The cryptocurrency market is showing signs of an impending correction hours before the release of the US Consumer Price Index report.

The global crypto market cap decreased by 3.3% over the past 24 hours, standing at $2.22 trillion, according to CoinGecko data. Market-wide trading volume is moving between $80 billion and $87 billion as the bears continue to dominate.

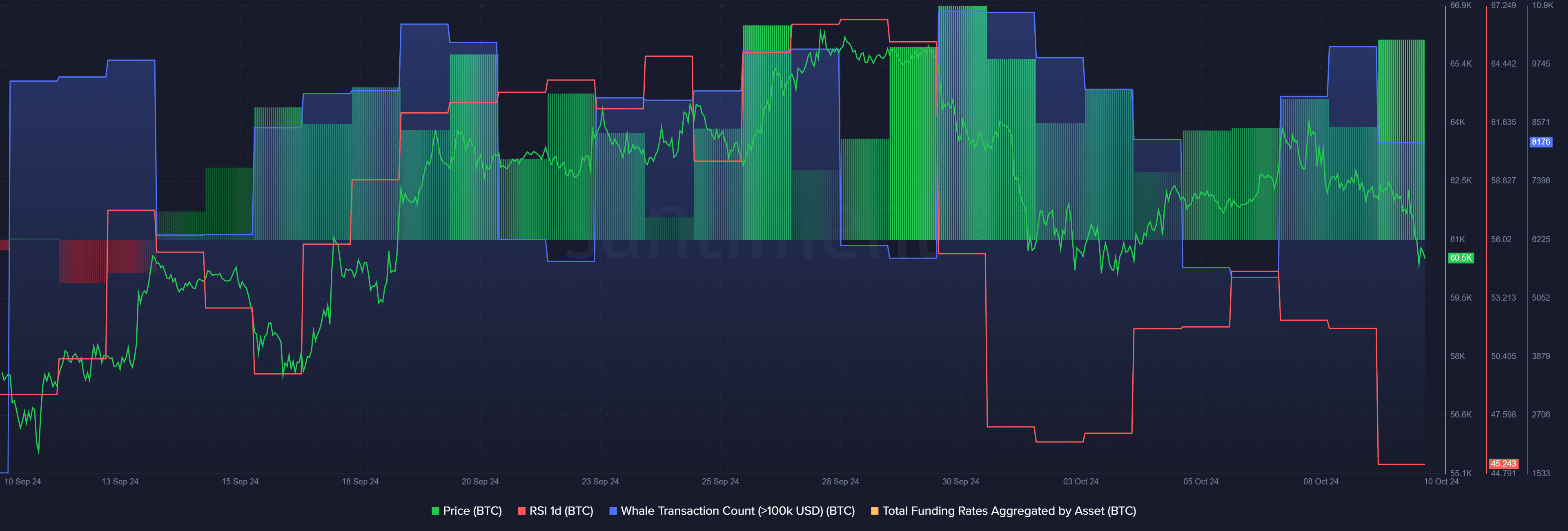

Bitcoin (BTC) has plunged below $61,000 and is trading at $60,800 at the time of writing. The leading cryptocurrency briefly touched an intraday low of $60,300 earlier today.

According to data provided by Santiment, whale transactions worth at least $100,000 worth of BTC increased from 10,098 to 8,176 over the past day. Decline in whale activity usually alludes to market uncertainty or a selloff on the part of retail traders.

Notably, the BTC funding rate recorded a sharp increase, from 0.004% to 0.007% over the last 24 hours. The indicator shows that the amount of bets on the price movement of Bitcoin is mainly bullish. However, a fall below the $60,000 mark could lead to increased liquidations and, hence, a further correction.

Bitcoin’s Relative Strength Index is currently 45, according to Santiment data. The RSI shows that BTC is currently in a neutral zone ahead of the US CPI report, scheduled for today.

The US CPI for August came in at 2.5%, a level not seen since March 2021, and is expected to fall to 2.3%. This could increase the chances of another rate cut at the Federal Open Markets Committee meeting on November 6-7.

One of the bullish catalysts last week was the US jobs report, which propelled the BTC price above $64,000. If US inflation slows again, bullish momentum would be expected in financial markets, including crypto.