This article is also available in Spanish.

Miles Deutscher, a prominent crypto analyst with over 575,000 followers on AI sector in the cryptocurrency landscape, Deutscher suggests this could be “the biggest opportunity in the bull run.”

Why AI offers a lot of potential

Deutscher highlights the rapid expansion of the global AI market, noting that it grew by approximately $50 billion between 2023 and 2024. Projections estimate a compound annual growth rate (CAGR) of 28.46%, potentially surpassing $826 billion by 2030. Despite AI’s significant presence in public discourse – accounting for nearly a third of attention in the crypto space – it currently ranks 34th in the crypto sector by market capitalization, lagging behind sectors like liquid staking, memecoins, and decentralized finance (DeFi). “Yet AI is still only the 34th largest crypto sector by market cap, behind liquid staking, dog memes, DeFi, and more. I could easily see AI as a top 5-10 industry within a year,” Deutscher said.

He says this disparity presents a huge opportunity for investors. “Many mid- and low-cap AI tokens are still sitting at ridiculously low valuations. All it takes is a strong shift to AI for many of them to quickly revise their prices 5 to 10 times higher,” he explained. Deutscher lays out his core thesis for why AI crypto is expected to see substantial growth. First, he notes that everyone is realizing the impact AI will have on society. “People are either scared, excited, or intrigued by the latest developments. This already cements AI in general in the minds of the masses,” he said.

Related reading

Second, he points out that AI is constantly innovating and new products are coming to market regularly. “Every time a new AI product is launched, it puts even more emphasis on the sector. And crypto is an attention economy. More eyeballs equals more speculation,” Deutscher observed. Third, he believes crypto offers a lower barrier to exposure to AI growth. “Crypto is easier to access, can be fractionalized, and generally ‘cheaper’ than investing in, say, AI stocks. For retail, this is a huge advantage,” he said.

Finally, he highlights the recent rise of AI agents, which has raised awareness of the power of AI integrated into cryptography. “We are moving towards a future where AI agents will autonomously trade on-chain for you, manage your portfolio and risk, DeFi, and much more. This will completely change the crypto landscape,” predicted Deutscher. He also notes that this trend is occurring in traditional technology sectors, with companies like Adobe and Expedia integrating AI agents into their operations.

Focusing on the AI and crypto landscape, Deutscher mentions that it invests in various verticals, with a particular focus on AI agents and AI infrastructure. It focuses on “shovel infrastructure protocols” rather than individual AI agents or broader DePIN games. He reveals that he holds positions in all the projects he mentions, some as a strategic advisor and investor.

Top 10 AI Altcoins

Deutscher’s top ten AI altcoins, ranked from largest to smallest market capitalization, are as follows.

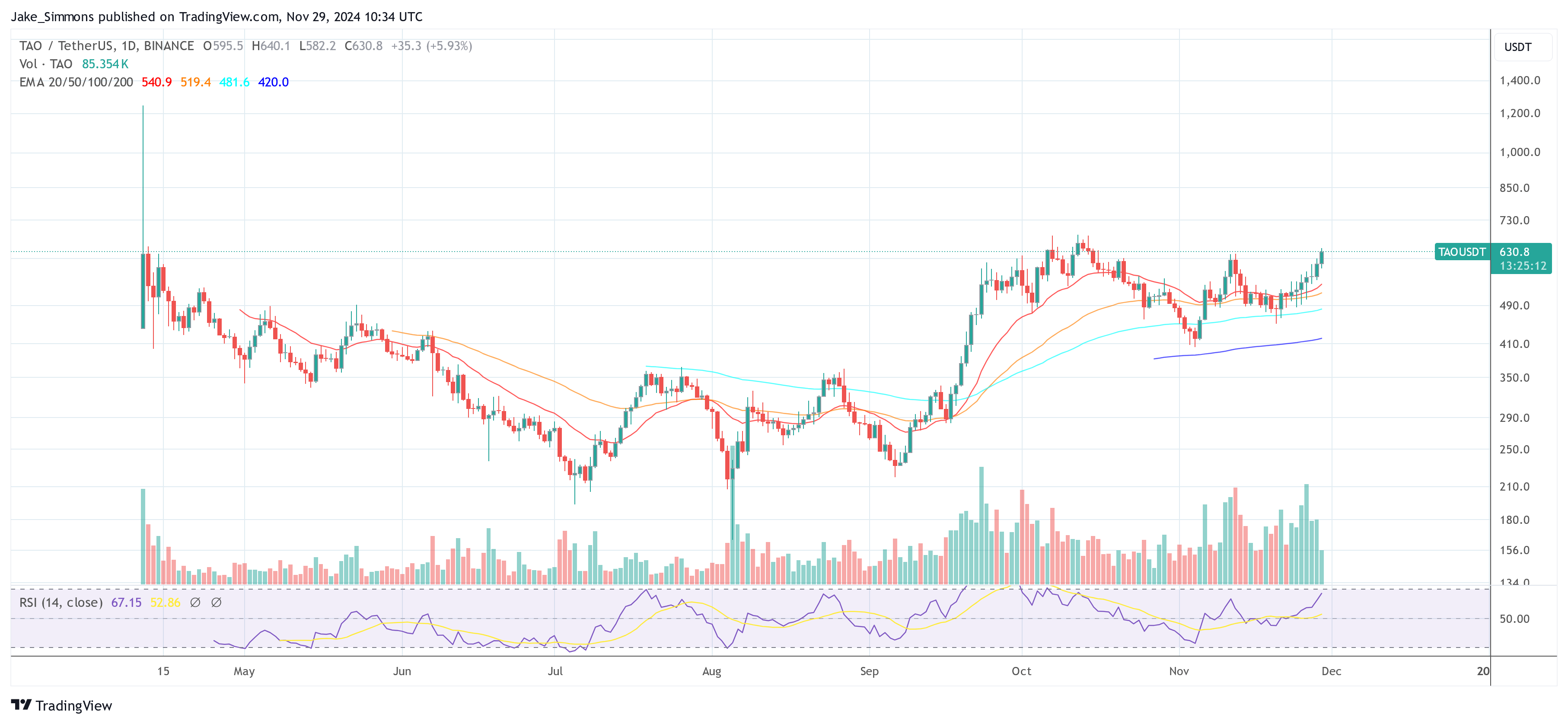

The first on the list is Bittensor (TAO)which he describes as the market leader in AI. Bittensor focuses on decentralizing AI research and has already been widely adopted by scientific communities. “With the recent rollout of EVM compatibility, the network has taken a huge step forward, opening the door for developers to build DeFi ecosystems and unlock new use cases,” Deutscher noted.

The second is NEAR Protocol (NEAR)which it identifies as the leading AI-crossing Layer 1 (L1) blockchain. “For those who are bullish on both verticals, NEAR is a strong indicator. Fun fact: Since its launch on mainnet in October 2020, it has maintained 100% uptime,” he noted.

The third is Grass (GRASS)a notable launch this cycle due to its data pipeline that seamlessly connects the real world to AI and crypto. “Recent developments in AI make data one of the world’s most valuable assets. Grass uses cryptographic incentives to create a data pipeline that most AI companies would not otherwise be able to leverage,” he explained. He added that the demand for the Grass network is undeniable and the future of the protocol looks incredibly promising.

Related reading

The fourth is Spectral (SPEC)one of the leading AI agent frameworks, allowing anyone to deploy and interact with AI agents. “With Syntax V2, you will be able to interact with sensitive agents with personalities, who trade on Hyperliquide based on community feedback. It’s an interesting mix of fun, collaboration and speculation,” commented Deutscher.

The fifth is Mode Network (MODE)which, although known as a Layer 2 (L2) solution, has been developing AI technology for over a year. “They are leading the future of DeFi by facilitating the deployment of AI-powered agents, which will autonomously mine yield and optimize your portfolio on your behalf,” he said.

Sixth on the list is NeuralAI (NEURAL)connecting AI and gaming, two of the biggest drivers of crypto adoption. “They just announced SentiOS, which provides autonomous AI to create, populate and bring virtual worlds and economies to life,” Deutscher said.

The seventh is PinLinkAiwhere Deutscher is strategic advisor and investor. PinLink is the first real-world asset tokenized DePIN platform, enabling fractional ownership of yield-generating assets, physical or digital. “They have also recently partnered with Akash, Pendle, FetchAI, OpenSea, Alephium, ParallelAI, and more. Their commercial development is at another level,” he praised.

The eighth is Zero1 Laboratories (DEAI)another project where he acts as a strategic advisor and investor. Zero1 Labs enables innovators to build decentralized AI applications with fully homomorphic encryption, ensuring secure data governance and complete privacy. “Think of it as a scrappy AI infrastructure game. With a market cap of around $76 million, this is one of my ‘highest upside’ AI bets,” Deutscher revealed. He highlighted the beginnings of Seraphnet, the first of many projects planned by their incubator.

The ninth is Empyreanalso a project where he is an advisor and investor. As a proponent of AI agents, Deutscher points out that Empyreal provides AI infrastructure to transform social media messages into on-chain actions such as transactions and exchanges through their Simulacrum platform. “It’s super cool,” he added.

The tenth is enqAI (ENQAI)another project in which Deutscher is involved as an advisor and investor. EnqAI is a large decentralized network of language models that addresses the bias and censorship issues common to centralized AI. “Despite its $20 million market cap, enqAI already has 20,000 monthly active users in over 50 countries and has already processed over 1 million API requests with minimal downtime or lag” , he stressed.

As a bonus, Deutscher mentions Guru Network (GURU)where he is also an advisor and investor. With its Layer 3 mainnet now operational, Guru powers AI processors and chatbots with decentralized exchange, stablecoin support, bridges, and core chain integration. “I worked with Guru to launch a Telegram and Discord mini app, offering a complete turnkey solution for DeFi on Telegram. It’s going to be very cool! he exclaimed.

Deutscher emphasizes the importance of risk management. He reveals that his personal portfolio balance is approximately 70% large caps and 30% small and mid caps. “I recommend that you do your own research, and if you decide to take a position in one of these protocols, be sure to manage position sizes and risks in accordance with your goals and overall strategy,” a- he advised.

At press time, TAO was trading at $630.80.

Featured image created with DALL.E, chart from TradingView.com