This article was originally published in First comeCoinDesk’s daily newsletter, putting the latest developments in the crypto markets into context. Subscribe to receive it in your inbox every day.

Latest prices

CoinDesk 20 Index: 1,918.40 -0.63%

Bitcoin (BTC): $62,086.59 -0.68%

Ether (ETH): $2,431.18 -0.10%

S&P 500: 5,751.13 +0.97%

Gold: $2,621.91 -0.01%

Nikkei 225: 39,277.96 +0.87%

Featured

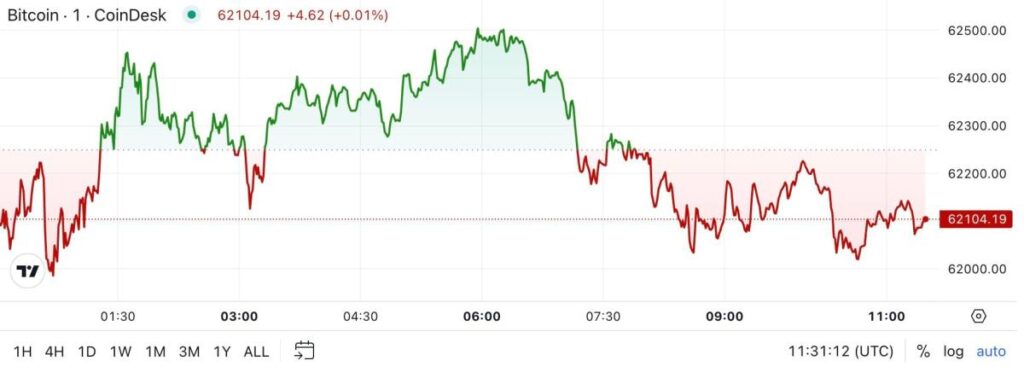

Crypto market little changed following highly anticipated event HBO documentary that promised to shed new light on the identity of Satoshi Nakamoto. “Money Electric: The Bitcoin Mystery” identified Bitcoin developer Peter Todd as the pseudonymous creator of the cryptocurrency, a claim Todd had denied even before broadcast. Positive developments in the revelation of Satoshi’s true identity could, in theory, constitute a volatility-boosting event for crypto markets. However, HBO’s attempt, like all previous ones, proved unsuccessful. Bitcoin is trading at around $62,150, down around 0.45% over the past 24 hours. The broader digital asset market, as measured by the CoinDesk 20 Index, has also changed little.

Spot Bitcoin ETFs in the United States recorded a cumulative release of over $18 million Monday, SoSoValue data shows. Ether ETFs have seen over $8 million in withdrawals. BTC’s low volatility came after a lack of new measures and announcements of new stimulus measures during a Chinese briefing on Tuesday, which dampened hopes for a long-standing stimulus package, which had contributed to a rush into Bitcoin in recent weeks. Chinese stocks are deep in the red, with the Shanghai Composite Index down 3.9% and the Shenzhen Component Index down 4%. Traders, meanwhile, are looking to upcoming notes from the Federal Reserve’s September meeting for clues about BTC’s next direction.

A major Bitcoin options exchange anticipates a shift from the current regime of low volatility to a period of increased price fluctuationspotentially exceeding the $53,000 to $87,000 range. The operation saw the entity pay a net premium of more than $1 million to purchase 100 contracts of the $66,000 strike call and put options expiring on Nov. 29, according to data confirmed by Lin Chen, Head of Business Development in Asia at Deribit. A long straddle is best when the market is expected to move enough in one direction or the other for the call or put option to be worth more than the cumulative premium paid. For the strategy to become profitable and overcompensate for the premium paid, the price of bitcoin must exceed $87,000 or be below $53,000 by the end of November, Chen told CoinDesk.

Chart of the day

-

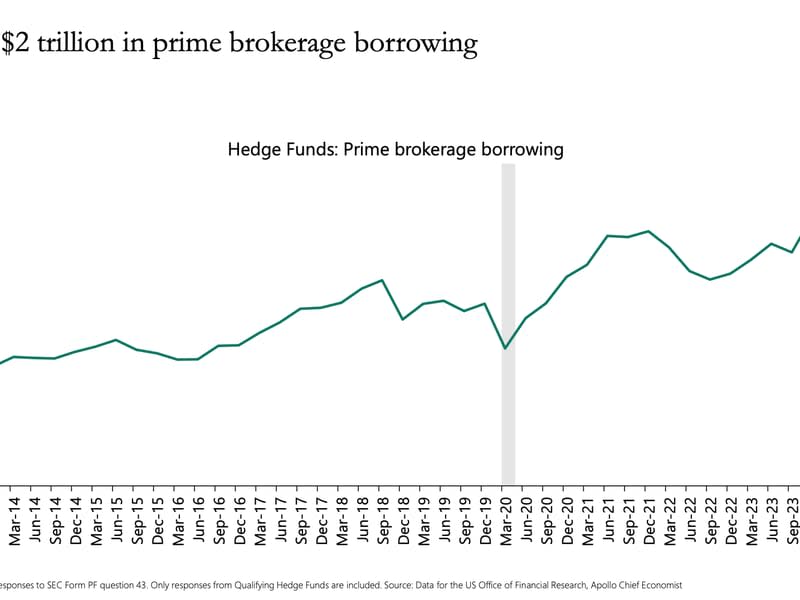

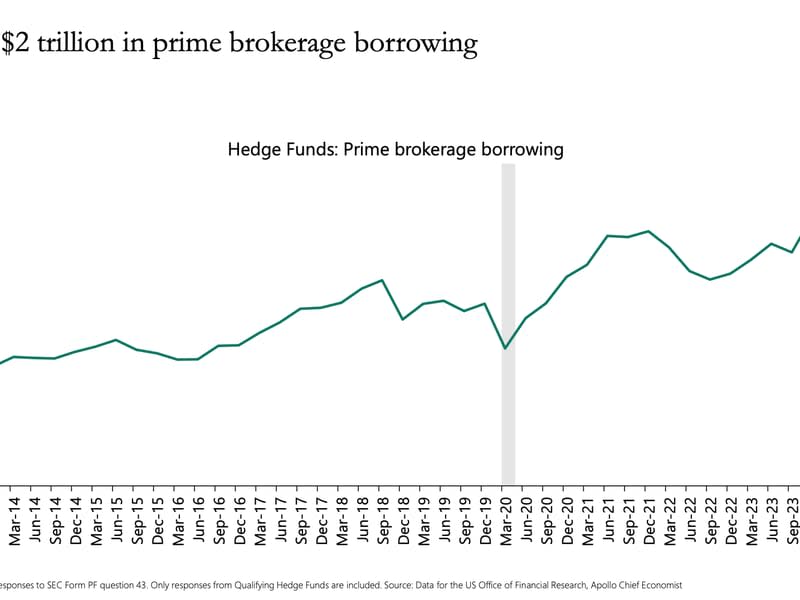

The chart shows the total amount of outstanding loans made by brokerages to hedge funds.

-

The total amount amounts to more than $2 trillion, posing a risk to financial stability, according to Apollo chief economist Torsten Sløk.

-

Source: Data from the US Bureau of Financial Research, Apollo Chief Economist

-Omkar Godbole