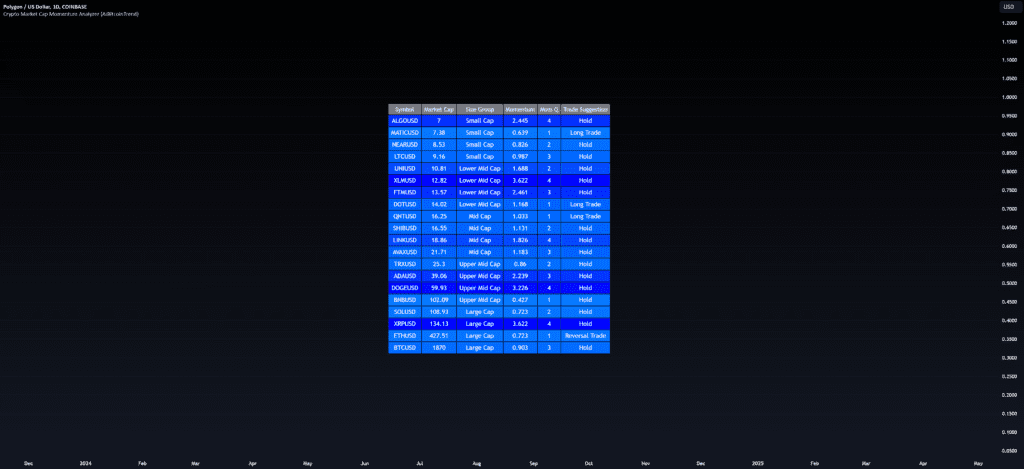

This indicator classifies cryptocurrencies into market capitalization quintiles and ranks them based on their 2-week momentum. It then suggests potential trades – whether going long, anticipating reversals, or simply holding – based on the crypto’s market cap group and momentum trends.

👽 How the indicator works

👾 Classification of market capitalization

The indicator classifies cryptocurrencies into one of five market capitalization groups based on user-defined inputs:

- Large cap: Highest level of market capitalization

- Upper middle cap: Second highest group

- Mid cap: Intermediate market capitalizations

- Lower middle heading: Slightly below intermediate level

- Small cap: Lowest level of market capitalization

This classification dynamically adjusts based on the market capitalization data provided, ensuring that you are always working with a representative market structure.

👾 Momentum Calculation

By default, the indicator uses a 2-week momentum measure (for example, a 14-day look back when set to daily). It compares the current price of a cryptocurrency to its price 14 bars ago, thereby quantifying its short-term performance. Users can adjust the momentum period and rebalance period to capture short or long term trends based on their trading style.

👾 Dynamic ranking and business suggestions

After assigning cryptos to size quintiles, the indicator sorts them based on their momentum within each quintile. This two-step process results in:

- Long trade: For groups with smaller market capitalization (Small, Lower Mid, Mid Cap) which have weak momentum (lower quintile), anticipating a trend continuation or breakout.

- Reverse trade: For the largest market capitalization group (Large Cap) which shows weak momentum, we expect a mean reversion towards equilibrium.

- Socket: In scenarios where the coin’s momentum does not present a strong contrarian or trend following signal.

👽 Applications

👾 Small cap trend following: Identify small or mid-cap cryptocurrencies with low momentum that may be poised for a breakout or sustained trend.

👾 Mean reversion in large caps: Identify large-cap cryptocurrencies experiencing a temporary lull in performance, potentially ripe for a rebound.

👽 Why it works in crypto

The cryptocurrency market is heavily influenced by retail investor sentiment and volatility. Research shows that:

- Small cap cryptos: They tend to experience higher volatility and speculative tendencies, making them ideal for momentum trading.

- Large cap cryptos: Exhibit more predictable behavior, making them suitable for mean reversion strategies when momentum is low.

This indicator captures these dynamics to give traders a strategic advantage in identifying momentum and reversal opportunities.

👽 Indicator Settings

👾 Rebalancing period: How often momentum and trading suggestions are recalculated (daily, weekly, monthly).

- Shorter periods (daily): Fast updates, suitable for short-term trading, but no more noise.

- Longer periods (weekly/monthly): Smoother signals, ideal for swing trading and more stable trends.

👾 Dynamic period: The lookback period for calculating momentum (default is 14 bars).

- Shorter periods: More responsive but prone to noise.

- Longer periods: Reflects broader trends, reducing sensitivity to short-term fluctuations.

Disclaimer: This information is for entertainment purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions.