Crypto is down again, and the decline is eating into our wallets as we see the rise in crypto liquidations and the debate over Michael Burry and his comments on Bitcoin. With cryptocurrencies falling across major assets and liquidations increasing, we wonder why Bitcoin is falling even as traditional markets are rising.

What deepens the discussion is how often Michael Burry’s skepticism towards Bitcoin arises during these spikes in volatility, particularly when the crypto is falling without any direct negative catalyst. As the crypto market absorbs the latest wave of liquidations, the mood has shifted from surprise to concern.

Cryptocurrency Fear and Greed Chart

1 year

1m

1w

24h

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

New crypto liquidations despite strong markets

The strangest part of today’s selloffs is the asset contradiction: Nasdaq is up, silver is up, and the S&P 500 is green, but crypto is down. And Bitcoin lost 3% that day.

All of the above intensified the liquidation rush, creating a cascade that reminded many of previous crypto shakeouts. Currently, Bitcoin has briefly fallen towards the $89,000 zone, moving away from the October high and adding pressure just when we were hoping for stabilization.

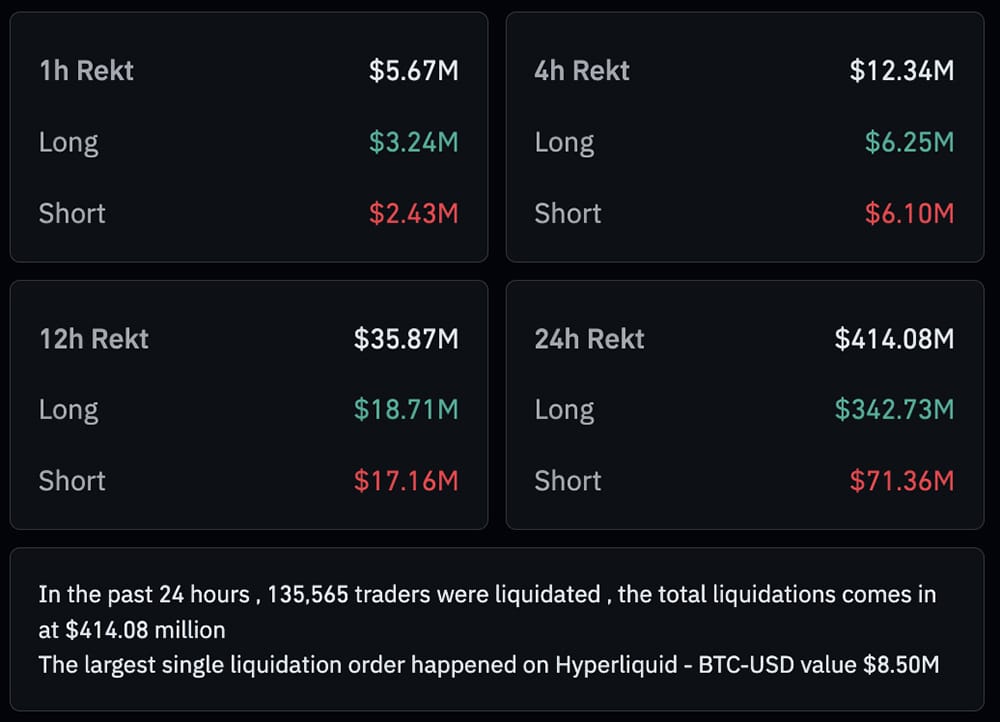

Earlier today, bullish PCE data triggered a sharp rally in BTC and ETH, but the momentum quickly evaporated. In 30 minutes, nearly $100 million in long positions disappeared in new crypto liquidations. The total has now surpassed $414 million for this session alone.

(source – Liquidation data, Coinglass)

Thinking back to the flash crash of October 10, the scale becomes clearer since on that day a staggering $19 billion was liquidated as Bitcoin plunged from $126,000 to $110,000. Since this disastrous event, subsequent waves of selling have released over $637 million in additional positions. Crypto falling seems to be an understatement.

However, despite the turbulence, the total crypto market capitalization still hovers around $3.1 trillion, rebounding from the critical low of $2.9 trillion. These levels often mark turning points, although cryptocurrency selloffs prolong volatility and weaken confidence.

(source – Total market capitalization of cryptocurrencies, TradingView)

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Michael Burry Bitcoin skepticism comes as crypto tanks

In his first interview in more than ten years, Michael Burry’s criticisms are violent. Burry compared Bitcoin to a tulip bulb, saying it is worthless and vulnerable to crime.

He compared Bitcoin to gold, which he has considered a stable store of value since 2005. His bearish stance changes the mood at a time when the crypto is down and sentiment already seems fragile.

Michael Burry of The Big Short gives his first interview in over 10 years and says: “Bitcoin is worthless. It’s the tulip bulb of our time.” pic.twitter.com/ge1zteSVqS

— Document ₿itcoin

(@DocumentingBTC) December 4, 2025

Not just Bitcoin, Michael Burry predicts a bigger crash, worse than the collapse of internet companies, citing excessive valuations and growing consumer debt. His short positions in Nvidia, Tesla and Palantir, as well as the delisting of his fund, are sparking debate over whether markets have become too euphoric. But critics say these companies remain profitable.

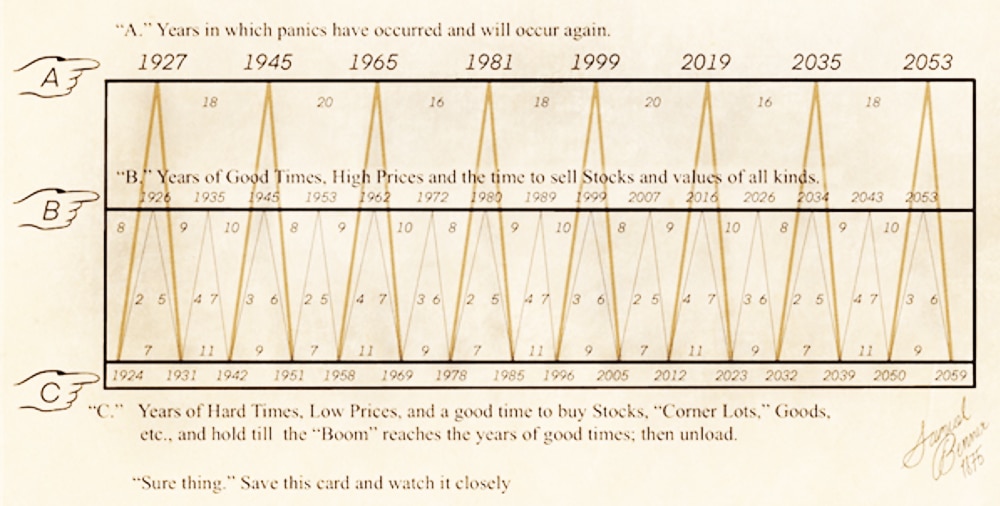

Countering the gloom is Samuel Benner’s cyclical chart from 1875. He called 2023 a tough year and a good time to accumulate risky assets, including crypto (if it was available in his day), with a predicted market peak in 2026. Even now, while crypto is down, the trend shows an opportunity, a year away from collapse, if it should collapse.

Benner cycle diagram 1875

And so, while the market waits, crypto is down and selloffs continue, but experienced traders insist that recovery often begins where fear peaks and where traders least expect it.

This Saturday, enjoy the weekend, touch the grass and decorate the Christmas tree, because Santa Claus is coming to town.

DISCOVER: 10+ next cryptos to 100X in 2025

Join the 99Bitcoins News Discord here for the latest market updates

SUI Crypto ETF with 2x Leverage Informed by SEC: Bitcoin Layer-2 Next?

The SEC’s approval of the new 2x leveraged SUI Crypto ETF came at a good time. Just when the market seems hungry for the next regulatory surprise.

This green light gives SUI another boost in the institutional spotlight, and the arrival of a leveraged crypto ETF on Nasdaq gives traditional investors a way to track SUI’s daily movements without touching the token itself.

The hammer also hits a sign that regulators are warming up to altcoin ETFs after months of approvals in the crypto market, and it adds fuel to Sui’s growing efficient network.

Read the full story here.

Hawk Tuah Girl crypto coin: the consequences

Is Hawk Tuah Girl’s Crypto Coin Making a Comeback? Hailey Welch, the viral star of “Hawk Tuah” whose 2024 catchphrase has become Internet currency, now faces a very real legal question.

In case you don’t remember:

- Welch launched crypto rugpull scam

- After stealing millions from her followers, she hit the road

In fact, it wasn’t even millions. She may have gotten a few hundred thousand, which isn’t bad, but it destroyed her “career” as a result. Meanwhile, there is a new development with Welch added to a federal class action lawsuit alleging she played a key promotional role in the failure of the HAWK token.

Read the full story here.

The post Crypto Market News Today, December 6: Crypto is down and liquidations are the latest trend in the Bitcoin cycle as Michael Burry Piles Shorts appeared first on 99Bitcoins.

(@DocumentingBTC)

(@DocumentingBTC)