Join our Telegram channel to stay up to date with the latest news

Heavyweights in the crypto and tech industries are sounding the alarm over a proposed California tax law, warning it could lead to an exodus of wealth and capital flight.

The act, the Billionaires Tax Act of 2026is supported by the Service Employees International Union-United Healthcare Workers West and proposes a 5% tax on net wealth over $1 billion. The purpose of this tax is to help finance the health care system and state assistance programs.

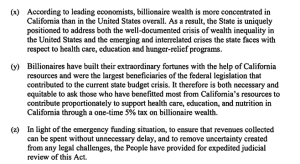

Extract from the tax bill (Source: OAG)

Crypto industry executives warn tax will do more harm than good

One of the main advocates of the proposal is crypto-friendly U.S. Rep. Ro Khanna. In a series of X articles, he argued for the tax and said it would help fund better child care, housing and education. According to him, this would be beneficial for American innovation.

Several crypto industry executives opposed the tax bill. One of the main points of contention around the proposal is that the tax will also be applied to paper gains that have not yet been realized. Critics argue that the unrealized gains tax would force sales of equity and assets to cover costs.

Among the crypto and tech leaders who have responded strongly to the tax bill is Kraken co-founder Jesse Powell. He said in a Dec. 28 article that this tax, if implemented, “will be the straw that breaks the camel’s back.”

A 5% theft of unrealized gains and already paid asset taxes is just about the most retarded thing I’ve ever heard. I promise you this will be the straw that breaks the camel’s back. Billionaires will take all their spending, hobbies, philanthropy and work with them. Solve the problem of waste and fraud.

– Jesse Powell (@jespow) December 28, 2025

“Billionaires will take with them all their spending, their hobbies, their philanthropy and their work,” Powell warned.

Hunter Horsley, CEO of Bitwise, echoed these warnings. “Many of those who made this state great are quietly discussing leaving or have decided to leave within the next 12 months,” he said. said.

Wealth taxes are not always effective

Fredrik Haga, co-founder and CEO of Dune, argued that taxes on the rich don’t always work, pointing out that Norway had tried a similar tax. This has led to a mass exodus of the Nordic country’s wealthy, the Dune CEO said. It also resulted in less money being raised than expected.

“Friendly reminder to California: unrealized capital gains taxes have led to more than half of the wealth held by Norway’s 400 largest taxpayers being transferred abroad,” Haga said.

“Norway became more egalitarian and made everyone poorer and poorer, just as you would expect with strong socialist ideas. »

Questions arise about how the money would actually be spent

Along with warnings of wealth exodus and capital flight, questions have also emerged about whether the money will succeed in achieving its goals.

Professor at New York University and founder of Zero Knowledge Consulting, Austin Campbell, sharp to a December audit by the California State Auditor. The audit found problems with how taxpayer funds were spent, including unaccounted for or poorly justified expenses.

Pro-crypto lawyer John Deaton also highlighted the audit and said Khanna should first focus on the recently reported $70 billion fraud before going after the wealthy with the proposed tax.

It’s clear after @RoKhannaTax unrealized gains and seize private party positions, that when government and affordability fail, the Democratic Party’s instinct is not reform or accountability — but punishment. Tax success. Tax unrealized gains. Avoid responsibility at all…

– John E Deaton (@JohnEDeaton1) December 28, 2025

Related articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news