Brief

- Bitcoin is hovering near $90,600 after failing to rise above $94,000, stuck in death territory despite a brief ETF-fueled spike.

- The total crypto market cap stands at $3.06 trillion, down 1.14%, with bearish technical indicators suggesting further decline to come.

- Prediction markets remain decidedly bullish, with traders giving just a 4.9% chance of a new “crypto winter.”

This brief glimmer of hope in the crypto market? Probably gone. Bitcoin is trading around $90,600 after a quick trip above $93,000 earlier this week, and the broader crypto market is feeling the chill. The total market cap stands at $3.06 trillion, down about $35 billion, or 1.14%, and a quick look at the top 100 coins shows 80% are underperforming today. That’s it for this gathering of New Year’s resolutions.

The macroeconomic picture isn’t really about shouting “buy everything.” Traditional markets are showing cracks. The S&P 500 just completed its third straight year of gains above 14%, but analysts warn the AI-powered party may be running out of champagne. Gold, meanwhile, is on a sharp downtrend – up more than 60% in 2025 and pushing towards $4,500 an ounce as investors seek safe havens amid geopolitical tensions and questions about the sustainability of AI spending.

The entire crypto market is also back in bear territory, with a total capitalization of $3 trillion. It would need to remain above the $3.2 trillion mark for traders to once again speak of a general market recovery.

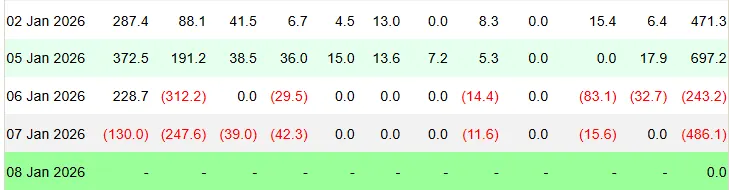

But for crypto, the concern isn’t just about low prices. This is what happens when institutional money gets nervous. Bitcoin ETFs, investment funds that track the spot price of BTC, saw $1.2 billion flow in over the first two trading days of 2026 – the largest single-day inflow since October with $697 million – but then immediately hit the brakes with $243 million in outflows on the third day and $476 million yesterday.

This kind of boost suggests that the institutional attempt is back, but it is fragile.

What Bitcoin Gives, Bitcoin Takes

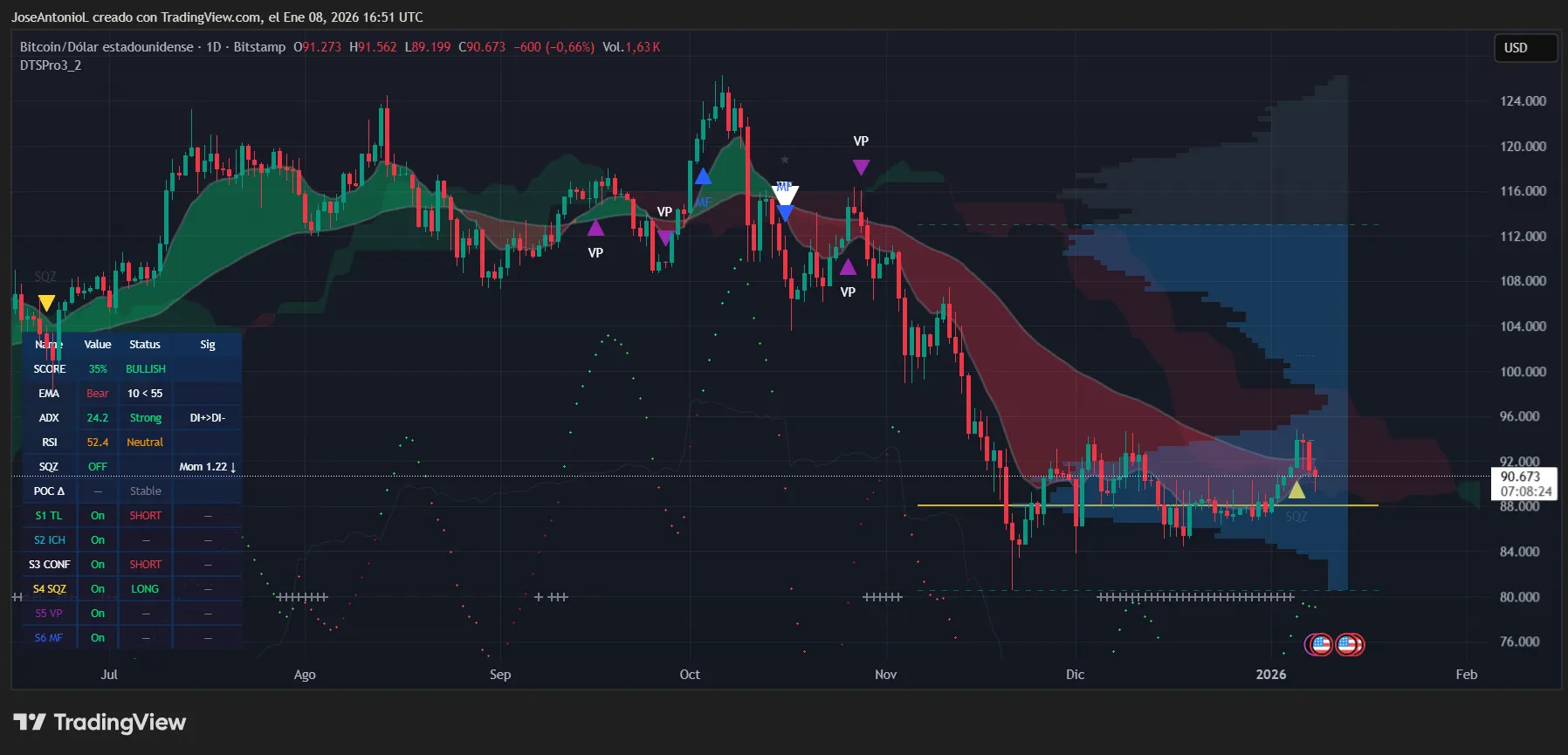

Bitcoin’s technical setup tells the same story. The price is currently trading at $90,673, down about 0.66% on the day, but still up 3% over the past seven days after a sharp rise earlier this week that took prices out of the death cross zone for a day.

The death cross – when the 50-day exponential moving average, or EMA, crosses below the 200-day EMA – remains in place, a pattern that usually signals traders to expect more declines or extended sideways action. With prices now below both averages, the gap is set to widen again, making it more difficult to obtain that coveted golden cross – the opposite of a death cross.

The gap is very slim at the moment, so there appears to be an even struggle between the bulls and the bears trying to set the course for the next few months. With such a small gap, even if prices remain bearish, the pace should be slower today than it was a few months ago, when Bitcoin began its fall from an all-time high above $126,000.

The average directional index, or ADX, sits at 24.2, just below the 25 threshold, confirming a strong trend. ADX measures trend strength on price charts, regardless of direction, on a scale of 0 to 100, with readings above 25 generally indicating to traders that a strong trend is in place. After the peak at the beginning of the week, Bitcoin’s ADX fell. But now its ADX is gradually increasing, which could mean that the current downtrend is gaining some momentum again.

The relative strength index, or RSI, reads 52.4, placing Bitcoin squarely in neutral territory. The RSI tracks momentum on a scale of 0 to 100, with readings above 70 considered overbought and below 30 oversold. At 52, Bitcoin is not giving any extreme signals in either direction. Traders see this as a market stuck in limbo – not hot enough to chase, not cold enough to panic sell.

Support lies around the $88,000-$90,000 area, where Bitcoin has found buyers during recent declines. If this level exceeds, the next major bottom is closer to $80,000 – a level that Bernstein analysts called a bottom in late November. On the upside, resistance lies between $94,000 and $97,000. The price briefly reached $94,000 this week, but was unable to maintain it, and this level now acts as a psychological barrier that bulls must recover before anyone starts talking about new highs.

That said, sentiment in the prediction markets remains relatively optimistic, and these traders do not believe the doom and gloom talk.

On Myriad, a prediction marketplace developed by Dastan, Decrypt’s parent company, traders say there is now only a 4.9% chance that a new “crypto winter” will occur in 2026.

Myriad traders appear to be pricing in a market rally, but not necessarily a major uptrend. The odds on Myriad hitting a new all-time high in Bitcoin before July stand at just 20%.

The charts are bearish, the technicals are weak, and yet the smart money in prediction markets isn’t screaming panic. So what does that give?

The answer might lie in time horizons. Short-term technical data suggests further disruption or declines to come, but longer-term structural factors – like institutional adoption, spot ETF flows, and macroeconomic tailwinds from possible Federal Reserve rate cuts – are keeping the bullish scenario alive. Tom Lee of Fundstrat expects a pullback in the first half of 2026 before a rally in the second half, with a year-end target of $115,000.

If this happens, it would break the historical pattern, since 2026 would normally line up as a winter crypto year as part of the usual cycle of a major crash after three bull years.

For now, however, bulls need to see Bitcoin reclaim $94,000 with conviction – ideally with the ADX rising above 25 to confirm momentum. In the meantime, expect more sideways movement, with occasional dips testing the $88,000-$89,000 support. The death cross does not guarantee disaster, but it does mean that easy money has been made. What happens next will depend on whether institutions continue to be present or decide not to participate.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment or other advice.

Daily debriefing Newsletter

Start each day with the biggest news stories of the day, plus original features, a podcast, videos and more.