Crypto market sentiment is seeing a major shift as major digital assets continue their bullish momentum.

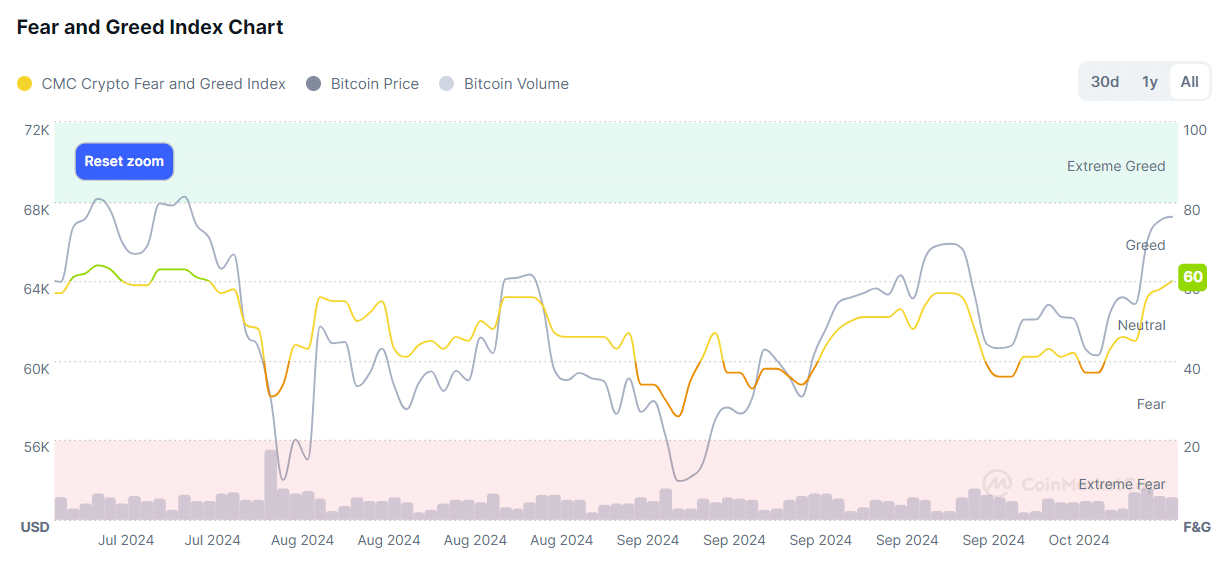

According to data provided by CoinMarketCap, the Cryptocurrency Fear and Greed Index entered the 60 zone today, signaling slightly greedy market conditions.

This is the first time the crypto market has reached the greed zone in six weeks – the last time on July 31. The major drop occurred in early August when the price of Bitcoin (BTC) plunged below $54,000.

The recent rebound of the entire market occurred thanks to the bullish momentum of Bitcoin. The price of BTC has been steadily rising since October 10, seeing a 12% rise over the past week – Bitcoin briefly touched a two-month high of $68,375 on October 16.

Despite a slight correction, Bitcoin is still up 0.3% over the past 24 hours and is trading at $67,350 at the time of writing.

According to data from IntoTheBlock, 95% of Bitcoin holders are currently making profits, 3% are close to their initial investment, and 2% are experiencing losses.

At this point, short-term profit taking would be normal, due to the increasing number of profit holders.

On the other hand, the number of profitable daily active addresses increased from 112,780 to 91,160 unique wallets between October 15 and 16. This drop shows that some investors may be targeting further price increases instead of taking profits immediately.

One of the main reasons for Bitcoin’s bullish momentum is the increased demand for BTC spot exchange-traded funds in the United States. According to a report by crypto.news, these investment products saw a net inflow of over $1.6 billion over the last four days, or $458.5. million entries for the day of October 16 alone.