- The Fear and Greed Index was at 73, indicating increased market optimism.

- Despite growing greed, the total cryptocurrency market cap remained solid at $2.23 trillion.

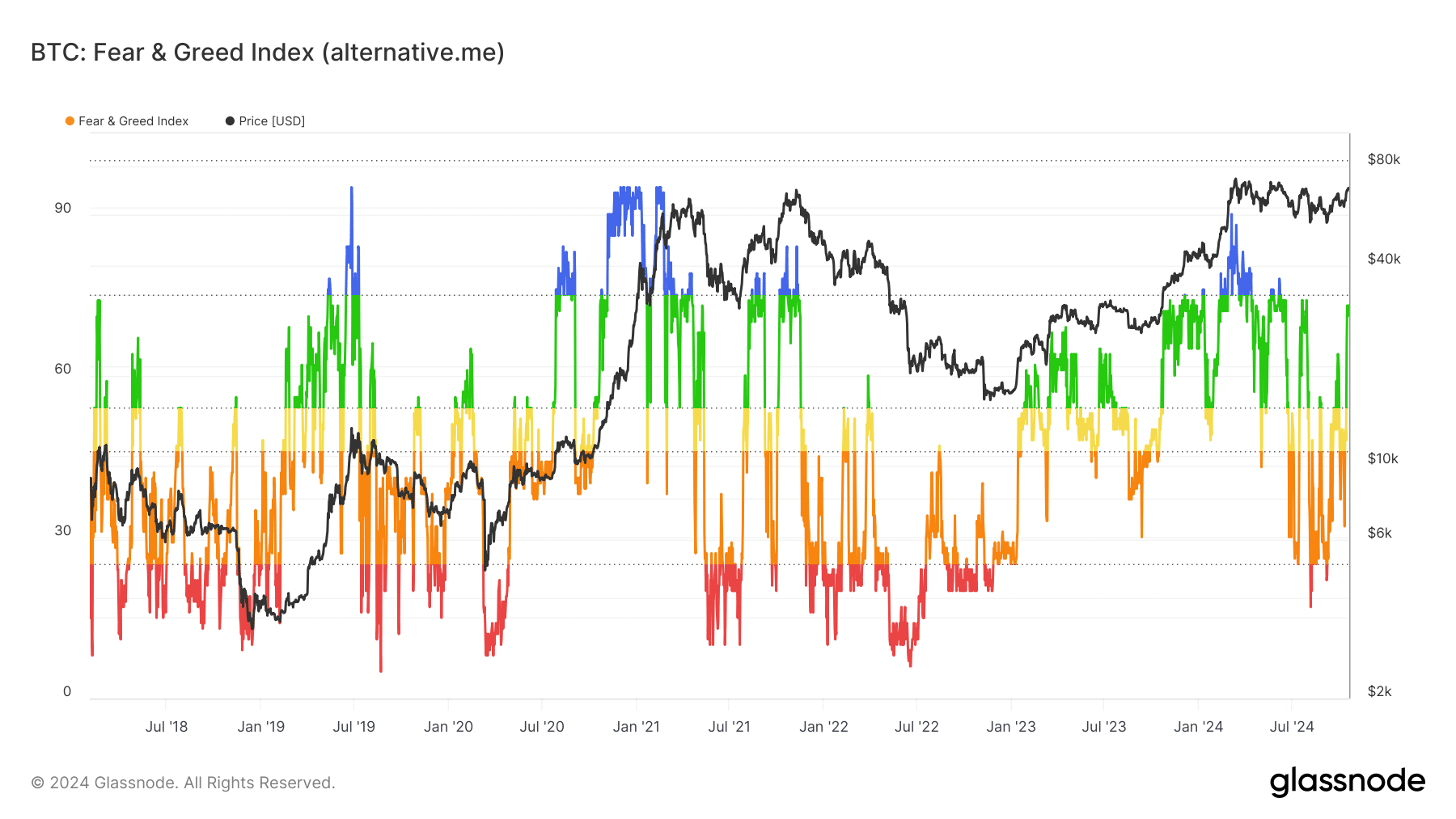

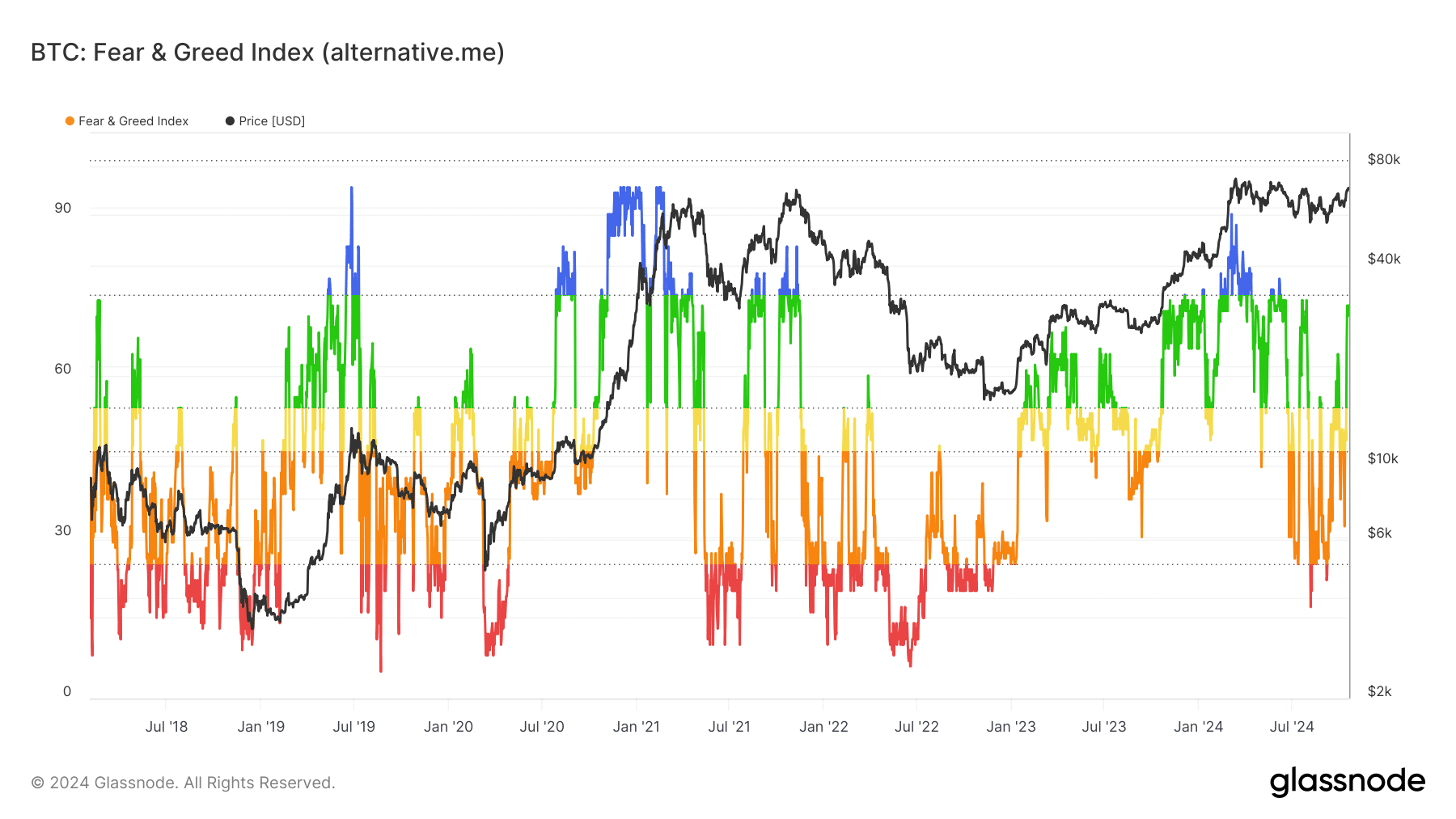

The Fear and Greed Index was 73 at press time, indicating that the market is in a state of greed. This level of optimism suggests that many investors are confident about further price increases.

It also raises concerns about possible overheating of the market.

Potential for market overheating

AMBCrypto’s analysis of Glassnode’s Crypto Fear and Greed Index highlighted a reading of 73, signaling that the market was moving deeper into greed territory.

This increased greed can often be a double-edged sword. While growing optimism can push prices higher, it also increases the risk of a sharp market correction.

Source: Glassnode

When the Fear and Greed Index reaches high levels, traders may take excessive risks and seek higher returns without fully considering the potential downsides.

This behavior can cause a short-term price spike, but history shows that periods of extreme greed often precede corrections.

For example, in early 2021, the index showed similar levels of greed, followed by a substantial market pullback.

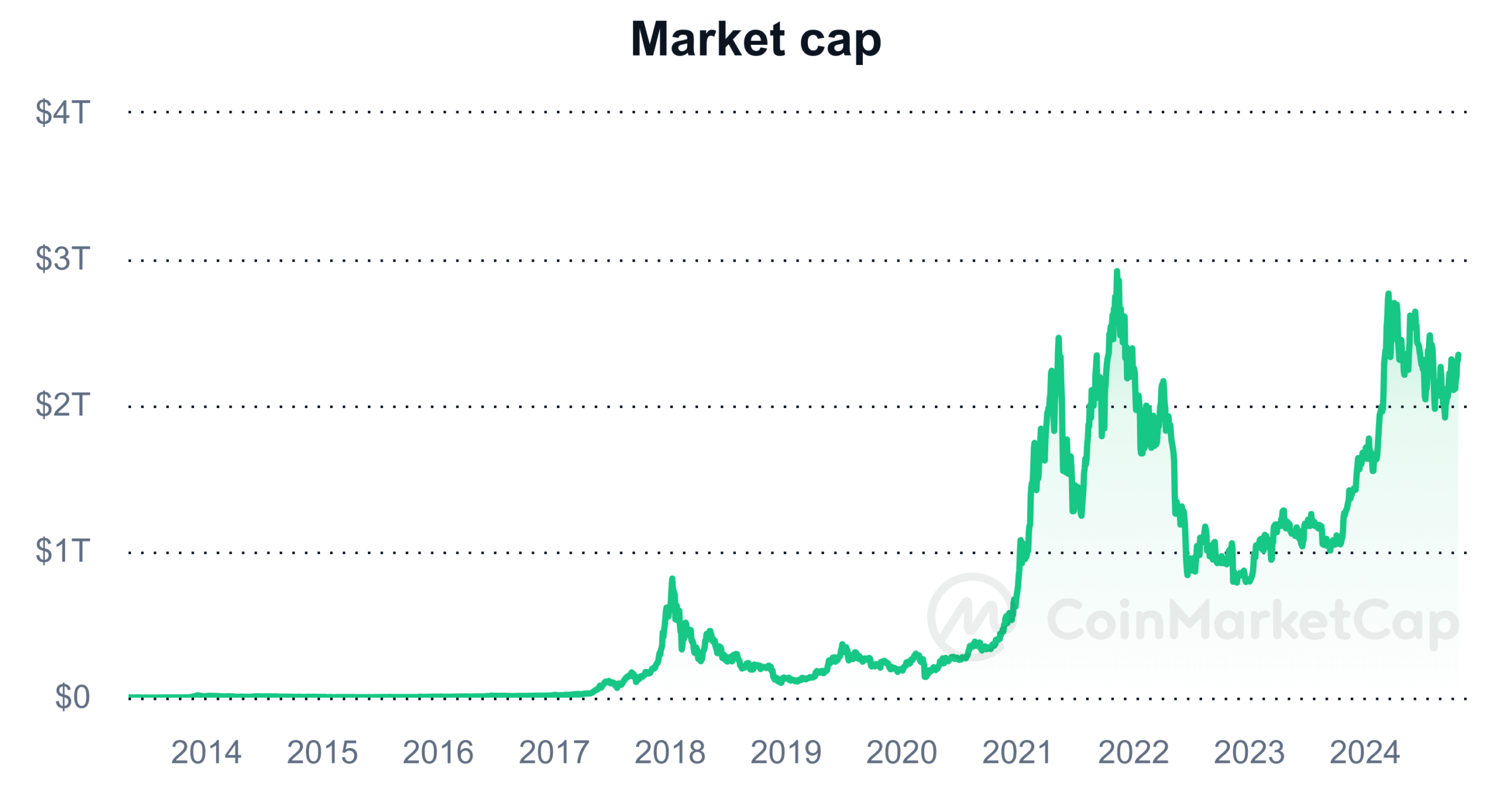

Market Remains Strong Despite Fear and Greed Index

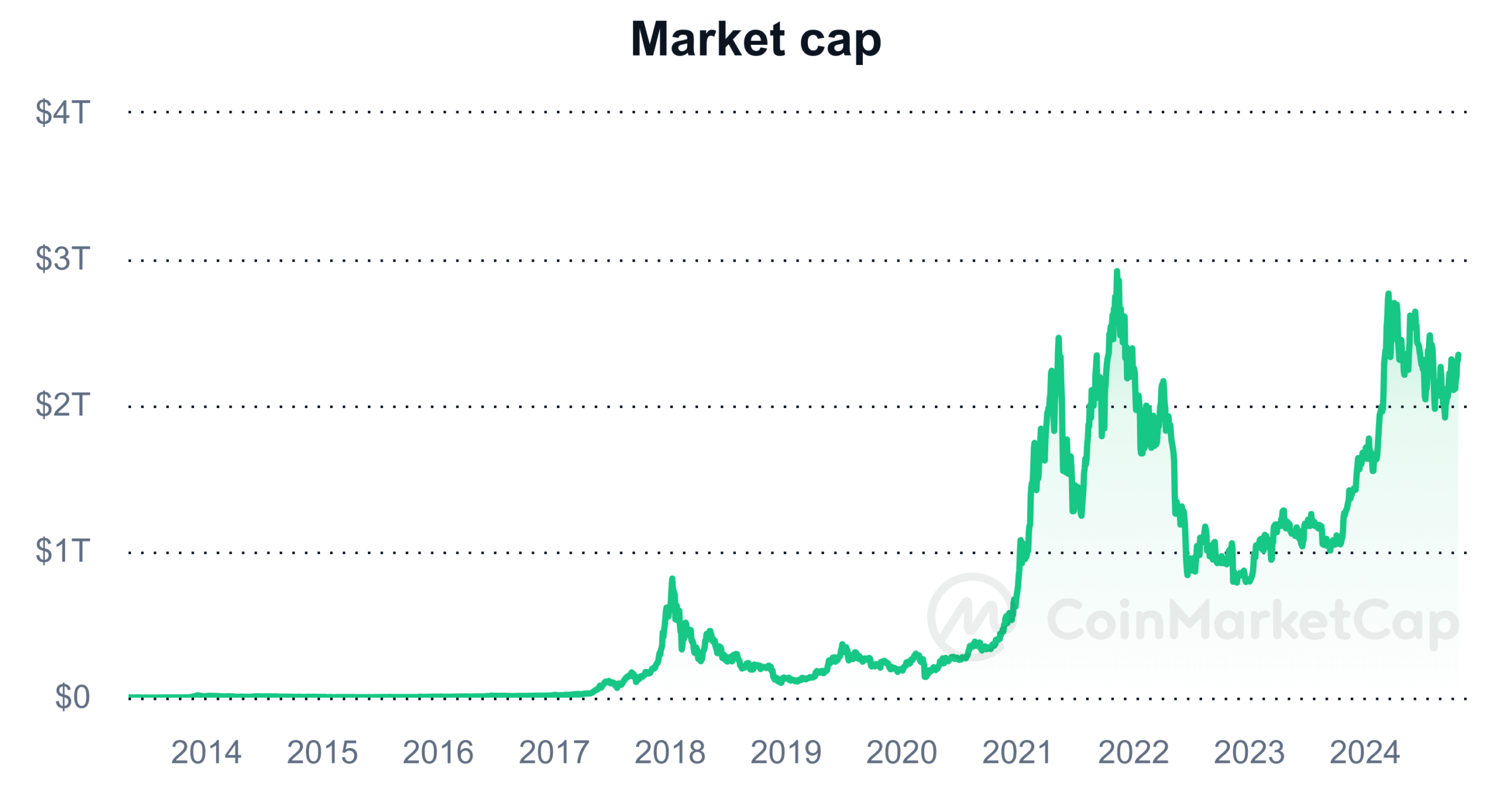

Even though the Fear and Greed Index signals caution, the total cryptocurrency market cap remained strong at $2.23 trillion. This strong market capitalization reflects continued interest from institutional and individual investors.

Top cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) continued to anchor the overall market value, contributing to its positive trend.

Source: CoinMarketCap

In addition to these major assets, altcoins such as Solana (SOL) and Worldcoin (WLD) have also played a key role in maintaining the market trend.

Despite the growing greed, the stability of the market cap shows that confidence in the long-term potential of the crypto market remains strong.

Outlook: opportunity or risk?

With the Fear and Greed Index firmly located in the Greed Zone, traders must weigh both opportunities and risks. On the one hand, strong market sentiment and solid market capitalization could lead to further gains in the near term.

On the other hand, periods of high greed have always been followed by market corrections, with investors locking in profits and risk appetite diminishing.

Much like the current reading, high levels of the Fear and Greed Index often serve as a warning sign that a correction could be on the horizon.

Although current optimism presents opportunities for gains, traders should remain cautious and prepare for potential volatility.