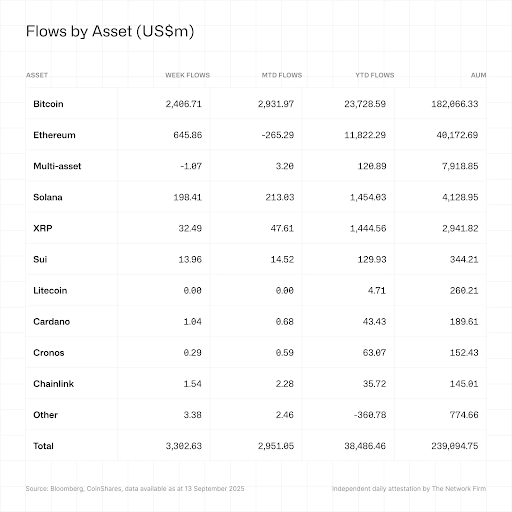

Last week was a good week for digital asset investment products, which attracted a collective of $ 3.3 billion in entries, according to the Last weekly report of corners. The latest entry figures pushed assets under management (AUM) to $ 239 billion, just under $ 244 billion in August. The rebound in the entrances, which came After losing $ 352 million The previous week, had to be softer than expected American macroeconomic data And solid end -of -week price earnings on the cryptography market.

Bitcoin and Ethereum lead the reversal

Unsurprisingly, recorded bitcoin The strongest change in feeling. In particular, investment products based on the main cryptocurrency have experienced $ 2.4 billion in admissions, its largest weekly total since July. The dominant bullish feeling throughout the week made it possible that short -term products have experienced modest outings that pushed their alms to only $ 86 million.

Ethereum Also balanced in positive territory after eight days of consecutive negotiations of outings. He recorded $ 646 million in entries, supported by four consecutive daily sessions of feeling of positive investors. It was a quick reversal of $ 912 million in outings the previous week.

Other assets have also benefited, the products based in Solana reaching their entry into a single day of $ 145 million on Friday and ending the week to a total entry of $ 198 million. XRP -based products added $ 32.49 million, while SUP products, Cardano and Chainlink experienced $ 13.96 million, $ 1.04 million and $ 1.54 million, respectively. Recovery from several altcoins is a significant improvement in institutional trust compared to previous weeks of downward pressure.

Regional trends show American domination

Flows in digital asset funds were extremely concentrated in the United States, which saw $ 3.2 billion in entries. Most of them were In the Bitcoin spot and ETHEREUM ETHE, who have experienced $ 2.34 billion and $ 637.69 million Sosovalue data.

The digital asset funds based in Germany followed with $ 160 million and crowned the week with their second daily influx. However, Switzerland -based products stood out on the decline and have recorded $ 92 million in outings that partially compensate for European gains.

Looking at the service providers, the FNB Ishares in the United States attracted $ 1.1 billion in new funds, the Fidelity Bitcoin Fund for Fidelity added $ 850 million and Bitwise ETFs and Ark 21shares combined for more than $ 360 million. Meanwhile, Graycale attracted nearly $ 147 million, although it is still on the net outings of the year.

The resumption of fund flows has lifted Global AUM for digital asset investment products at 239 billion dollars, 2% below the summit of $ 244 billion in August. Continuous influx this week Could see global AUM reaching a new summit of all time this week.

Bitcoin dominates the ranks of AUM with $ 182 billion, which represents a participation of 76.15%. Ethereum, on the other hand, represents $ 40 billion. The third highest alms is Solana with $ 4.1 billion. Although he’s far behind, Solana was an impressive witness AUM growth this year.

Pixabay star image, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.