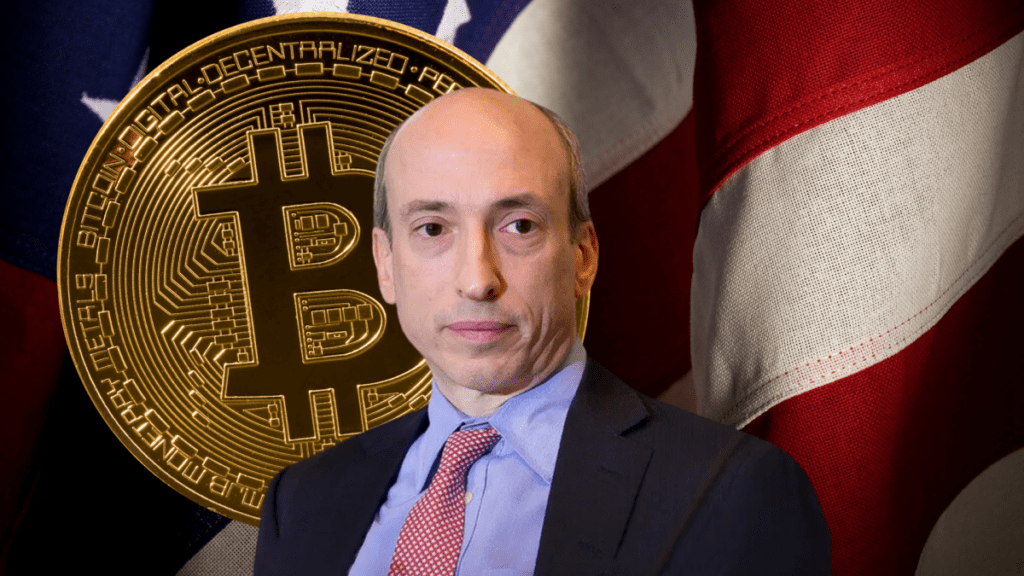

Gary Gensler’s decision to resign as chairman of the Securities and Exchange Commission on January 20 has had ripples across the cryptocurrency world, sparking conversations about the future of cryptocurrency regulation in the United States. United.

Rob Nelson spoke with Gav Blaxberg, CEO of WOLF Financial, and Mauricio Di Bartolomeo, co-founder and CSO of Ledn, to examine how this change in direction could affect the broader crypto landscape beyond bitcoin.

Rob Nelson highlighted the controversies surrounding Gensler’s tenure, noting, “It’s time to move…you haven’t done a good job.” He highlighted the SEC’s actions against companies like Grayscale and Coinbase, highlighting the irony of the U.S. government’s custodial relationship with Coinbase as the SEC took legal action against the exchange.

To be fair, the SEC had already agreed years ago to challenge the idea that Bitcoin could be a security. Since then, its cases have largely targeted other cryptocurrencies that could qualify as securities, according to Chairman Gensler.

Gav Blaxberg stressed the need for clear regulation, saying: “The biggest problem with Gary Gensler’s leadership was really just the lack of any direction and direction that they provided. ” He mentioned that companies are eager to comply but need clear rules: “They were suing Coinbase and Coinbase was telling them, just tell us the rules, what would you like us to do? » Blaxberg believes that new leadership could “allow the entire crypto ecosystem to move forward” and highlighted the rapid development of new financial products: “They are already creating high-end Bitcoin ETFs. came back… It’s already out.”

Mauricio Di Bartolomeo predicted a strategic focus on initiatives that align with US interests. “I think positioning the United States as pro-tech and pro-bitcoin is an important goal,” he said. Highlighting the importance of stablecoins, Di Bartolomeo explained: “Stablecoins are the sixth largest buyer of US bonds today… This is a huge strategic advantage that they could exploit. » He expects regulatory hostility towards “security and meme-like tokens” to diminish over time, but warned that it will take “some time” to achieve full clarity.

Nelson wondered where the biggest moves in crypto could occur over the next year, excluding Bitcoin’s independent trajectory. Di Bartolomeo responded: “You’re going to see a focus on initiatives with the greatest ROI (return on investment) for U.S. strategic interests. » He believes that the United States will prioritize expanding the reach and utility of the US dollar through stablecoins, leveraging them to “fuel the crypto economy.”