Cryptocurrency commentator Raoul Pal has caught the attention of the cryptocurrency community by reaffirming that the market remains in the “banana zone”, a term he coined to describe periods of rapid price increases on the cryptocurrency market.

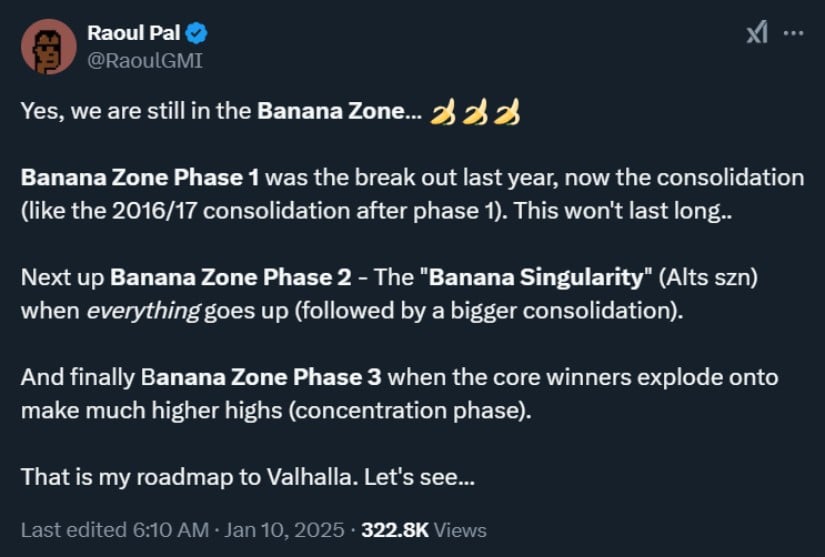

According to Pal, the current phase represents a stage of consolidation, after a significant breakthrough that occurred last year. But the real bull run is yet to come, giving hope to crypto investors around the world.

The “banana zone” refers to a market phase in which cryptocurrencies experience an accelerated upward price trajectory, with price movements resembling the shape of a banana on a chart. Pal used this term to illustrate the rapid upward movements in the prices of Bitcoin and other altcoins during various market cycles. He pointed out that the first phase of the banana zone occurred last year when Bitcoin had its breakthrough, but has now moved into a period of consolidation.

Banana Singularity and Altcoin Season

Raoul Pal’s forecast for the next stage of the Banana Zone, which he calls “Banana Singularity”, anticipates a massive altcoin rally. During this phase, Pal predicts that the value of altcoins will increase and the entire market will see a broad upward movement. However, Pal also warns that such a phase will be followed by another period of consolidation.

Source: Raoul Pal via

“Banana Singularity will be the altcoin season where everything goes up,” remarked Pal in his recent article. His prediction matches expectations that altcoins will see a significant rise in the coming months, especially after Bitcoin’s dominance in the market begins to wane. Altseason typically occurs when Bitcoin’s dominance wanes, paving the way for altcoins to capture a larger share of the market.

Concentration phase: the final stage

According to Pal, the final phase of the banana zone will be the “concentration phase,” where the major winners in the crypto space will grow exponentially. This phase marks the culmination of a bull market, when certain cryptocurrencies reach new all-time highs and the market narrows down to the top performers. The question investors are asking is: which will be the best performers? Ripple’s XRP token is a prime candidate. With Ripple’s battle against the SEC almost over, the market is clear for XRP to be one of the top performers in this year’s crypto bull run.

Source: CryptoNobler via

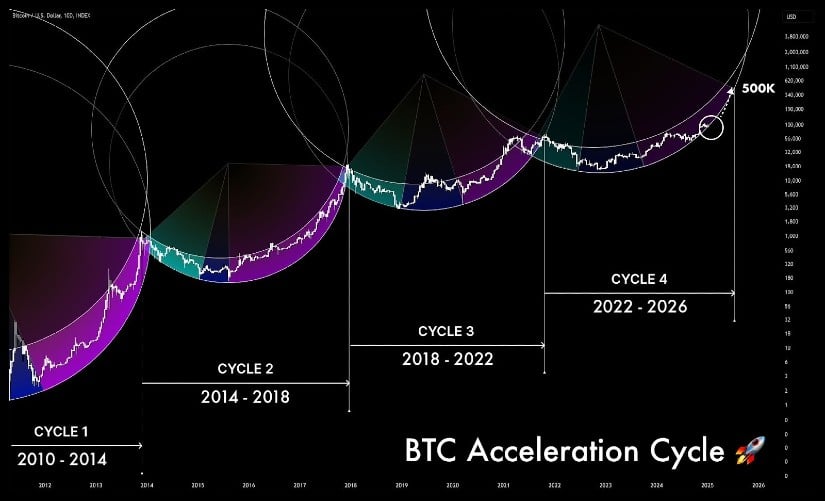

Pal had previously called the markets with relatively good timing, including his call regarding the rise of cryptocurrencies in September 2024. His thoughts turned mainly to silver, as global liquidity has seen numerous rebounds: “As As global liquidity increases, cryptocurrencies will rise… as will other markets like the Nasdaq,” he said in a previous article as he reflected on the broader macroeconomic factors affecting the crypto market.

Recent Bitcoin Price Movement and Market Outlook

Bitcoin price action has been very volatile lately and the cryptocurrency has seen extreme fluctuations. After hitting highs above $102,000 in early January 2025, Bitcoin plunged below $92,000 and then recovered to around $94,800.

Bitcoin (BTC) was trading at $93,563 at press time. Source:Bitcoin Liquid Index (BLX) via Brave new piece

As Bitcoin corrects from its current price levels, Bitcoin and the general crypto market have grown significantly over the past year, with the total market cap increasing from $1.8 trillion to $3.4 trillion.

Pal’s ideas on the correlation between Bitcoin and global liquidity remain central to his market outlook. He emphasized that despite short-term market corrections, the overall trajectory of Bitcoin and other cryptocurrencies remains positive in the long term.

The future of cryptography: awaiting regulatory developments

Looking ahead to the start of 2025, Pal’s predictions of the “banana singularity” are supported by the growing optimism surrounding the crypto space. Even as regulatory challenges and uncertainty over global economic conditions persist, the potential for a major altcoin rally remains high. Pal’s optimistic view relies on increasing institutional adoption and eventual stabilization of regulatory environments.

In conclusion, even if the current phase of the market may seem uncertain due to Bitcoin price corrections, the general trend remains upward, according to Raoul Pal. Its “Banana Zone” framework provides a roadmap for crypto investors to anticipate future market movements and determine which crypto to buy, with altcoins poised to take center stage in the coming months. Keep an eye on XRP, it is expected to see strong performance in 2025.