The crypto market is under pressure today, with Bitcoin, Ethereum and major altcoins like XRP experiencing bearish pressure. Although the price action may seem worrying, this drop is not driven by panic or bad news. Instead, market data indicates a technical reset driven by leverage, liquidity conditions, and short-term positioning. This pullback comes at a time when gold made a remarkable rise to $4,500 while the S&P 500 closed above 9,000 for the first time in history.

Understanding these factors is crucial to determining whether this move signals deeper weakness or a temporary pullback.

Leverage is what drives the sale

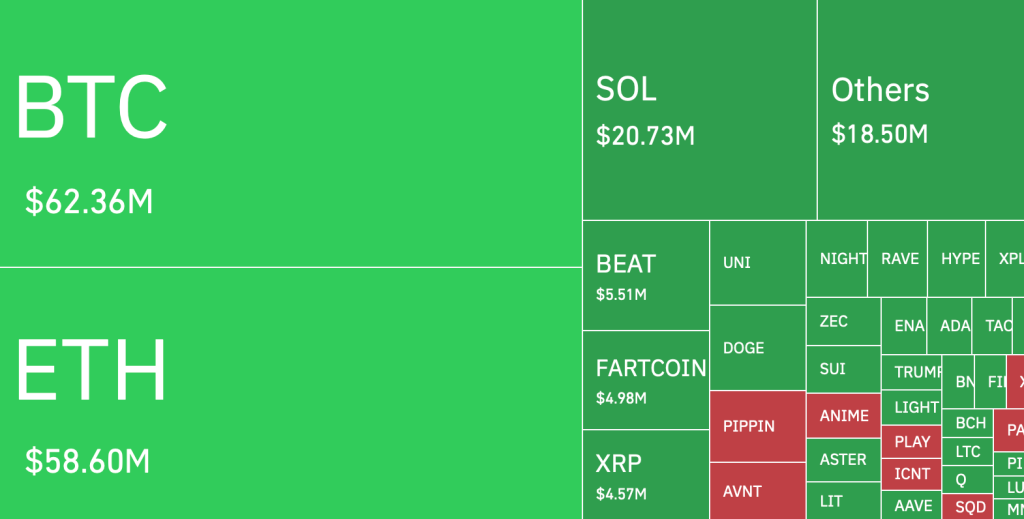

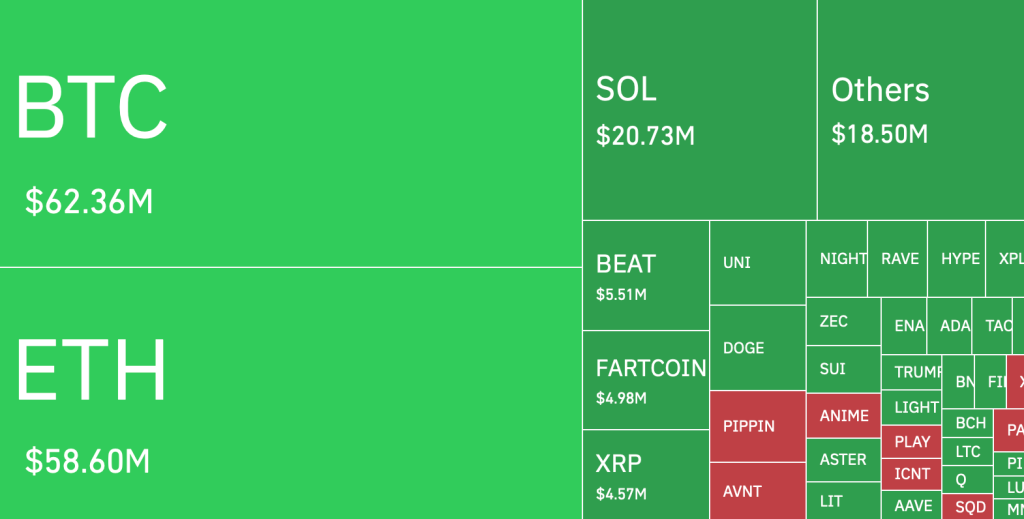

Over the past 24 hours, over $180-$220 million in leveraged positions have been liquidated in the crypto market, with Bitcoin and Ethereum accounting for over 60% of the total. BTC alone saw around $65-75 million in liquidations as the price fell below short-term support. Funding rates, which previously held between +0.015% and +0.02% on perpetual securities, have started to tighten towards neutrality. This confirms that the move is driven by saturated long positioning, not further aggressive short selling.

- Read also:

- Chainlink Price at a Crossroads: Why LINK is Struggling Near $12

- ,

Cash purchases have slowed

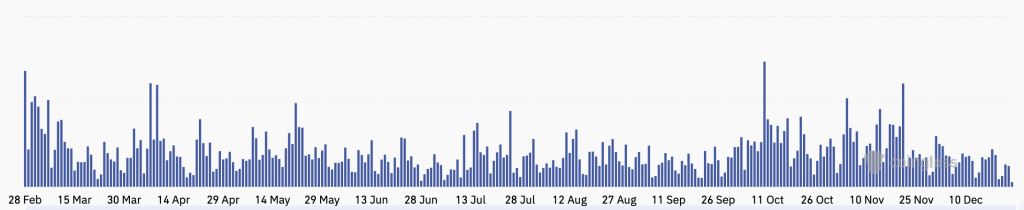

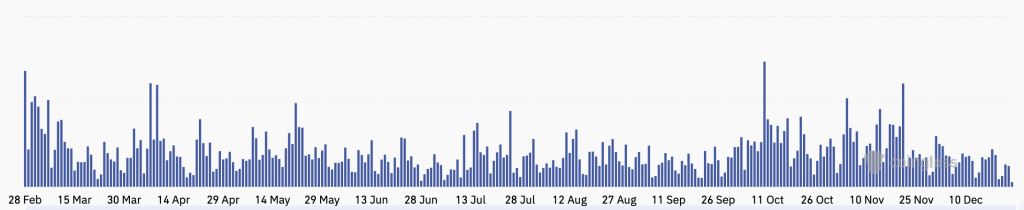

Spot market data shows downward tracking. Bitcoin spot volumes are down about 25-30% week-over-week, while net exchange flows remain neutral rather than strongly positive or negative. ETF-related inflows slowed compared to last week, reducing support for passive offerings. This means that selling pressure from derivatives is not absorbed quickly by spot buyers. When leverage dominates volume and spot participation decreases, the price generally declines until the forced sell exhausts.

What’s Next for the Bitcoin and Crypto Price Markets?

Crypto markets are pulling back at a time when gold and the S&P 500 are hitting or holding near their all-time highs, and that contrast is important. Traditional markets are pricing in macroeconomic stability and controlled easing, while crypto is still digesting the excess leverage resulting from the recent rally. In other words, risk is rewarded by slower moving assets, while high beta cryptocurrencies are forced to reset their positioning first.

With the first US jobless claims expected in the coming hours, traders are reducing their exposure rather than pressing on new long positions. Any upside surprises in claims could reinforce recession fears and further tighten risk appetite, keeping crypto under pressure. Until macroeconomic data removes uncertainty and leverage is completely reset, crypto remains in consolidation mode, not trend acceleration.

FAQs

The decline is mainly due to leveraged traders being forced out of their positions. This is a technical reset, not panic selling or negative fundamentals.

The current price action resembles a normal pullback caused by the unwinding of leverage. There is no clear sign of a deeper downtrend yet.

Gold and stocks benefit from macroeconomic stability and lower volatility. Crypto, being riskier, often resets its leverage before resuming trends.

Monitor funding rates, spot buying strength and macro data. A return of spot demand generally signals that the downturn is coming to an end.

Trust CoinPedia:

CoinPedia has been providing accurate and timely updates on cryptocurrencies and blockchain since 2017. All content is created by our expert panel of analysts and journalists, following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, Trustworthiness). Each article is checked against reputable sources to ensure accuracy, transparency and reliability. Our review policy ensures unbiased reviews when recommending exchanges, platforms or tools. We strive to provide timely updates on everything crypto and blockchain related, from startups to industry majors.

Investment Disclaimer:

All opinions and ideas shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the writer nor the publication takes responsibility for your financial choices.

Sponsored and advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are clearly marked and our editorial content remains entirely independent from our advertising partners.