Join our Telegram channel to stay up to date with the latest news

US crypto exchange Coinbase is leading a $2.5 billion race with Mastercard to acquire stablecoin startup BVNK.

It is according to a report by Fortune, which cited sources familiar with the matter as saying the two companies had held advanced discussions with BVNK about the acquisition.

The conditions and the successful bidder have not yet been finalized, with the sale price estimated between $1.5 billion and $2.5 billion. Three of the sources said Coinbase appeared to have an advantage over Mastercard.

If a deal goes through, it could be one of the largest acquisitions of a stable company to date.

Citi buys stake in BVNK

BVNK’s core technology is a blockchain payments rail that facilitates stable transactions on a global scale. It also allows customers to easily transfer funds between fiat currencies and stablecoins.

The reported discussions between Coinbase, Mastercard and BVNK follow the announcement that banking giant Citi has acquired a stake in the stablecoin infrastructure company.

Happy to announce a strategic investment of @Citi Businesses.

“Stablecoins are seeing growing interest in on-chain and crypto asset transaction settlement. We were impressed with BVNK’s enterprise-grade infrastructure and proven track record.” —Arvind… pic.twitter.com/xUKlw8IetT

– BVNK (@BVNKFinance) October 9, 2025

This investment was made through the bank’s venture capital arm, Citi Ventures. BVNK did not provide details on the scale of the investment or the valuation of the transaction.

However, one of BVNK’s co-founders, Chris Harmse, said the investment was made at a higher valuation than the $750 million publicly disclosed in its last funding round.

Citi’s investment comes just months after the institution warned that stablecoins could drain deposits from traditional banks.

In May, BVNK revealed that it also secured strategic investment from Visa through its venture capital arm, Visa Ventures.

The Stablecoin market is booming following the signing of the GENIUS law

Recent moves by payment and finance giants toward BVNK come amid a boom in the stablecoin market.

Over the past few months, the capitalization of the stablecoin sector has gradually increased. This rise accelerated around mid-July, when US President Donald Trump signed the GENIUS Act, providing the first regulatory framework for stablecoin companies seeking to issue their tokens in the United States.

This bill provided the industry with long-awaited regulatory clarity and paved the way for companies in the traditional finance (TradFi) sector to enter the stablecoin market.

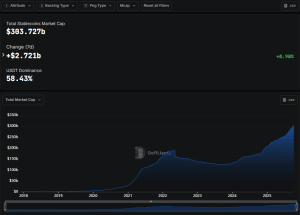

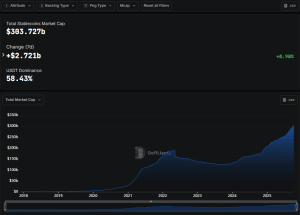

After Trump signed the GENIUS Act in July, the stablecoin’s market capitalization climbed above $300 billion for the first time, data DefiLlama broadcasts.

Stablecoin market capitalization (Source: DefiLlama)

In the last week alone, the stablecoin’s market cap increased by 0.9%, with approximately $2.721 billion flowing into the market, and Coinbase predicts the space will reach $1.2 trillion by 2028.

Meanwhile, Citi’s base case forecasts the market to reach $1.6 trillion by 2030, adding that a bullish scenario could see the sector’s capitalization reach “up to $3.7 trillion.”

Analysts Fear Stablecoin Growth Comes at a Cost for TradFi

The expected growth of the stablecoin market, however, has sparked warnings of a decline in bank deposits in traditional finance.

Standard Chartered said U.S. dollar-backed stablecoins “could withdraw up to $1 trillion from emerging market banks over the next three years.”

Banking lobbies also warned lawmakers about a “loophole” in the GENIUS Act that could lead to capital outflows of up to $6.6 trillion from the banking industry. They argue that the GENIUS Act’s failure to expand its ban on stablecoin companies offering returns to token holders to third parties and affiliates gives companies a way to circumvent the restriction.

However, the crypto industry has opposed the banking lobbies’ claims and said their efforts stem from their attempt to prevent new competitors from entering the market.

Indeed, stablecoins, via exchanges and third-party platforms, offer token holders returns well above the average offered by savings accounts with banks. So, many argue that banks will have to increase the returns they offer to their customers, or risk losing business to greed.

Good article on the evolution of the stablecoin market structure. I would go further: yes, I think that stablecoin issuers will have to share the yield with others, but this is just an example. Everyone will have to share the yield. Today, the average interest rate on American savings…

-Patrick Collison (@patrickc) October 3, 2025

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news