After a 100x sprint, COAI, once touted as the best crypto to buy now, crashes over -52% in a day as euphoria cools and on-chain scrutiny intensifies.

ChainOpera AI’s token COAI has fallen nearly 52% in the past 24 hours after a week of rapid gains that sent it into the multi-billion dollar range.

(Source:Coingecko)

As of Saturday evening ET, COAI was trading between $10 and $11, with daily volume of around $295 million on major exchanges.

The drop follows growing talk of large profits among major holdings and possible coordinated sales.

The correction came shortly after COAI’s explosive rally from around $0.14 on September 26 to an all-time high near $44.90 on October 12, a more than 100-fold surge in just over two weeks.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

What did Bubblemaps discover about COAI’s suspicious wallet activity?

Coingecko the data shows a 24-hour range between $9.79 and $25.12, placing the actual market cap around $1.9 billion to $2.1 billion based on an estimated circulating supply of 188 million to 200 million tokens.

CoinGecko lists COAI on Bitget and Gate.io, each handling tens of millions of transactions today.

The token was one of the best performers of the week, rising over 300% before volatility hit.

SATURDAY, DEX Filter Data of the BNB Chain pair showed COAI down around -52% over 24 hours, reflecting the pullback seen in both centralized and decentralized markets.

Bubblemaps has raised questions about a group of wallets linked to Chain Opera AI (COAI) after discovering surprisingly uniform trading behavior.

In his investigation common on X, the analytics platform identified 60 wallets that executed thousands of automated trades under almost identical conditions.

According to Bubblemaps, each wallet received an initial transfer of 1 BNB from Binance around 11:00 UTC on March 25 before using the Binance Alpha platform to make synchronized transactions.

BREAKING: One entity controls HALF of top earners $COAI wallets

Total profit: $13 million

What’s going on with ChainOpera?

pic.twitter.com/CF4AAA9ReY

– Bubblemaps (@bubblemaps) October 16, 2025

The model indicates possible central control or a closely coordinated strategy behind these addresses.

Meanwhile, fresh data de Nansen suggests that traders become cautious. COAI tokens held on centralized exchanges increased from 47.48 million to 55 million over the past week, an influx that often signals a potential sale or portfolio rotation to other altcoins.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

COAI Price Prediction: Can COAI hold onto its key crypto support between $8.65 and $7.17?

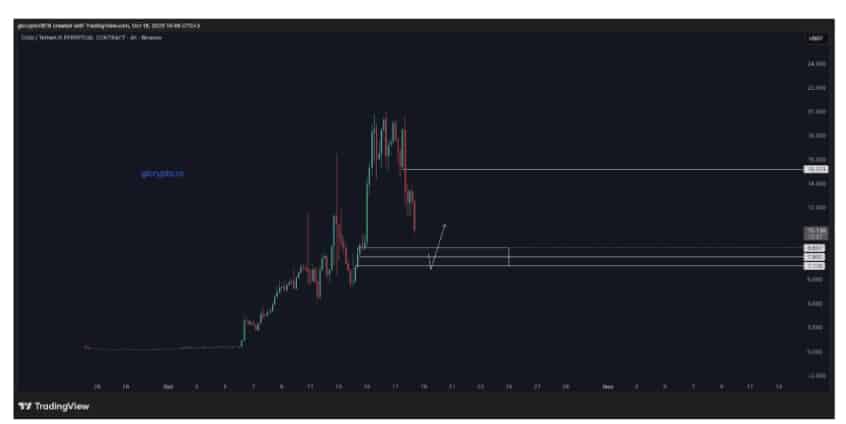

Technically, the COAI/USDT four-hour chart reflects this mood.

After a sharp 10-fold jump from the $1.737 level to around $24, the token slipped into a sequence of lower highs and lower lows, a classic sign of profit-taking and waning momentum.

A 10-fold increase from the reported level at $1.737 (article cited).

Now for an aggressive takedown. If it goes directly into the range shown in the picture and doesn’t see a reaction, it’s not good for the room…

pic.twitter.com/LEx3YIfFSg

– GL Crypto (@glcrypto1618) October 18, 2025

It remains unclear whether this marks a temporary pause or the end of the COAI boom, but traders appear to be acting more cautiously as attention to the project intensifies.

COAI is now trading around $10.13, closing in on a key support zone between $8.65 and $7.17.

The chart shows two major demand zones: the first between $8.65 and $7.93, and the second around $7.17, where previous accumulation had taken place.

According to the analyst, how the price reacts here will determine the next direction.

A rebound from these areas could show that buyers are returning, causing a short-term rebound towards the $15.21 resistance.

(Source:X)

However, there is an indication of danger represented by the projection line on the map.

When COAI moves into this support zone and gives no indication of a recovery or high trading volume, the structure is likely to weaken. This could spell the end of its strong rise and constitute a new correction.

Simply, the long-term direction of COAI will be determined by whether this pullback is consolidated into a healthy pullback or it degenerates into a collapse below important support levels.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Post COAI Crypto Aborts After 100X Sprint: Is Chain Opera AI Running Complete? appeared first on 99Bitcoins.