The crypto crash accelerated this week, with Bitcoin falling all the way to key $80,000 support and the market cap of all tokens falling to $2.9 trillion.

Summary

- The crypto crash accelerated this week with most coins in the red.

- There are signs that a new uptrend is imminent, including the decline in the Fear and Greed Index.

- Bitcoin and most altcoins have entered their oversold territories.

Most altcoins have fallen by double digits over the past seven days, with Ethereum (ETH), Ripple (XRP), Binance Coin (BNB), and Cardano (ADA) falling more than 12%.

Yet amid the ongoing doomsday predictions, there are signs that the crypto market crash is about to end. These signs, which all happened in the past, have now aligned.

Crypto Crash Could End With Fear and Greed Index Crash

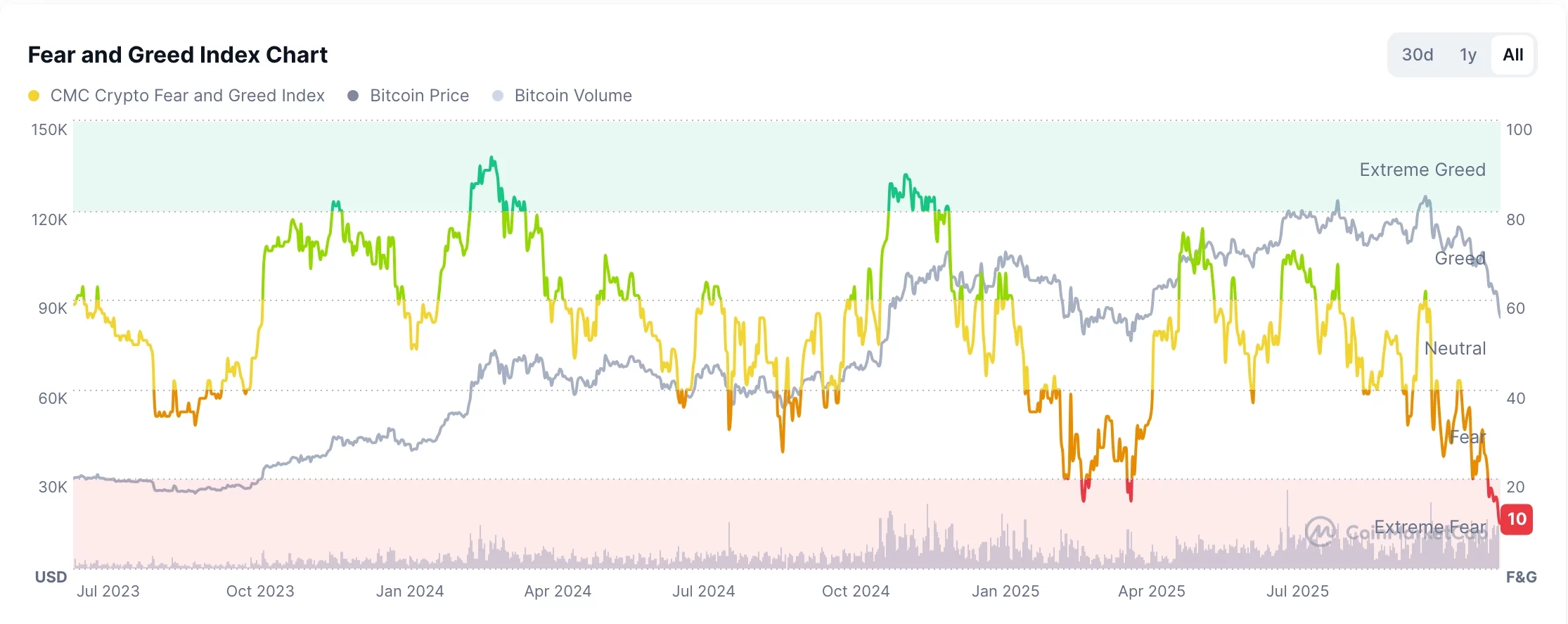

One potential catalyst for a new uptrend in cryptocurrencies is that the closely watched Fear and Greed Index has fallen to a year-long low of 10.

This drop occurred as the crypto sector’s momentum waned, volatility increased, and social media sentiment turned negative.

A closer look shows that most cryptocurrency bull markets start when the index is in the red. For example, Bitcoin (BTC) hit a new all-time high in May this year, a few weeks after the index moved into the extreme fear zone.

On the other hand, cryptocurrency bear markets always start when the index is in the green zone or extreme greed zone. Therefore, as November comes to an end, it is likely that December will be a better month for cryptocurrencies, perhaps due to the Santa Claus gathering.

Crypto market cap has become oversold

The other potential catalyst for the next crypto bull run is that the industry has now become severely oversold.

Data shows that the Cryptocurrency Market Cap Relative Strength Index has fallen to the oversold level of 24. This means that the downward divergence trend that has lasted since July this year is coming to an end.

It is therefore likely that Bitcoin and other altcoins will start to rebound in the coming weeks. Of course, this bounce will not happen in a straight line, one possibility being the formation of a double bottom pattern.

Crypto cleanup is coming to an end

Another possible reason why the crypto crash is ending is the end of the ongoing cleanup in the industry. This cleanup is visible in the ongoing futures open interest.

Data compiled by CoinGlass shows open positions in futures contracts fell to $123 billion, down from a yearly high of more than $320 billion. Total liquidations since October 10 have jumped to more than $40 billion.

Ongoing liquidations and falling open interest mean the crypto market will be a bit healthier going forward as investors use less leverage.

There are other potential catalysts for the next crypto bull run, including the high chances of interest rate cuts from the Federal Reserve, the skyrocketing M2 money supply, and the ongoing approvals of altcoin ETFs.