- BTC Upsy was capped by macro uncertainty in the midst of Trump’s pricing wars.

- It remains to be seen how the American job report will define the next management for the market.

President Donald Trump’s prices and inflation fears continue to weigh Bitcoin (BTC).

The greatest price in cryptocurrency in the world has dropped for three consecutive days, strengthening macro uncertainty pending on the wider market of cryptography.

During the same period, BTC failed to recover $ 100,000. Likewise, ETH was struggling to bounce over $ 3,000 Solana (soil) Taiild less than $ 200. Ripple (XRP) also remained in a mute and remained below $ 2.5 at the time of the press.

Source: CoinmarketCap

Weak feeling before us employment report

Given the Price Impact of President Trump on inflationary pressure, the markets will focus on the January jobs report in the United States (non-agricultural pay) for FED levels.

According to the Crypto options office, QCP Capital, there was an increased coverage activity with put options (Paris fucked) before the report.

This suggested an increase in lower risk protection and a potential lowering feeling. Business declared,,

“While we are heading for the non -agricultural pay report tonight, the feeling of the market remains cautious. The office continues to observe the interest in BTC 28FEB25 80K PUT and BTC 21FEB25 90K food, reflecting persistent caution despite the buttocks always promoting calls. »»

In particular, the FXSTREET data revealed that economists expected that the jobs in January increase by 170k after a gain of 256K in December.

If the real report lacks the objectives of January, the Fed could be inclined to further reduce rates. It would be positive for BTC and risky assets.

However, if the Jobs report shows a greater gain than estimated, such a solid labor market would encourage regulator to maintain current interest rates stable longer. With the fears of current inflation, it would be bad for the BTC and the crypto as a whole.

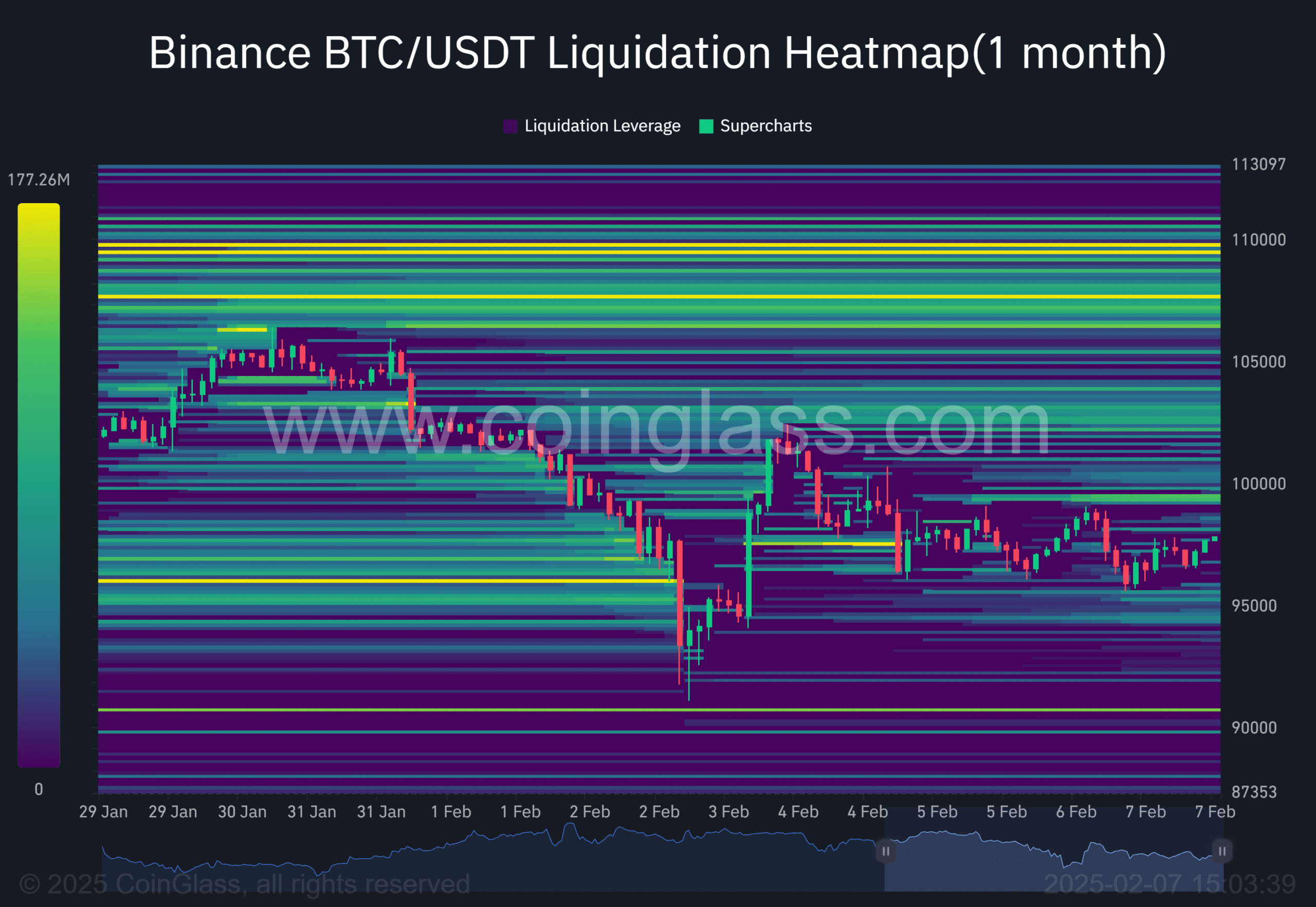

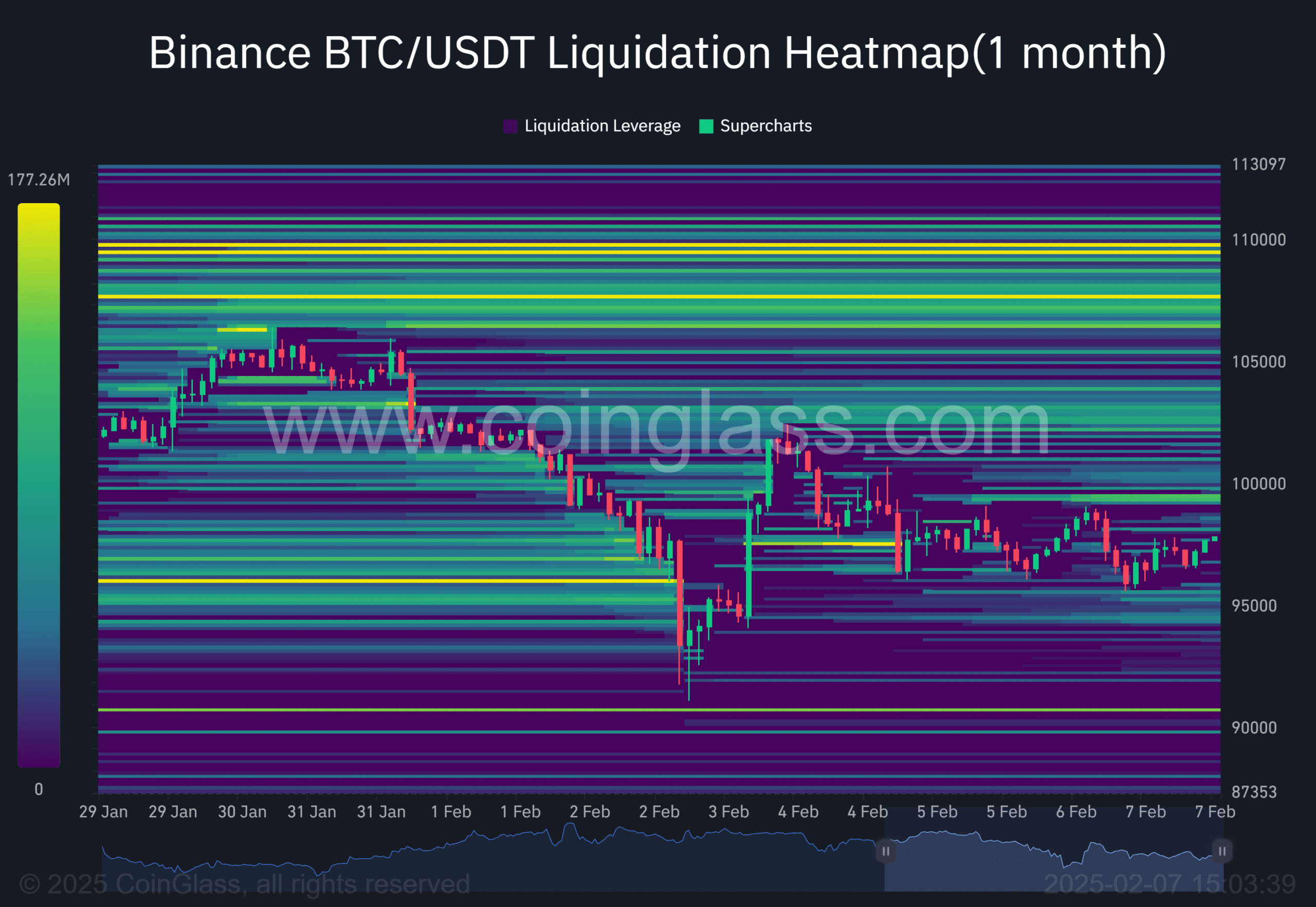

That said, according to the Coinglass liquidation thermal card, the keys to following are $ 90,000, $ 100,000 and $ 110,000. These key liquidity pockets generally act as price magnets, especially during liquidity together.

Source: Coringlass