Ethereum has increased by more than 70% since mid-June, marking one of its most impressive rallies of the year. This decision was motivated by a strong momentum, with bulls firmly in control, while ETH recently recovered the critical level of $ 3,500. In particular, the upward trend has shown little or no retracement since the initial rupture, signaling an interest in purchase and the confidence of investors.

Related reading

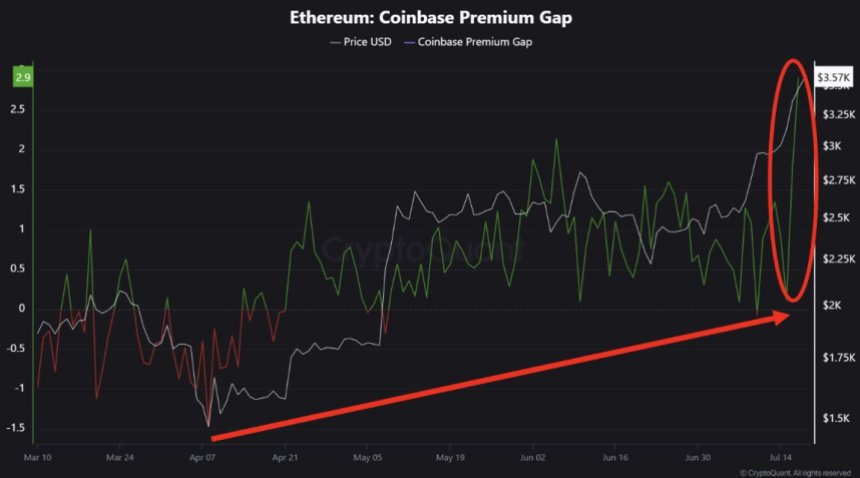

One of the most striking developments in support of this decision comes from cryptocurrency, which highlights the emergence of an important premium on Ethereum exchanged via Coinbase. This is particularly remarkable because Coinbase is a platform mainly used by American institutions and high net individuals. The premium suggests purchases of aggressive points by whales, indicating a renewal of institutional interest for Ethereum.

This renewed request comes while the wider market of cryptography sees lighter regulatory signals and the increase in FNB takes place in products related to ETH. While Ethereum continues to outperform and attract capital, the traders look closely to see if this momentum will take place in a wider Altcoin rally – or even signaling the start of a long -awaited season.

American whales are carrying out the load as Ethereum purchase activity accelerates

According to a recent report by the cryptocurrency Crypto Dan, Ethereum notes a significant increase in the purchase activity, in particular on the part of the American whales. The constant increase in accumulation, combined with a clear bonus on Coinbase, suggests that high -clear players are positioned before the rise.

Supporting this trend, the daily entries in ETHEREUM ETF ETF has reached new heights of all time. This net point reflects increasing institutional confidence in ETH as a basic digital intake, in particular after recent regulatory clarity in the United States. Ethereum now negotiating above $ 3,600, demand continues to exceed supply on several channels.

What makes this rally particularly interesting is the current market environment. Chain metrics show that Ethereum is not yet considerably overheated. Indicators such as NUPL (profit / net loss not made) suggest a place for additional expansion before excessive euphoria settles.

However, the coming weeks will be crucial. If strong entrances and the bullish momentum persist at the end of the third quarter of 2025, analysts warn that he could trigger signs of overheating. Although we are not yet there, the vertical movements repeated without retirement should cause caution. Investors may need to reassess risk levels if the model continues.