Things do not seem good for the Solana price (floor) at the moment, following the weak beginnings of a new Solana product on the CME and as a soil continues to get below.

Det around $ 124, the Solana price remains in a clear decreased trend in the record heights it reached in January nearly $ 300, and is currently down around 57% of these peaks.

The recent rejections of the 21DMA in recent weeks, as well as a strong rejection of the 200DMA earlier this month, suggest that the bears remain very controlled by this market.

And a low interest in institutional investors in the new Solana Futures product on CME will give bears new ammunition to reduce the price.

The lowering conditions on the Solana market are justified in the context of wider macro concerns, which have made a heavy price on the appetite for risks in recent weeks and the drop in activity on the chain.

While the American economy continues to resist the beginning of 2025, the risks for medium -term prospects have increased considerably thanks to Trump’s trade wars and reductions in public spending linked to DOGE.

Managers of the Trump administration and even the president himself warned that an adjustment period could occur which could be painful for the economy and the markets.

And, during all this time, since the peak in the immediate consequences of the launch of the play even Trump and Melania launched in January, the Solana chain activity was in decline.

The Solana transaction costs, an indirect indicator of activity on the chain, have just reached its lowest levels since September, suggesting a request for a block space, depending on the block.

How much could the Solana price go?

The fundamental and technical images both seem excessive from Solana’s price. Another decline is very likely.

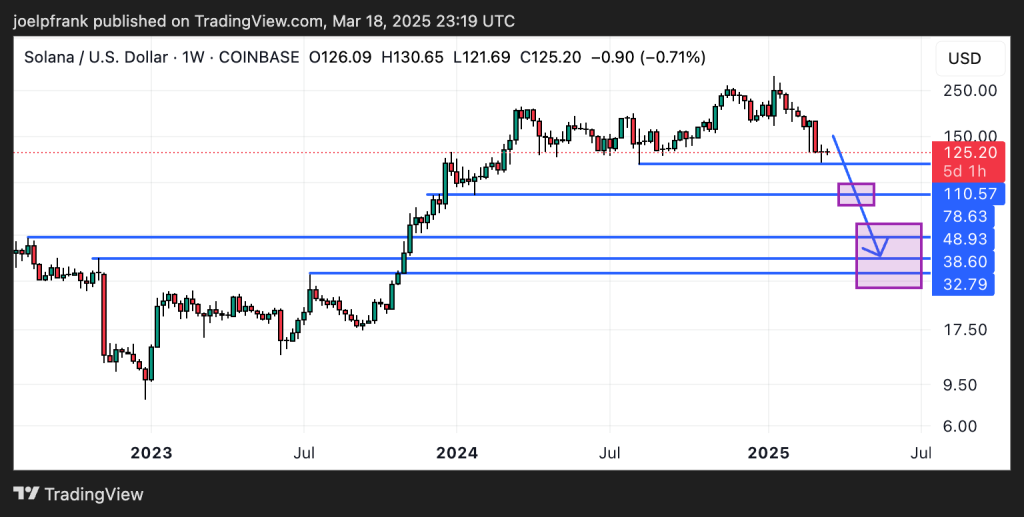

But how much could the Solana price go? Well, $ 110 was a solid support area dating back to mid-201.

If this level breaks, a rush down towards the almost notable area around $ 80 seems likely. But depending on the severity of things on the macro front, Solana could see a much greater drop than that.

Let us say that the American economy falls into recession, but that stubbornly high inflation complicates the efforts to soften the Fed, and the federal government seems to be reluctant to intervene with an increase in stimulus via more public spending.

This could relaunch the discussions of a new “great recession”. And this could be an environment where Solana collapses up to her levels from the beginning of 2023 in the $ 15 to 30 zone.

This would mark a drop of 90% compared to its January heights. In the world of crypto, it is not unknown to the decline.

In fact, in Altcoin, it is planned. And Solana already has a history of similar declines, lowering 97% compared to its peak of 2021 above $ 260 to its hollow of 2022 approximately $ 8.

Buy the Solana dip?

Investors informed would consider a drop in Solana prices to $ 30 as generation investment swap.

This is because, even if macro uncertainties could persist for a while, the future of the crypto looks brighter than before.

The industry has received a historic boost from the United States government and the global adoption of Bitcoin is booming.

The Trump administration is filled with hodlers crypto and supporters. David Sacks, the current White House crypto and Tsar AI was a former investor.

Aside from the medium -term macro risks, the longer -term perspectives for the cryptographic industry seem as strong as ever.

The fears by Macro will eventually facilitate and, if financial conditions are considerably facilitated in the years to come, the cryptographic markets are put in pop.

Solana will be no exception. No one should be surprised to see Solana reaching $ 1,000 per token at the end of Trump’s four -year term.

Could the position of Solana to increase to $ 30 in 2025? appeared first on Cryptonews.