Big news from the Federal Reserve, which has just injected $2.5 billion into the US banking system in an overnight repo, adding to the $120 billion injected into the market this year. But despite this massive increase in liquidity, Bitcoin price is still lagging and struggling to break the $90,000 resistance.

On a positive note, Visa has officially declared crypto “mainstream” in 2025, with stablecoins and AI payments leading the way. All this is happening as gold hits an all-time high of $4,562 an ounce and silver now sits at $79. Both metals have been trending higher lately, much like the trend seen in 2020, when gold ($2,075/oz) and silver ($29/oz) hit their highs, which then sparked big rallies for other assets.

With so much bullish news surrounding Bitcoin, it’s a bit surprising to see its price lagging, especially with gold and silver continuing to surpass their highs.

So, could Bitcoin be next in line for a major surge?

Gold and silver hit all-time highs as Federal Reserve injects more liquidity

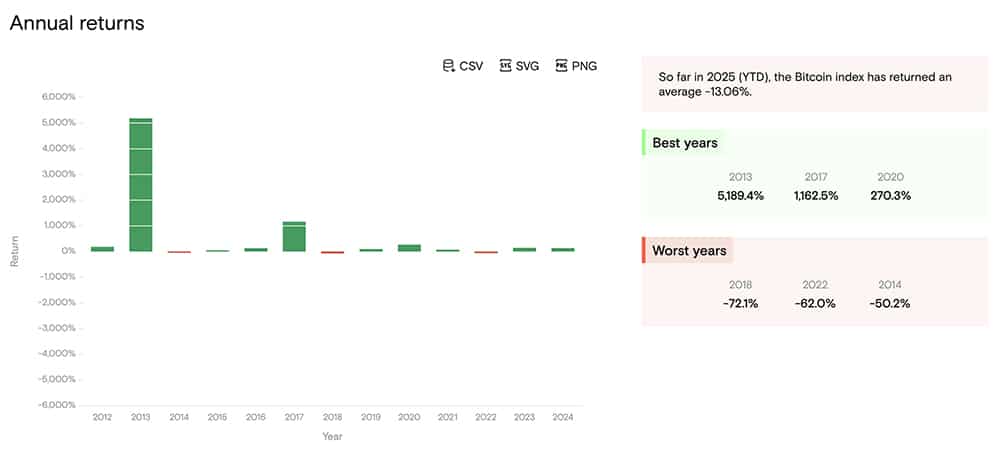

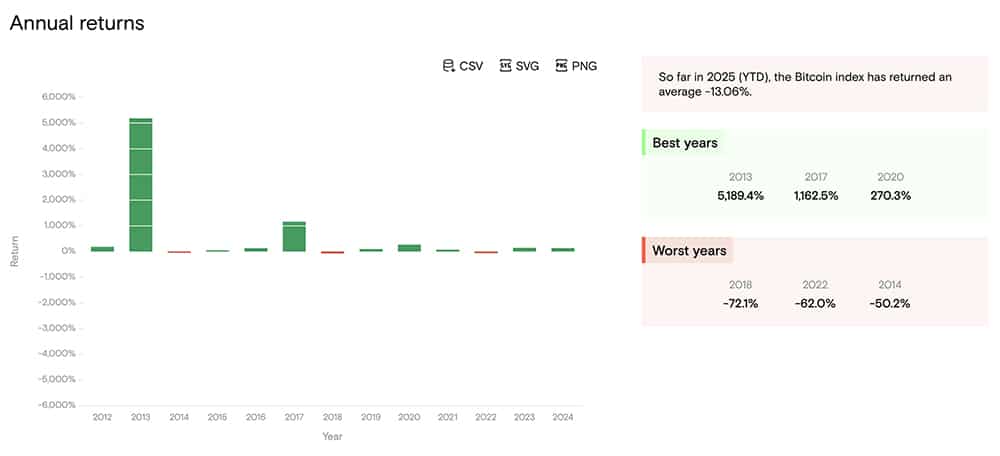

Looking back to 2020, after gold and silver reached their peaks, Bitcoin saw a huge breakthrough. It went from $11,500 to $29,000 at the end of the year, a gain of 150%. In 2021, the market capitalization of cryptocurrencies grew from around $390 billion to over $2 trillion. Traditional stocks like the S&P 500 have also seen nice gains, rising 7% in 2020, followed by a 27% rise in 2021.

(source – Curve)

Today, as the Federal Reserve continues to inject liquidity into the market, Bitcoin could follow a similar path and the bear market could finally end. The question is: when will it happen?

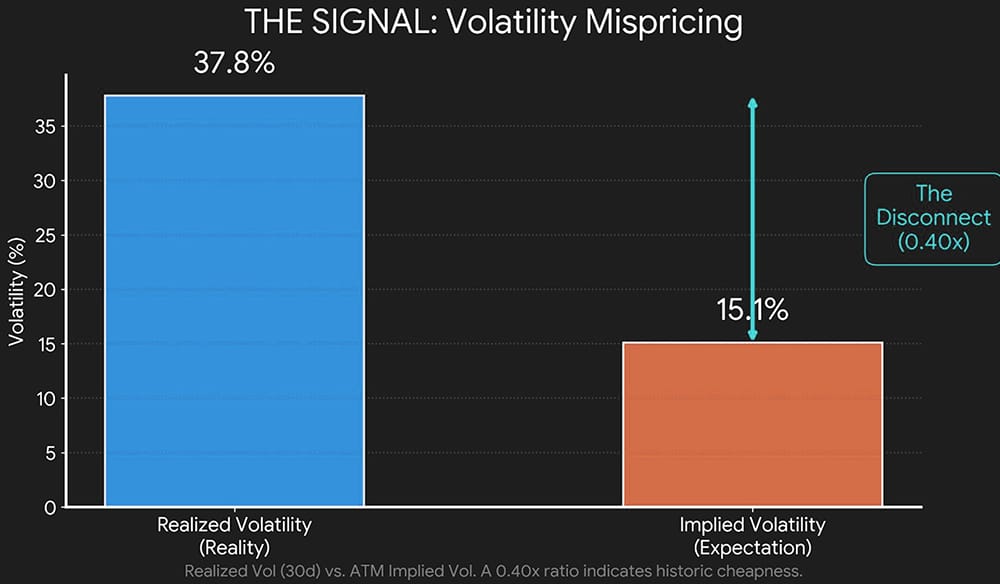

Right now, Bitcoin is stuck below $90,000, but there is a huge volatility anomaly that could lead to a breakout. Realized volatility sits at 37.8%, showing that Bitcoin is actually moving, but implied volatility is much lower at 15.1%.

This disconnect between what the market expects and what is actually happening is historically unsustainable, and it could just as easily cause the price of Bitcoin to rise soon.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The Volatility Anomaly and the Bitcoin Price

So why is this volatility asymmetry so important? Because, simply put, this puts Bitcoin on sale right now. People jump into call options (betting on higher prices), expecting the price of Bitcoin to rise. As a result, dealers must track rising prices to make these bets, which turns small increases into much bigger runs.

There’s also the fact that a 4chan user who correctly predicted Bitcoin’s October peak at $126,198 is now predicting a Bitcoin price of $250,000 by 2026. Gemini CEO Tyler Winklevoss also tweeted that Bitcoin is “gold 2.0” and said, “Wait until the world realizes this.” All of this may be the spark needed for next year’s bull run.

Wait until the world realizes that Bitcoin is gold 2.0

-Tyler Winklevoss (@tyler) December 26, 2025

As Satoshi Nakamoto said:

If you don’t believe me or don’t understand, I don’t have time to try to convince you, sorry.

That’s a strong statement, but with everything currently happening in the market, Bitcoin is poised for a big breakout.

Keep an eye on decisions from the Federal Reserve and how they could drive the price of Bitcoin higher. The market may be lagging behind right now, but history shows that crypto always catches up in the most violent ways.

If you don’t believe me, I don’t have time to try to convince you.

DISCOVER: 10+ upcoming coins at 100X in 2025

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

Stricter EU tax reporting rules on cryptocurrencies come into force in January 2026: is DAC8 a crackdown on cryptocurrencies?

The European Union (EU) is ready to implement DAC8 for tax transparency of cryptocurrencies. What is DAC8, you ask? The Administrative Cooperation Directive is a comprehensive directive that will fundamentally change the way crypto transactions are monitored and taxed.

DAC8 was adopted by the EU Council in October 2023. Now, from January 1, 2026, crypto exchanges will be required to collect and report detailed user and transaction data to national tax authorities. However, companies have six months, until July 1, 2026, to fully comply. But will DAC8 succeed in closing critical gaps in crypto tax reporting? Or is this another crackdown on crypto?

Prepare for 2026 and increased monitoring of your financial data:

DAC8 in EU

SEC oversight in the United States

mandatory KYC on every centralized on-ramp and blockchain analytics companies tracing every transaction.

Your 8-Step Plan to Stay Alive in the New…

-CR1337 (@CR1337) December 9, 2025

To prevent tax evasion, DAC8 aims to provide tax authorities with visibility into crypto holdings and transfers similar to what they currently have for traditional bank accounts and securities.

Read the full story here.

The article Crypto Market News Today, December 27: Federal Reserve Injects $2.5 Billion into Market, Bullish for Bitcoin Price appeared first on 99Bitcoins.

SEC oversight in the United States

SEC oversight in the United States  mandatory KYC on every centralized on-ramp and blockchain analytics companies tracing every transaction.

mandatory KYC on every centralized on-ramp and blockchain analytics companies tracing every transaction.