Venture capitalist Arthur Cheong believes the decentralized finance (DeFi) sector is in the midst of a “renaissance.”

The CEO of DeFiance Capital tells his 177,800 followers on social media platform X that internal infrastructure improvements and external macroeconomic developments are driving DeFi’s resurgence.

“As global interest rates evolve, risky assets like crypto, including DeFi, become more attractive to investors seeking higher returns.

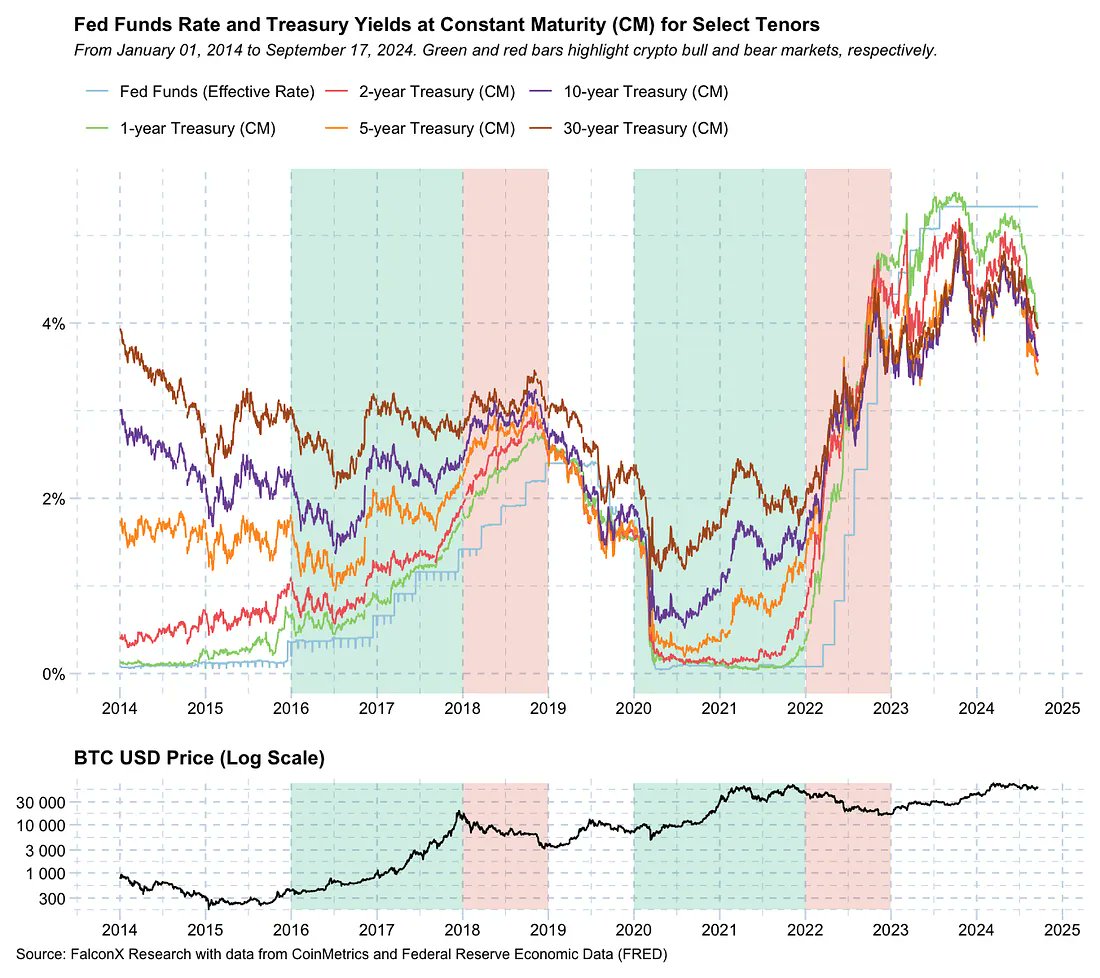

With the Federal Reserve implementing a 50 basis point rate cut in September, the stage is set for what could be a period of lower interest rates, similar to the environment that fueled the bull markets of cryptography of 2017 and 2020, as shown in the chart below. . Bitcoin (and crypto) bull markets are highlighted in green, historically in a low interest rate regime, while bear markets are typically highlighted in red during periods of rising interest rates.

Specifically, Cheong claims that DeFi benefits from lower interest rates because traditional treasuries and savings accounts offer lower returns. This is convincing more investors to look to DeFi protocols for higher returns, according to the venture capitalist.

The CEO of DeFiance Capital also notes that lower funding costs may encourage DeFi users to take out loans and direct them into the sector’s ecosystem, thereby leading to increased activity.

“Even though interest rates will not fall to the near-zero levels seen in past cycles, the reduced opportunity cost of engaging in DeFi will be significantly reduced. Even a moderate drop in rates is enough to make a big difference, since the difference in rates and yields can be amplified by leverage.

Additionally, we expect the new interest rate cycle to be a significant driver of stablecoin growth, as it significantly reduces the cost of capital for yield-seeking TradFi funds moving to DeFi.

Don’t miss a thing – Subscribe to receive email alerts straight to your inbox

Check Price Action

Follow us on XFacebook and Telegram

Surf the daily Hodl mix

& nbsp

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should conduct due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and transactions are at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: halfway