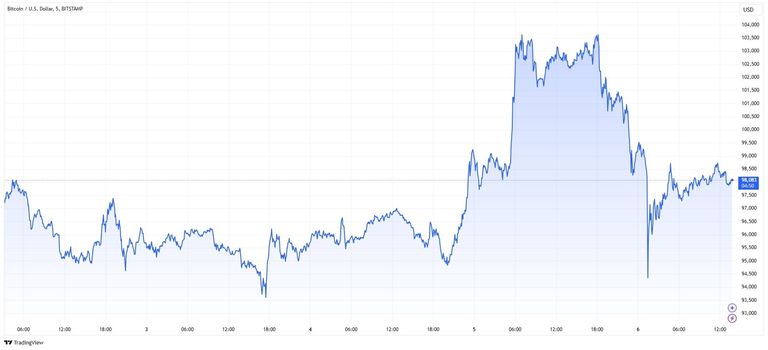

Bitcoin created a major buzz this week with a remarkable rise, reaching six figures for the first time. However, the profit-taking took its toll, bringing it back below the $100,000 mark early Friday as traders dealt with the token’s dramatic swings and famously heartbreaking volatility.

In a whirlwind of volatile swings, Bitcoin soared to an all-time high of $103,700 per coin yesterday before falling more than 6%, closing the day with a 1.6% loss at $96,900 per coin.

What motivates this historic gathering that has been making waves for weeks? President-elect Donald Trump may have the answer. He is assembling a powerful team of crypto advocates to lead efforts at the White House. Earlier this week, Trump tapped former SEC Commissioner Paul Atkins to replace current SEC Chairman Gary Gensler.

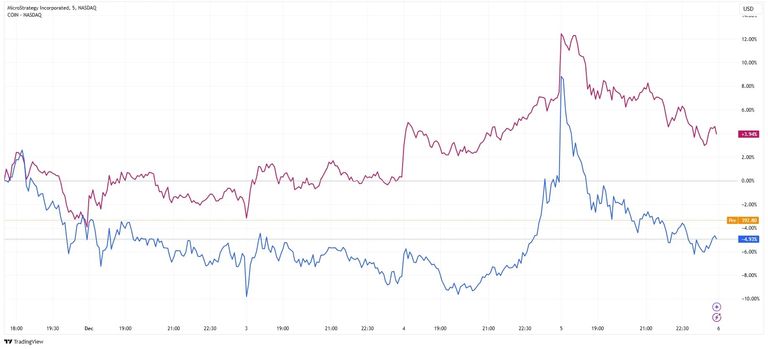

The meteoric rise of Bitcoin has shaken the industry as a whole – and beyond. As the price of Bitcoin surpassed the $100,000 mark, traders moved away from cryptocurrency-related stocks to join the rise of the flagship digital currency.

As a result, stocks of crypto-intensive companies have taken a hit. MicroStrategy’s stock slipped 4.8%, while Coinbase’s stock fell 3.1%. Both stocks started the day with gains, but gave up those advances as the session progressed.

Why does MicroStrategy stand out? This is a prime example of what happens when a company goes all-in on Bitcoin. Since its first crypto investment in 2020, the company has accumulated a staggering 402,000 Bitcoins in its treasury, worth around $40 billion. Notably, with an average purchase price of $57,000 per Bitcoin, half of that value represents pure profit.

This bold strategy has propelled MicroStrategy stock into overdrive, soaring nearly 500% this year to reach a market cap of $90 billion. Founder Michael Saylor remains focused on Bitcoin, rejecting all other tokens in a truly maximalist manner.

As Trump builds his crypto dream team, is it only a matter of time before Saylor is tapped for a central government role in shaping crypto policy?

Disclaimer: The opinions expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure the accuracy of the information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is for informational purposes only. This is not a solicitation to trade any commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article accept no liability for loss and/or damage arising from the use of this publication.