The global cryptocurrency market posted slight gains today, with the total market capitalization up 0.48% to $3.72 trillion.

Trading activity slowed significantly, however, with 24-hour trading volume falling more than 30% to $93.68 billion. Despite the slight rise in prices, investor sentiment remains cautious – the Fear and Greed Index currently stands at 35, reflecting a state of “fear” among market participants.

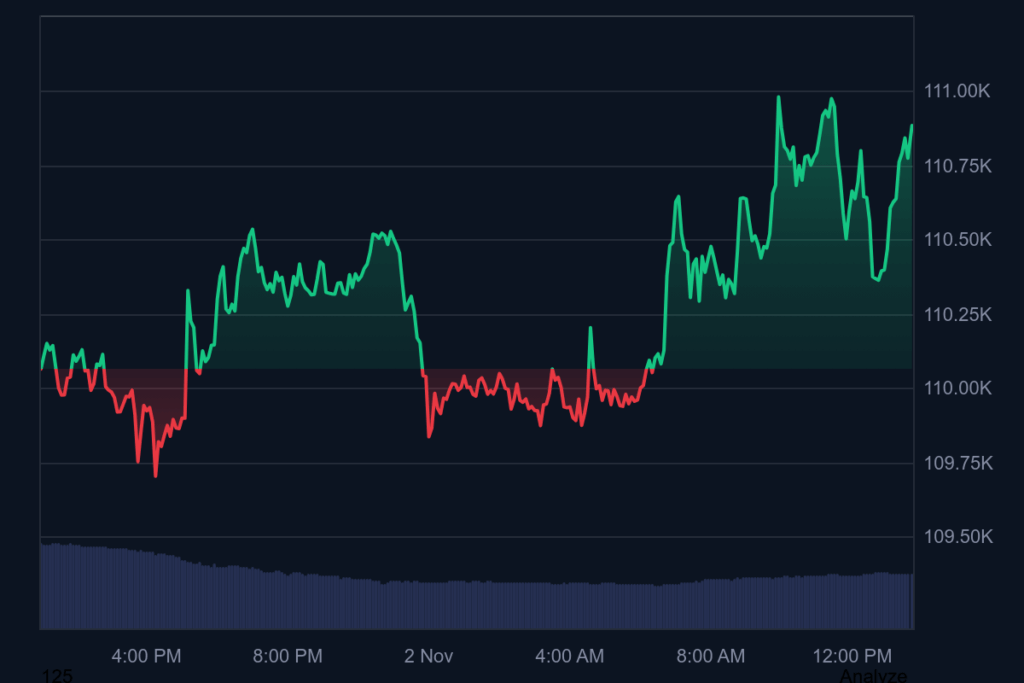

Bitcoin leads with modest growth

Bitcoin (BTC) continues to dominate the market, trading at $110,897, an increase of 0.8% in the last 24 hours. The leading digital asset maintains a market capitalization above $2.21 trillion, accounting for almost 60% of the total market dominance. Nonetheless, Bitcoin’s weekly performance is down 1.83%, signaling consolidation after recent volatility.

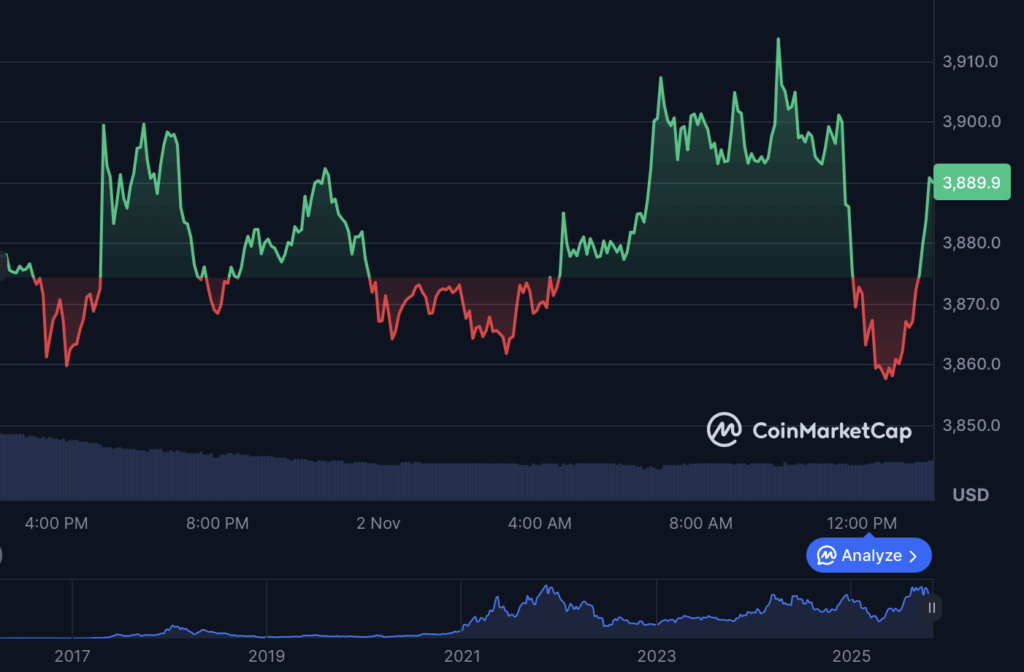

Ethereum shows cautious momentum

Ethereum (ETH) followed a similar trend, gaining 0.53% in 24 hours to trade at $3,892. The token’s 3.13% weekly loss suggests traders are hesitant to take aggressive positions ahead of possible macroeconomic developments. Its market capitalization remains strong at nearly $470 billion, keeping it firmly in second place behind Bitcoin.

Stablecoins hold up

Major stablecoins like Tether (USDT) and USD Coin (USDC) continued to perform as expected, maintaining near-perfect benchmark levels at $0.9998 and $1.00, respectively. These assets remain vital for liquidity, contributing significantly to overall trading volume – with Tether alone posting $80 billion in 24-hour volume.

Altcoins under slight pressure

Altcoins have shown mixed results. XRP edged up 0.83%, trading at $2.52, while BNB and Solana posted minor declines of 0.14% and 0.03% respectively. Dogecoin saw the largest seven-day decline among the top 10, dropping 7.01%, although it remains a favorite among retail traders. The Altcoin Season Index of 32/100 indicates that Bitcoin still outperforms most alternative assets.

Market sentiment and outlook

Broader crypto sentiment is conservative as traders assess uncertain economic indicators and regulatory developments. The average Crypto RSI of 48.96 suggests a neutral market – neither overbought nor oversold. Analysts expect prices to remain range-bound unless significant catalysts emerge, such as institutional inflows or new macroeconomic data.