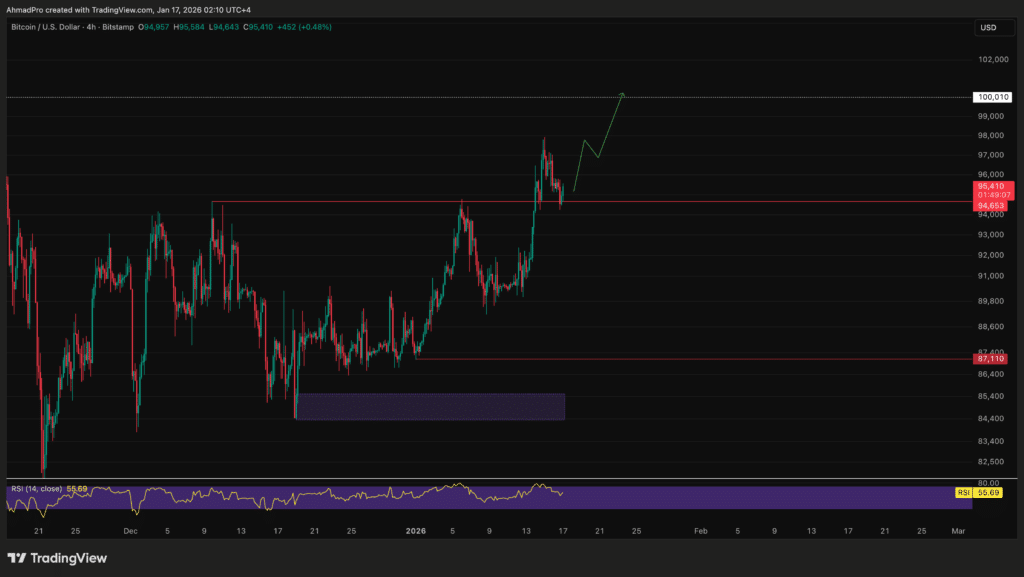

(Source: BTCUSD/TradingView)

Bitcoin is volatile. A macroeconomic narrative may stimulate interest, but prices remain highly fluctuating. Short-term declines can occur even in long-term adoption stories.

Additionally, central banks do not purchase Bitcoin directly. They still favor gold and local monetary systems. Bitcoin mainly attracts the attention of investors and not governments.

Translation: this is a tailwind, not a guarantee. Never take macroeconomic stories as a green light to bet on rent money.

As dedollarization continues, Bitcoin remains in the spotlight as a cover story. Watch how demand for gold and Treasury evolves, because Bitcoin is usually listening.

DISCOVER: The Best Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts

The article China Ditching US Treasuries: Here’s Why Bitcoin Cares appeared first on 99Bitcoins.