Shaun Lee, research analyst at CoinGecko, highlights the success of AI-powered crypto projects and the unprecedented growth of some meme coins.

In an interview with BeInCrypto, Lee also highlighted the use of crypto point farming for airdrops, perpetual trading on decentralized exchanges, and real-world asset (RWA) projects as other promising stories to watch out for in 2025.

The rise of AI-based projects

Since the inception of ChatGPT, Lee highlighted that the crypto community has taken keen interest in building projects aimed at converging the capabilities of blockchain technology and artificial intelligence. In 2024, many have shown positive results in facilitating decentralized access to AI.

Lee highlighted Virtuals Protocol, a decentralized platform for creating, owning and monetizing AI agents in virtual worlds, among the most successful projects.

In the last month alone, Virtuals has created more than 21,000 AI Agent tokens, according to Dune data, while some tokens like AIXBT and LUNA have surged more than 300% just days after their initial launch.

Lee also mentioned AI-focused venture capital firm AI16z, which launched in October and currently has a market cap of $600 million. As of this month, Eliza Framework, the technical foundation of AI16z, has become one of the most widely adopted open source frameworks for AI agents.

This open source platform allows developers of all levels to create and deploy AI-based solutions. The AI16z framework was specifically designed to bridge the gap between centralized and decentralized systems, making it accessible to Web3 and Web2 developers.

A successful year for Meme Coins

Along with AI integrations, the generation of new meme coins has increased, leading to increased trading volumes and increased overall profits.

“The resurgence of Solana and the creation of Pump.fun led to the proliferation of meme coins. Meme coins are easily accessible nowadays and can be created with just a few clicks, following the trend of 2023,” Lee told BeInCrypto.

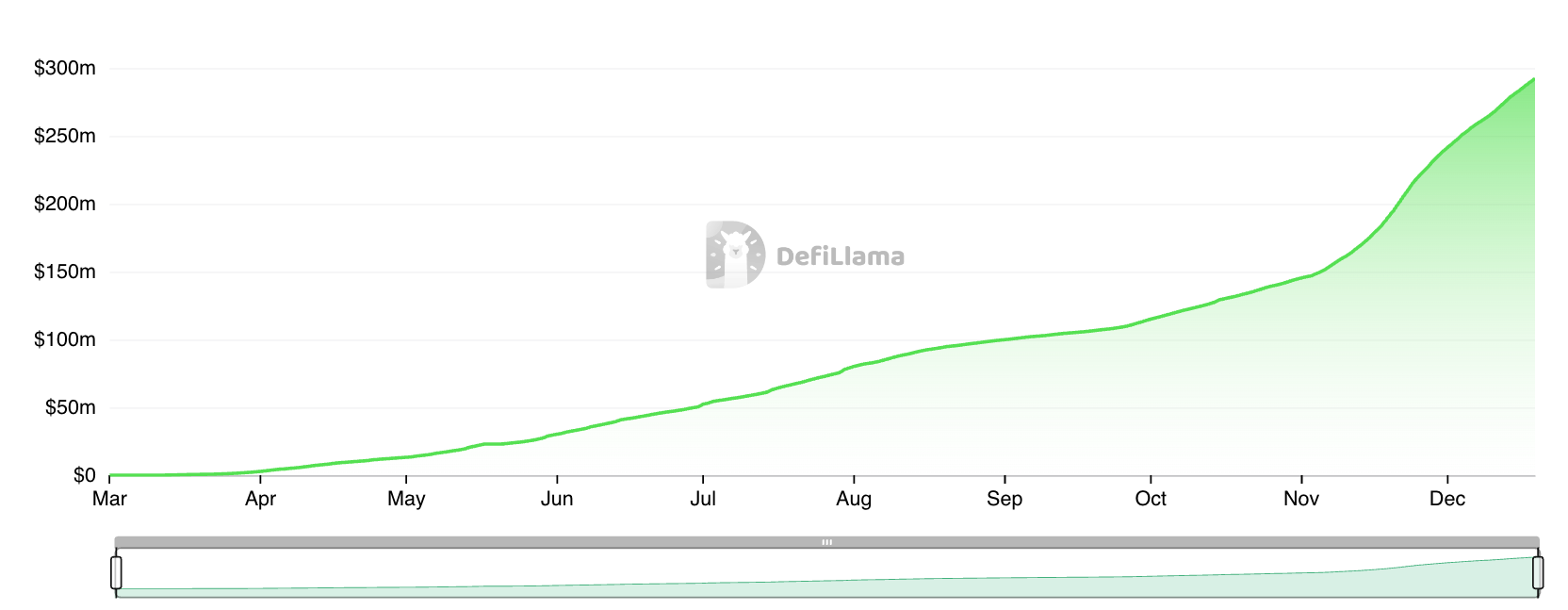

Since its launch this year, Pump.fun has become a major player and dominates Solana meme tokens. The meme coin launchpad generated nearly $300 million in revenue in 2024, according to data from DeFi Llama.

Promising drop stories

The success of airdrop stories in the DeFi space was also a highlight of the year, according to Lee.

“After lagging for the past two years, DeFi has been under bid again. Point farming for airdrops has boosted Pendle’s usage, while Ethena’s new stablecoin model and its integration with many popular DeFi protocols has helped boost its popularity,” he told BeInCrypto.

Pendle’s Ethereum-based yield trading protocol tokenizes the yield of crypto assets, allowing users to trade and manage yield-generating assets. It enables strategies such as fixed income yield, yield speculation, and yield farming, bringing traditional financial concepts to the DeFi world.

Although the concept behind Pendle has been around for a long time, its particular framework allows users to trade tokens while earning returns of up to 47% on the underlying assets, outperforming similar existing projects.

Launched in 2021, Pendle saw a surge in popularity this year due to the increase in Ethereum liquid staking and airdrops of DeFi protocols like Ether.Fi. In April, Ethena’s USDe pool cap increase to $400 million fueled additional activity, pushing Pendle’s total value locked (TVL) to a staggering $4.88 billion.

Crypto Points Farming Practices

Pendle’s approach to point farming has also been notable. Crypto Points are a reward system used by Web3 projects to encourage user engagement. By completing specific actions, users earn points that can lead to airdrops or can be used for other types of incentives.

“Points farming has been a surprising development, with many new projects such as Eigen and Staking Protocols taking advantage of unused capital during the bear market, by offering points (in anticipation of future airdrops) in exchange for total value locked,” Lee explained.

While discussing DeFi successes, the CoinGecko research analyst also highlighted the Aave protocol token, which has recently seen a surge in activity fueled by significant whale accumulation, injecting new liquidity into the market .

Similarly, decentralized exchanges have also seen a surge in popularity for perpetual trading. Lee used Hyperliquid’s most recent airdrop as an example of how this initiative has significantly increased trading volumes.

Hyperliquid, a high-performance decentralized crypto exchange built on its own layer 1 blockchain, made waves in late November by launching its HYPE token to over 90,000 users.

This generous distribution of tokens made crypto history as the largest airdrop ever, while the token’s price surge continued, reaching an all-time high this week. The crypto community greeted the move with surprise, setting a new standard for future crypto airdrops.

A bright future for real-world assets

According to Lee, real asset projects are here to stay. A type of physical or financial asset existing outside the digital spectrum, RWAs are represented on the blockchain in the form of a token.

“In previous cycles, the RWA discourse struggled to take off, but this time it managed to find its footing. Major financial institutions have increased their involvement in the RWA sector, with BlackRock establishing its BUIDL fund to provide qualified investors with the opportunity to earn US dollar returns,” he told BeInCrypto.

According to RWA.xyz, tokenized Treasuries have already exceeded $3 billion, up from just over $700 million at the start of the year.

When BUIDL, a US Treasury bond issued by asset management giant BlackRock, entered the RWA space in July, it experienced a market rally that also triggered an overall increase in the total market capitalization of assets linked to RWAs.

The year saw several prominent leaders among RWA crypto projects. Maple Finance, for example, symbolizes corporate debt, merging traditional and decentralized finance. The platform offers investment opportunities and financing solutions for businesses.

Using smart contracts and automated credit assessments, Maple enables institutional investors to lend to creditworthy companies through the tokenization of real-world assets, enabling new financial instruments and strategies.

Ondo Finance is another prominent RWA crypto project, specializing in the tokenization of fixed income assets. It offers various vault strategies to maximize returns and mitigate risks, while the ONDO token offers exposure to various assets, making it a compelling choice for investors looking for unique financial opportunities.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and views of industry experts and individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify the information independently and consult a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.