- The cryptocurrency market edged lower as markets prepare for this week’s release of Eurozone CPI and FOMC minutes.

- The futures market is showing increasing use of leverage, with more traders turning to short positions.

The cryptocurrency market declined slightly on Monday, August 19. The global cryptocurrency market capitalization was down 3% at the time of writing, with the two largest cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), trading in the red.

Bitcoin failed to hold the psychological threshold of $60,000 and had fallen to around $58,000 at press time. ETH, the largest alternative cryptocurrency, was also following a similar bearish trend to trade lower around $2,570.

With the Cryptocurrency Fear and Greed Index At 28, the market is in fear. However, the release of key economic data, including the Eurozone Consumer Price Index (CPI) and the Federal Open Market Committee (FOMC) minutes, could change the current sentiment.

Eurostat estimates Inflation is expected to reach 2.6% in July, up from 2.5% in June. The CPI data, to be released on August 20, is expected to influence the European Central Bank’s interest rate decision.

The ECB began cutting rates in June before pausing in July.

In the US, the FOMC minutes for the July meeting will shed light on the Federal Reserve’s accommodative stance after leaving rates unchanged last month.

Short traders increase their stakes

Following the dovish FOMC meeting last month, cryptocurrency prices failed to rallyand it appears traders are positioning for a similar move.

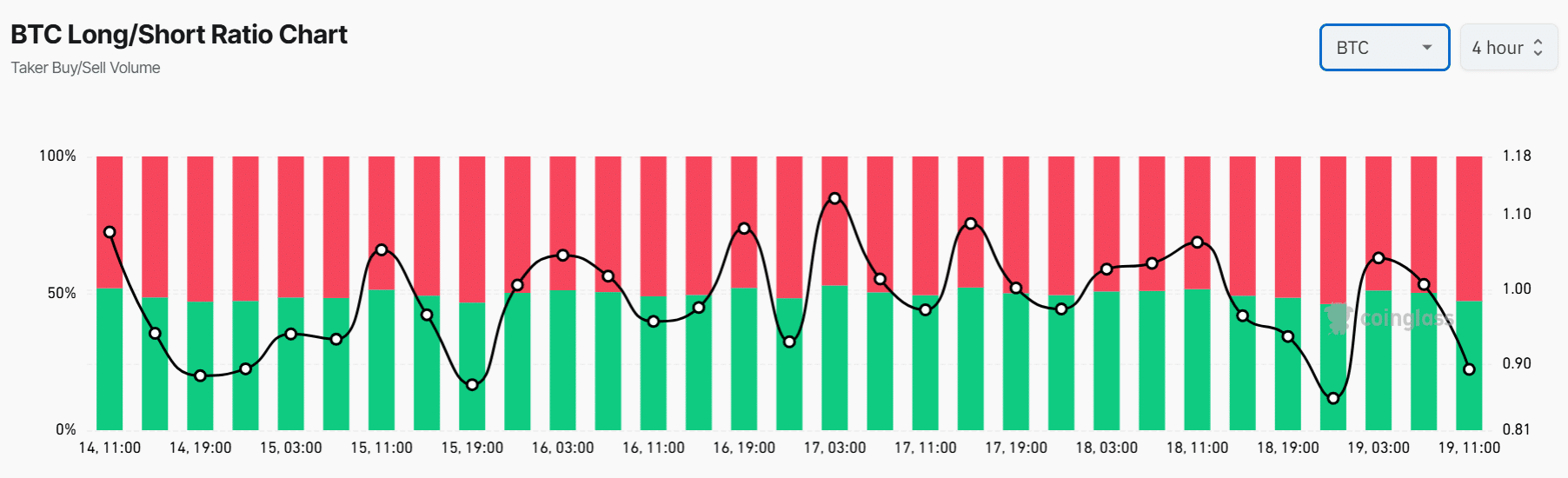

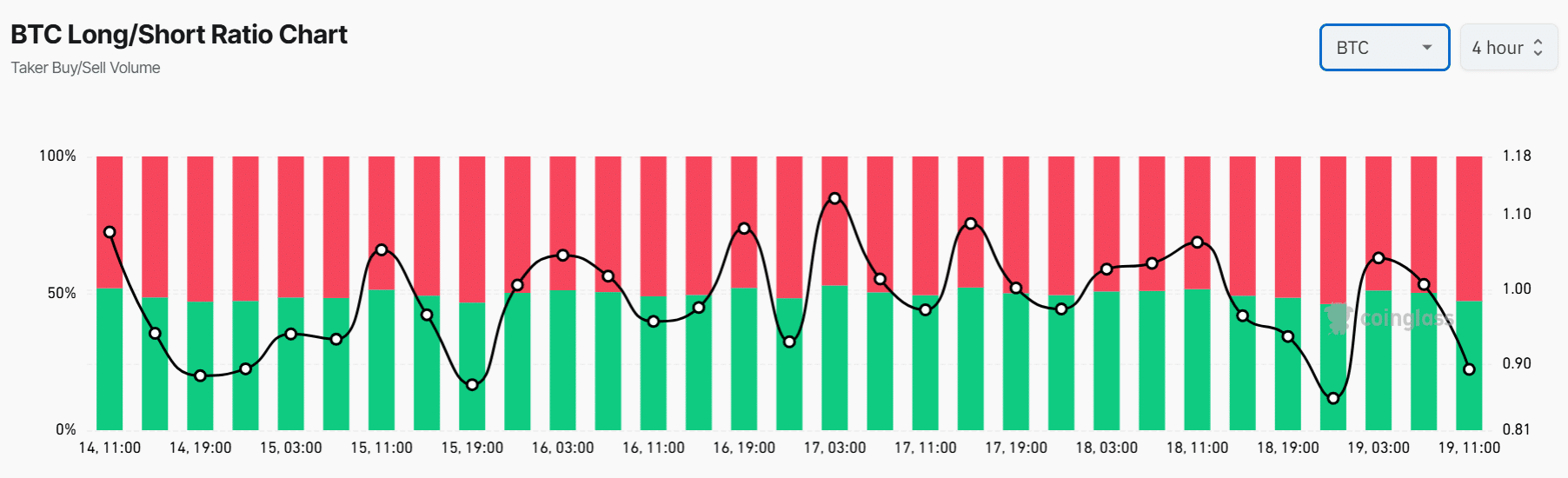

In the Bitcoin futures market, the long-to-short ratio has moved from a neutral position of 1 to 0.89. This change indicates that short positions are increasing as traders bet against the price of Bitcoin.

Source: Coinglass

Bitcoin funding rates had also turned negative at press time, with open interest falling slightly to $30 billion, suggesting long traders were exiting their positions.

Ethereum also had the largest liquidation volume in the cryptocurrency market at the time of writing. $30 million worth of ETH was liquidated in the last 24 hours, including $27 million worth of long positions.

These liquidations saw long traders opt to close their positions as short positions increased. Ethereum’s long-to-short ratio fell to 0.85, with 54% of futures traders holding short positions.

According to the author of CryptoQuant Crypto SunmoonIncreasing activity in the futures market shows that the bulls are still in play.

The analyst noted that investors are starting to take risks, which usually happens during bull markets. “Reckless use of leverage by risk-taking investors will fuel the cryptocurrency bull market,” the analyst said.