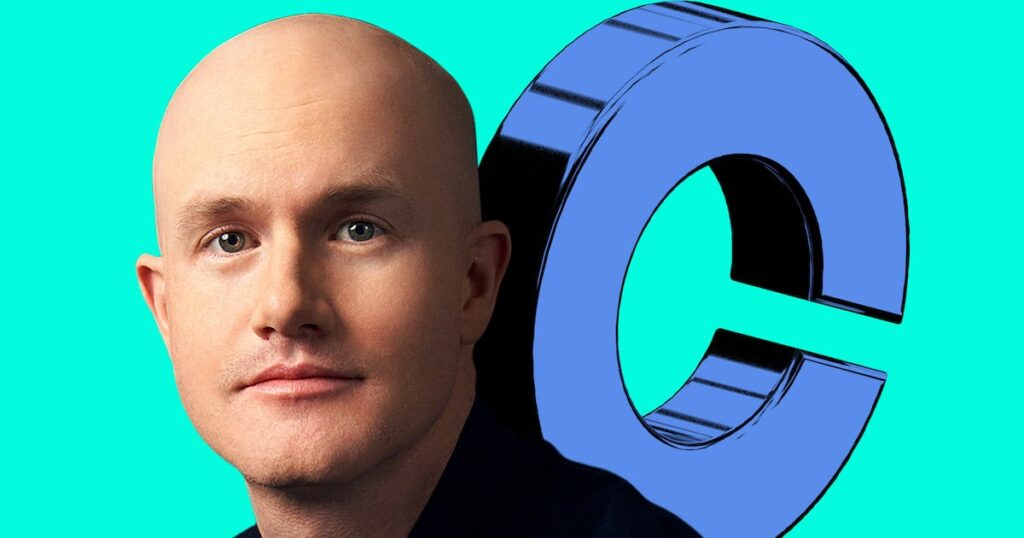

- Shares of Coinbase fell after the exchange posted lower-than-expected revenue and a subdued outlook.

- Decreasing retail interest in crypto, even as prices rise, is changing the composition of the market.

Bitcoin moved closer to its record high to hover around $71,000.

But the price surge masks a shift in dynamics that has kept retail traders from participating in the rally.

Take Coinbase. The exchange said a slowdown in retail trading helped drive lower-than-expected revenue in the third quarter.

“This year in particular, there was a lot of negative sentiment that probably deterred traders,” said Adam Morgan McCarthy, an analyst at data firm Kaiko. DL News.

However, Coinbase warned that volatile crypto prices in October would also pose a headwind during this quarter.

Coinbase said it expects fourth-quarter revenue of between $505 million and $580 million for its subscription and services unit – a retail product.

The outlook, which follows a 7% quarterly decline in that division’s revenue, “reflects some headwinds, including a 10% decline in Ethereum prices in October compared to the third quarter average, as well as a drop in interest rates,” Coinbase said.

This is a sign that retail traders have avoided crypto trading and have not yet returned, at least not en masse.

Join the community to receive our latest stories and updates

These forecasts, along with missed profit targets, have spooked investors. Shares fell 9% on Thursday in New York.

Coinbase said moderate volatility combined with falling crypto prices meant fewer investors were flocking to the exchange.

Flattened by the arrival of larger institutional investors and spot crypto exchange-traded funds, Bitcoin’s volatility fell 40% from 2020 through September, according to Volmex data.

Morgan McCarthy added that major selling events – from the German government and bankrupt crypto companies like Mt Gox – have added to the pessimism.

It’s not just about Coinbase.

Payments giant PayPal saw the amount of crypto it held on behalf of its customers fall by almost 11% between the second and third quarters, even as Bitcoin rose during the period.

This is because institutional investors occupy a larger share of the market and determine prices more than their retail counterparts.

CryptoQuant, a research firm, notes that over the past year, demand from so-called whales for Bitcoin spot ETFs has been twice that of retail.

There are, however, some bright spots in the retail scene.

“We’ve seen volumes rebound somewhat,” Morgan McCarthy said. “Bitcoin volumes on Coinbase have been growing at a faster rate than on Binance, for example.”

Liam Kelly is DL News DeFi correspondent based in Berlin. Do you have any advice? Email to liam@dlnews.com.